What are US Treasury Secretary Scott Bessent’s plans?

While tariffs have been grabbing all the headlines, US Treasury Secretary Scott Bessent has recently added more colour to the administration’s broader plans for economic reform, describing US President Donald Trump’s plans to “allow Wall Street and Main Street to rise together” through his “three steps to economic growth,” which include[1]:

- Tariffs: To create incentives for reindustrialisation and domestic manufacturing

- Tax cuts: To raise real incomes for consumers and businesses and encourage spending

- Deregulation: To complement tariffs by stimulating credit growth and investment in domestic manufacturing and energy

The Art of the Tariff?

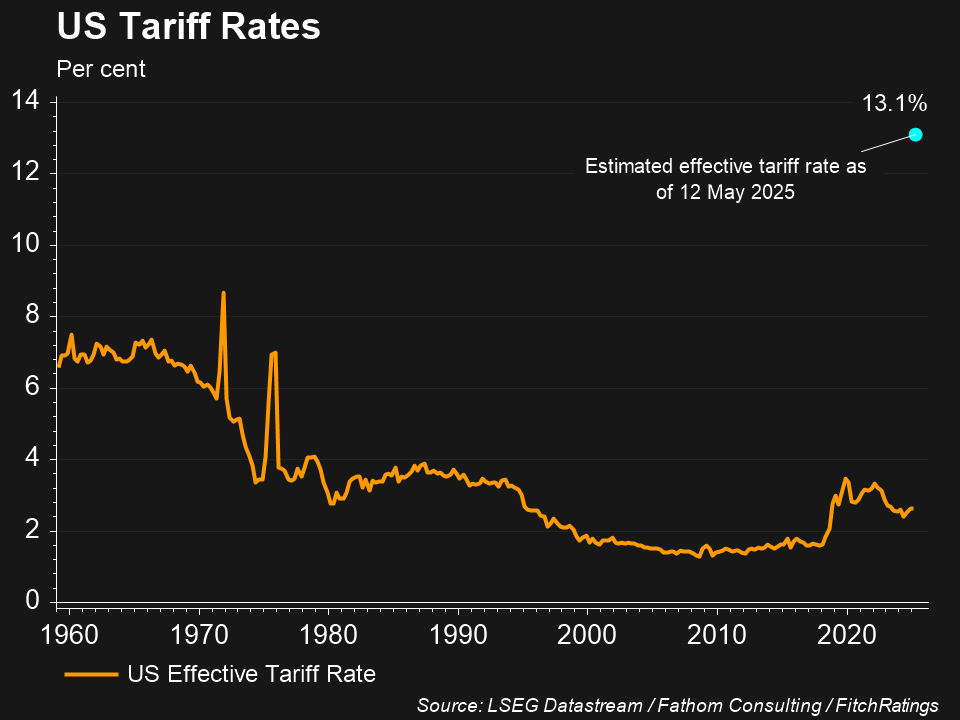

The most well-documented step in this plan is the president’s controversial tariffs, which have seen a baseline 10% tariff applied to all imported goods, and higher tariffs for specific countries that the administration views as having a large trade surplus with the US, most notably China who is currently facing a 30% tariff, and has placed their own 10% tariff on American goods. These, however, are significantly lower than the 145% and 125% tariffs that the US and China respectively had placed on each other post Trump’s April 8th Liberation Day – a result of Bessent’s trade talks with his Chinese counterparts in Geneva on the weekend of May 11th. Where he acknowledged that “neither side wants to decouple” from trade, and that “it would be implausible” for tariffs on China to fall below 10%, which still represents a significant ramp up on those prior to Trump’s inauguration[2]. Some investors have suggested that this sudden fall in tariffs from Liberation Day represents a significant backslide from the president, as he grapples with uneasiness on Wall Street and widespread recession concerns because of his policies.

Bessent, though, argues that these negotiations are part of a “long lasting and durable trade deal” with China, and that tariffs are needed to encourage US companies currently making products in China to instead move their manufacturing to the US to avoid tariffs, boosting domestic employment opportunities while shoring up America’s supply chains. Critics, however, believe that tariffs will simply result in higher prices for US consumers, as companies raise prices to protect profit margins, while also not producing a material upswing in manufacturing, as businesses either still view US production costs as uncompetitive and keep their supply chains overseas, or take several years to build the factories needed to move their manufacturing to the US.

100 Bessent effort?

While tariffs have received the most publicity, Bessent has also flagged his tax cut and deregulation agenda as key to his economic growth plans. Trump’s self-described “big, beautiful bill,” or his proposed permanence and expansion of the 2017 Tax Cuts and Jobs Act, is currently progressing through congress, and puts forward around $US4.5 trillion in tax cuts over the next decade. The tax cuts in the initial 2017 bill are due to expire by the end of this year, and the Republican party aims to pass the extension bill by July 4th. If the cuts don’t get through taxes would climb on more than 60% of households, as marginal tax rates rise across the board. A married couple, for example, making $US85,000, would see a $US1,661 tax increase[3]. The bill also includes new provisions to eliminate income tax on tips, overtime pay, and Social Security benefits.

Trump and Bessent have also proposed to congress to reinstate the 100% bonus depreciation that he implemented in his first term, which allows businesses to immediately fully expense equipment and factory investments, rather than requiring slower depreciation, making these investments more financially beneficial sooner by allowing businesses to immediately lower their current tax bills. Trump stated in his March speech to congress that investments from January 20th onwards would qualify, attempting to prevent businesses from freezing decisions while lawmakers write the bill. Bessent argues that the measures will work in tandem with tariffs to incentivise building new factories and bringing more manufacturing to the US, by making construction costs and equipment more attractive.

Deregulation is another priority for Bessent, which he says will kick in during the 3rd and 4th quarters of 2025[4]. The former hedge fund manager has said he wants to reduce the compliance burdens of banks to make it easier for them to lend and for businesses to access capital, stating in an interview on the All-In Podcast that the administration is reviewing “all bank regulation” and specifically exploring eliminating the supplementary leverage ratio, to allow banks to issue more loans with the same amount of capital on their balance sheets, which he hopes will spur credit growth, business investment, and spending[5].

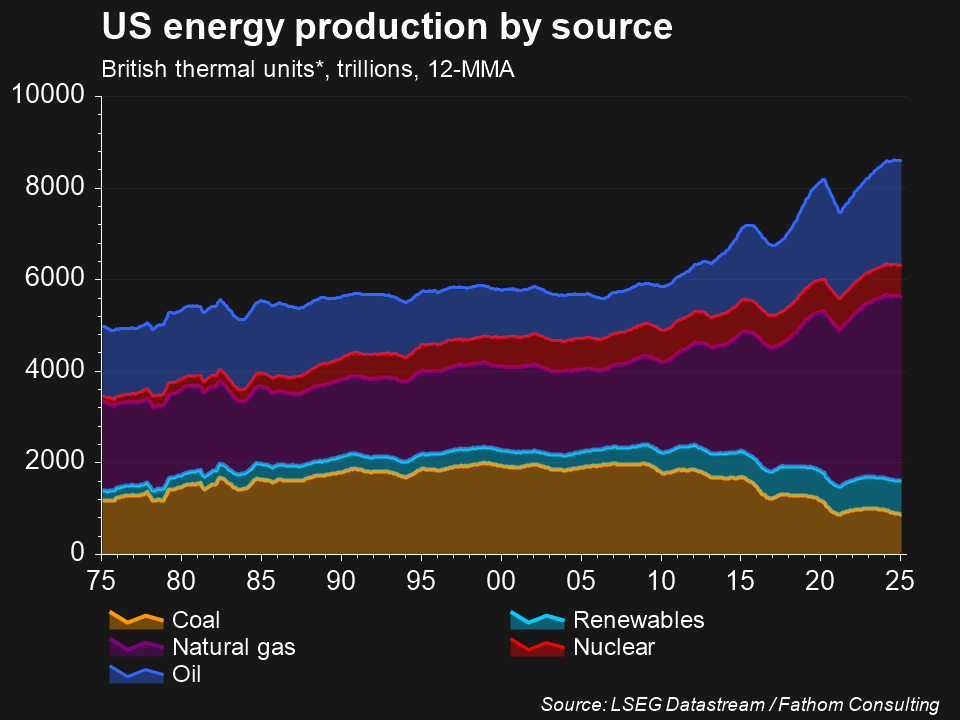

Bessent has also repeatedly described his 3-3-3 plan, that aims to increase US oil production by 3 million barrels per day, achieve 3% GDP growth, and reduce the federal deficit to 3% of GDP[7]. The Treasury Secretary argues that expanding domestic oil production will lower energy costs, helping to combat inflation and reduce pressure on profit margins. He emphasises that deregulating the energy sector is essential to achieving this, by streamlining permitting processes and reducing bureaucratic hurdles that impede energy infrastructure development. Trump has also declared a national energy emergency in response to high energy prices, while opening 1.53 million acres in Alaska for energy development, and lifting the Biden administration’s pause on liquefied natural gas terminals. Critics, however, caution that aggressive deregulation in the oil sector could have negative environmental implications and may lead to market oversupply, potentially affecting global oil prices and hampering future projects’ profitability, which could discourage new investment.

How has the market reacted to Bessent’s plans?

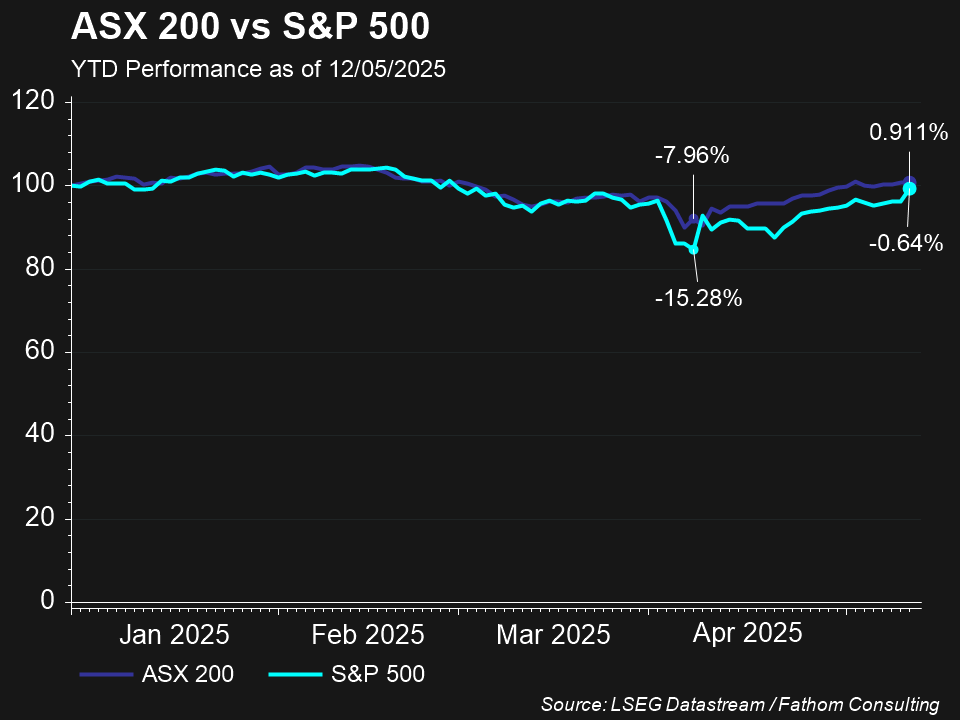

While initially very optimistic on Trump’s proposed deregulation and tax cuts following his inauguration, the market turned following his subsequent tariff announcements in the months following, which surprised many in their breadth and severity. This has caused the S&P 500 and ASX 200 to be down -0.64% and up 0.91% respectively year-to-date, as focus has shifted to concern around tariffs causing an inflation spike and recession, heightened by US GDP falling at a 0.3% annual rate in the first quarter of 2025, its first contraction since 2022. Markets have rebounded, though, since Trump’s Liberation Day tariff announcements. As trade negotiations with the UK and China spur optimism from bullish investors that bears are underestimating a tariff reprieve, and ignoring the positive impact the administration’s tax cut and deregulation plans will have.

Bessent himself has said critics of the Trump economic agenda attack individual policies in isolation, ignoring how these are interconnected. According to Bessent, trade, tax cuts and deregulation aren’t stand-alone measures, but interlocking parts of a plan designed to drive domestic manufacturing and economic growth. In his mind, tax cuts raise real incomes for consumers and businesses, while tariffs create incentives for reindustrialisation, and deregulation complements tariffs by stimulating credit growth and investment in domestic manufacturing and energy. Many investors remain sceptical however, as the shock-and-awe of Trump’s tariffs continues to reverberate through markets, and overshadow the administrations other agenda items.

References

-

- The Wall Street Journal, “Trump’s three steps to economic growth,” May 4, 2025

- The Wall Street Journal, “Surprise US-China trade deal gives global economy reprieve,” May 12, 2025

- The Wall Street Journal, “Republicans count on Trump tax plan to boost economy, but there’s a catch,” May 2, 2025

- Yahoo Finance, “Treasury Secretary Scott Bessent talks tariffs, taxes, and concerns about an economic slowdown” April 21, 2025

- All-In Podcast, “Scott Bessent | All-In in DC,” March 19, 2025

- Yahoo Finance, “Breaking down Scott Bessent’s 3-3-3 economic strategy,” January 20, 2025

- The Wall Street Journal, “US economy shrank in first quarter as imports surged ahead of tariffs,” April 30, 2025