On April 2nd in Washington, US President Donald Trump announced a baseline 10% tariff on all exports to the US, and higher tariffs on 60 countries that are the biggest contributors to the US’ $US1.4 trillion trade deficit, and who the president says impose tariffs on US goods. The changes will come into effect on April 5th, with China, already subject to a 20% tariff, facing an additional 34%, while the EU, Japan, South Korea, India, Indonesia, and Vietnam, will face tariffs of 20%, 24%, 25%, 26%, 34%, and 46% respectively.

While the 10% baseline tariff was below the 20% some market commentators had anticipated, the new tariffs on China and other South-East Asian countries, where Chinese companies built factories to get around tariffs in Trump’s first term, were well-above expectations. The US imports nearly $US500 billion in goods from China alone, which will undoubtedly become more expensive as Chinese businesses look to protect margins and pass on some of their added tariff costs to consumers. Across the board, US research firm Evercore estimates the average tariff across the economy now sits at 29%, up from about 2% at the start of the year.

What’s Trump’s beef?

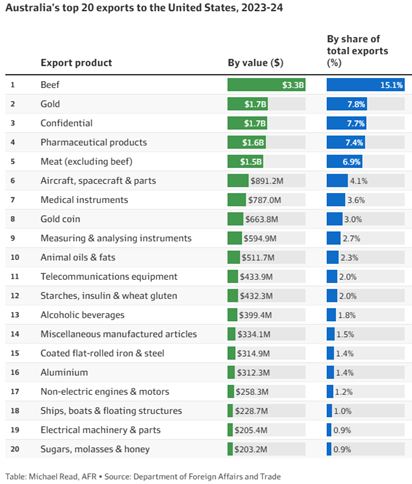

Australia will only be directly hit by the 10% baseline tariff, which will have a relatively muted impact, with America only accounting for around 4% of Australia’s goods exports. Trump did, however, single out Australia’s ban on US beef in his announcement of the tariffs in the White House’s Rose Garden, stating “Australians… they’re wonderful people, wonderful everything, but they ban American beef.” Australia’s beef exports, accounting for around 15% of our exports to the US and being our largest export there, will face the biggest hit from the 10% tariff however.

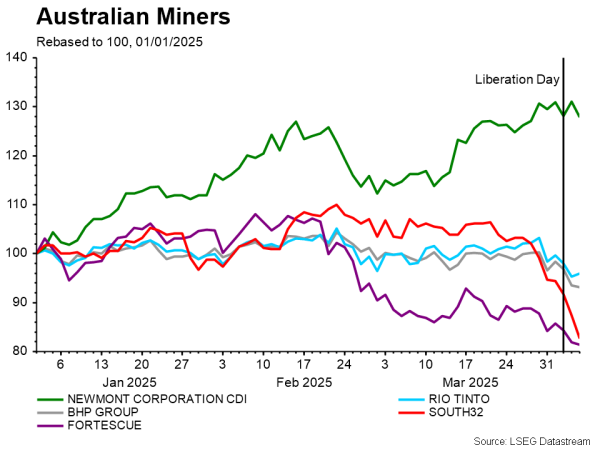

The bigger concern for Australia is a slowdown in the Chinese economy as a result of the tariffs, which we are exposed to through our iron ore exports being heavily linked to Chinese construction activity and property demand. China is our largest trading partner and accounts for 8.3% of Australia’s GDP because of their importing of our iron ore and other minerals. A tariff-induced slowdown in China, whereby they sell less exports to the US and suffer depressed profit margins on these exports, could result in less of our iron ore being purchased, as economic activity and employment suffer and weigh on consumer property demand and business investment in new infrastructure. Australia’s miners have sold off following Trump’s April 2nd tariff announcements, reflecting this more benign Chinese demand outlook.

What do the tariffs mean for investors?

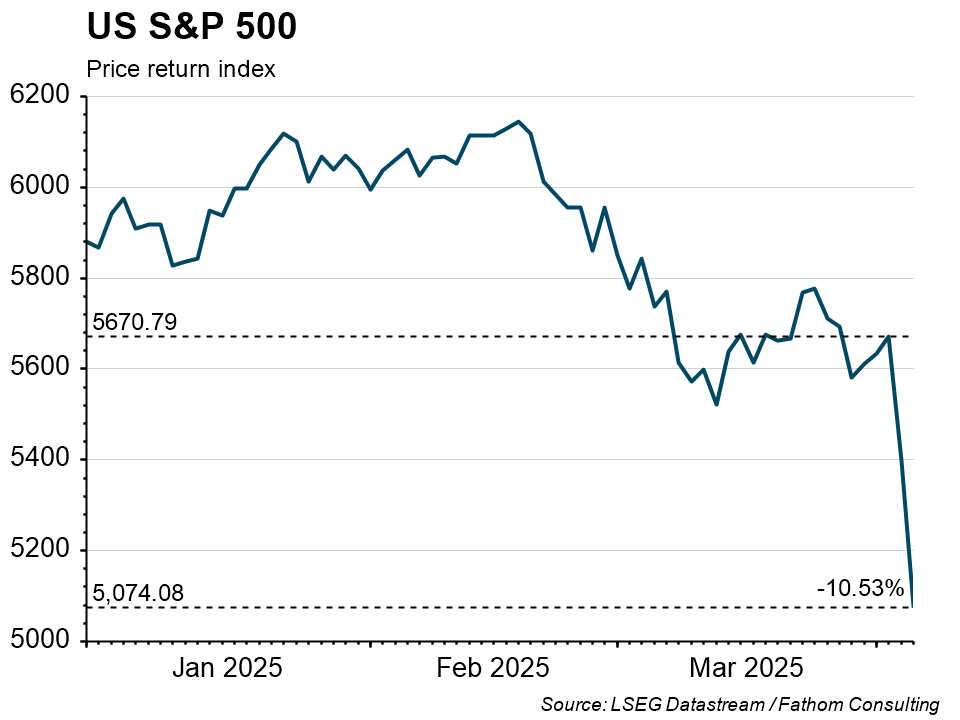

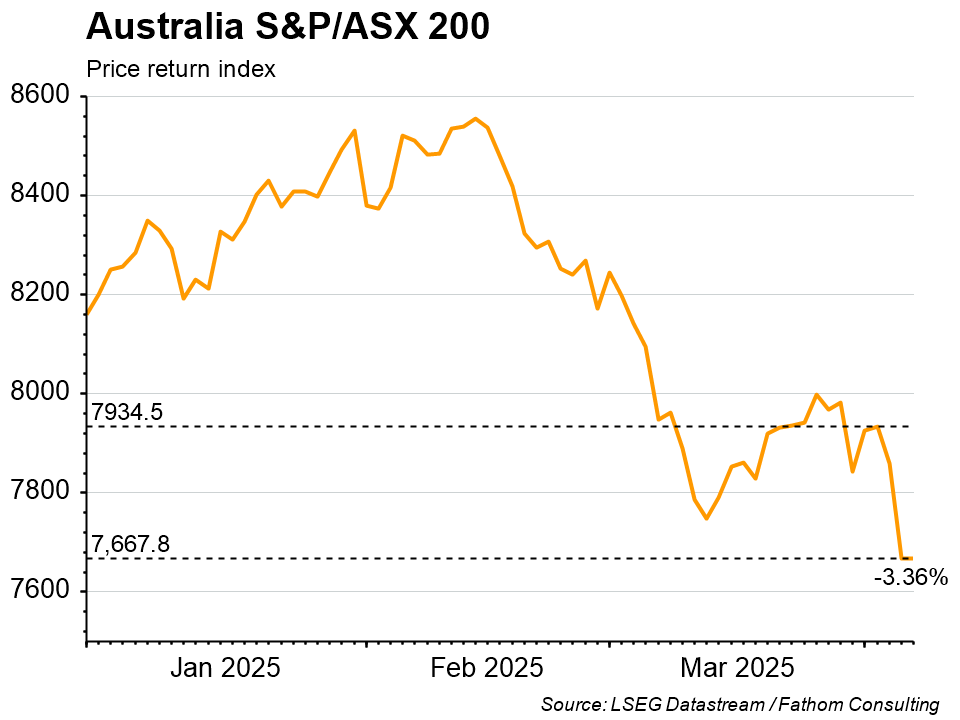

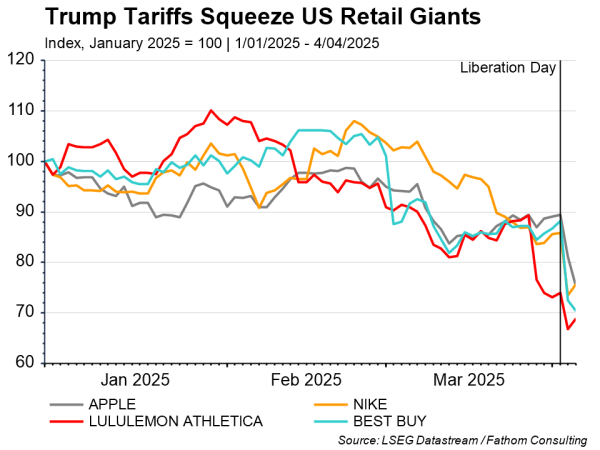

Markets reacted negatively to the tariffs, with the S&P 500 falling -10.53% since April 2nd, and the ASX 200 -3.36%. The hardest hit were companies importing products from China to sell in the US or to use in their production process, with the extent of the president’s tariffs on China and South-East Asia surprising investors. This included Apple (AAPL:NASDAQ), Nike (NKE:NYSE), Lululemon (LULU:NASDAQ), and Best Buy (BBY:NYSE), who all manufacture and import significant volumes of products from China, and have fallen 15.86%, 11.87%, 6.74% and 20.19% respectively since April 2nd as investors worry about how their profitability will be affected by tariffs, and whether they will be able to pass on higher import costs to consumers and maintain margins through pricing power.

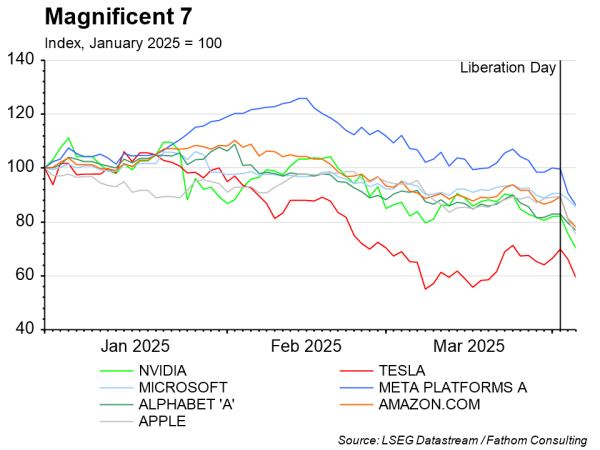

The magnificent seven tech stocks – Apple (AAPL:NASDAQ), Amazon (AMZN:NASDAQ), Alphabet (GOOG:NASDAQ), Meta Platforms (META:NASDAQ), Microsoft (MSFT:NASDAQ), Nvidia (NVDA:NASDAQ) and Tesla (TSLA:NASDAQ) – has also plunged 15.86%, 12.76%, 7.28%, 13.56%, 5.84%, 14.59%, 15.32% respectively since April 2nd. This has been driven by the high P/E ratios these stocks trade on, which reflect the strong earnings growth investors had been pricing into their valuations. Trump’s tariffs have caused a mass reassessment of these rosy outlooks, as the possibility of higher prices, tighter consumer wallets, and less business investment drive down earnings growth estimates. The magnificent 7 accounted for about 30% of the S&P 500 at the start of the year, meaning their price drops, and that of the broader technology sector, have had an outsized impact on the market’s performance.

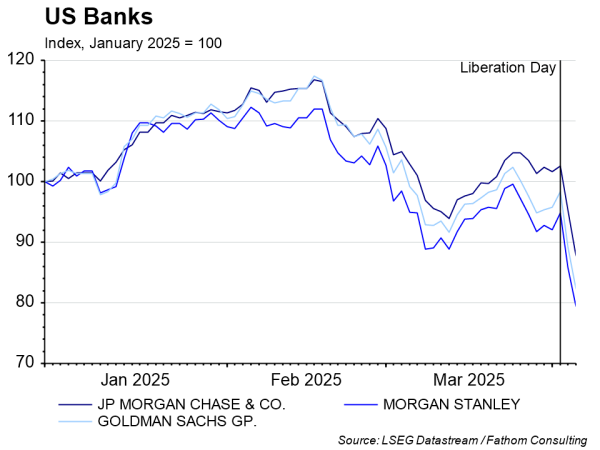

Another standout victim of Trump’s tariffs has been the US banking sector, with J.P. Morgan (JPM:NYSE), Morgan Stanley (MS:NYSE), and Goldman Sachs (GS:NYSE) all experiencing declines of 14.46%, 16.30% and 16.39% respectively since April 2nd. The banking business is inherently tied to the macroeconomic performance of the economy, with economic slowdowns increasing loan impairments and reducing credit growth as business confidence and investment wane, while increasing the probability of Fed rate cuts and net interest margin contractions as banks charge lower interest rates.

The market’s steep sell-off has also coincided with a surge in the VIX, the volatility or fear index, to a 2 and a half year high, highlighting investors anticipating big swings in the market in the near term. This has been driven by the uncertainty around how Trump’s tariffs will impact the global economy, and the length of time they are going to be in place, which has made it difficult for businesses to plan investment and inventory timelines, and which the president hasn’t provided significant direction on.

How will the tariffs impact the Fed and RBA?

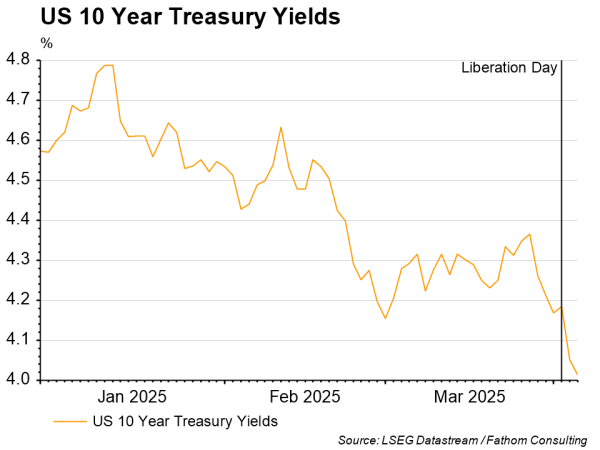

If economic weakness occurs as a result of Trump’s tariffs, which may prompt the Fed to resume interest rate cuts sooner than previously anticipated in order to avoid a sharper slowdown, even amidst potentially rising inflation from companies passing on higher import costs to consumers. Prior to the announcement, the 10-year US Treasury yield was rising, but has quickly reversed course and moved lower to 4.013% from 4.184% as investors price in more cuts.

Bond markets have similarly ratcheted up bets for more rate cuts from the RBA, with the central bank on Thursday in its financial stability review warning that the tariffs could pose a significant risk to the global economy and our commodity exports, which would hurt business investment and margins.

Trump’s tariffs will no doubt raise inflationary pressures in the US, weaken global economic growth, and hurt profit margins for American businesses importing products. These forces combine to increase uncertainty for investors, especially given concerns around whether US trading partners will respond with their own tariffs, and how long the president’s tariffs will last. Despite the recent selloffs, the S&P 500 and ASX 200 continue to trade on high P/Es relative to history, with plenty of earnings growth priced in, which we believe has the potential to unwind quickly, as uncertainty causes investors to re-think their rosy economic outlooks.