How unaffordable is Australian housing?

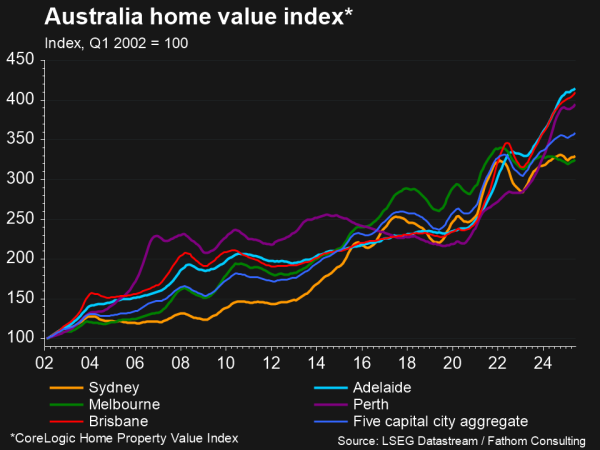

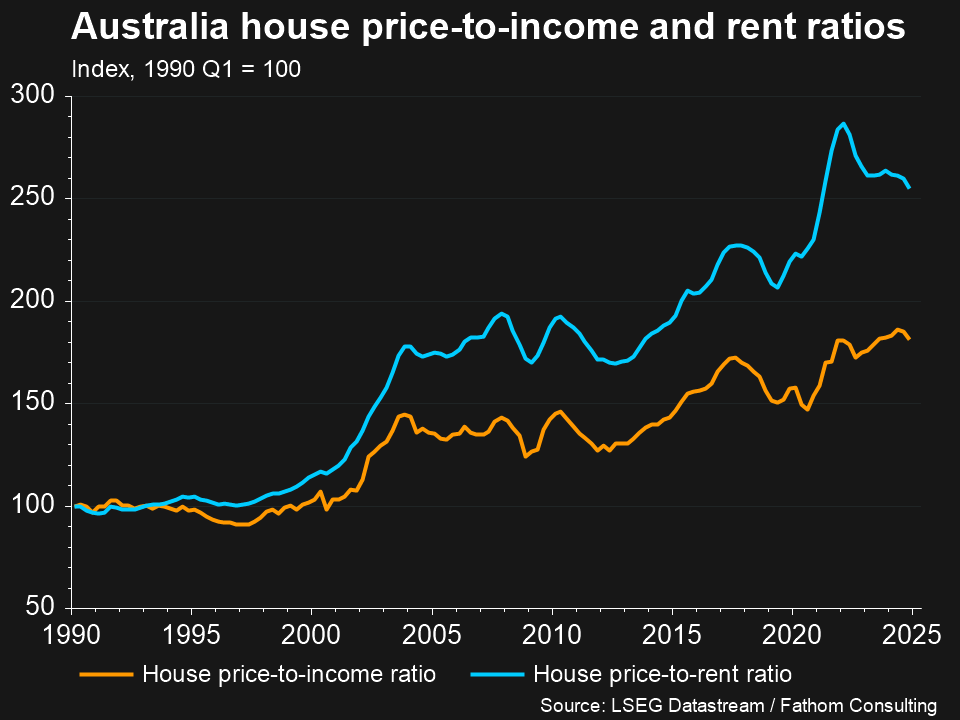

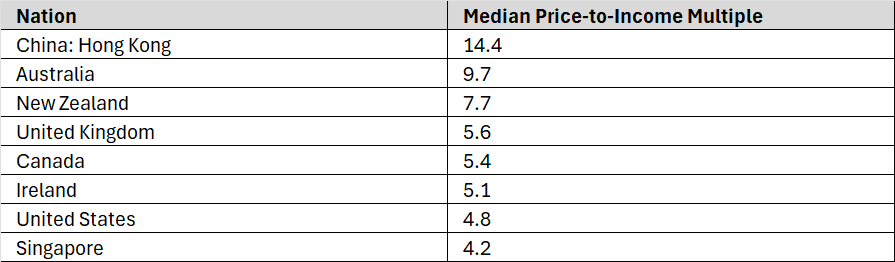

Australia’s average house price has passed $1 million for the first time ever in the March quarter of 2025, rising 0.7% as Sydney and Melbourne’s median house prices also hit $1.2 million and $900,000 respectively1. This comes after Chapman University in California posted its annual Demographia Housing Affordability study in May, which revealed Sydney as the second least affordable market globally, with a median house price to median income multiple of 13.8, and a score above 9 rated as “impossibly unaffordable” by the study. The report also highlighted Australia as the second most unaffordable country globally2.

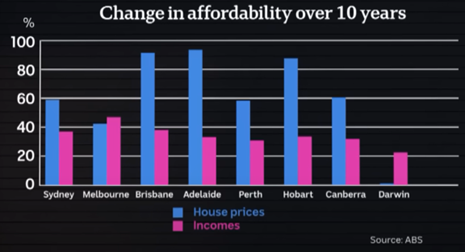

Wage data in May also highlights house price growth significantly outpacing wage growth over the last 10 years across all of Australia’s capital cities, except Melbourne and Darwin, highlighting housing becoming more unaffordable and mortgage repayments making up a greater proportion of incomes, as the value of the loans homeowners need to take on to buy houses has grown faster than their incomes3.

Why have house prices increased faster than incomes?

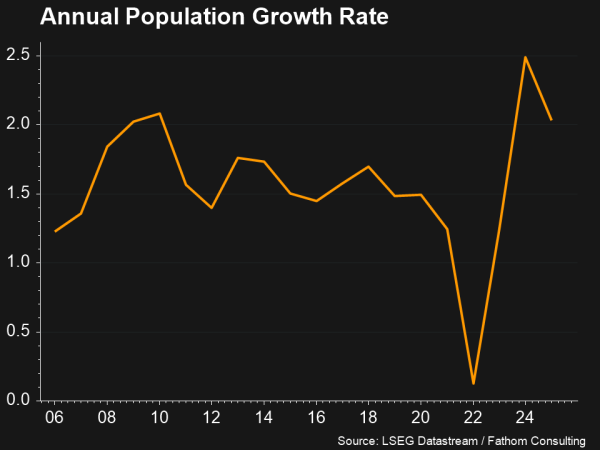

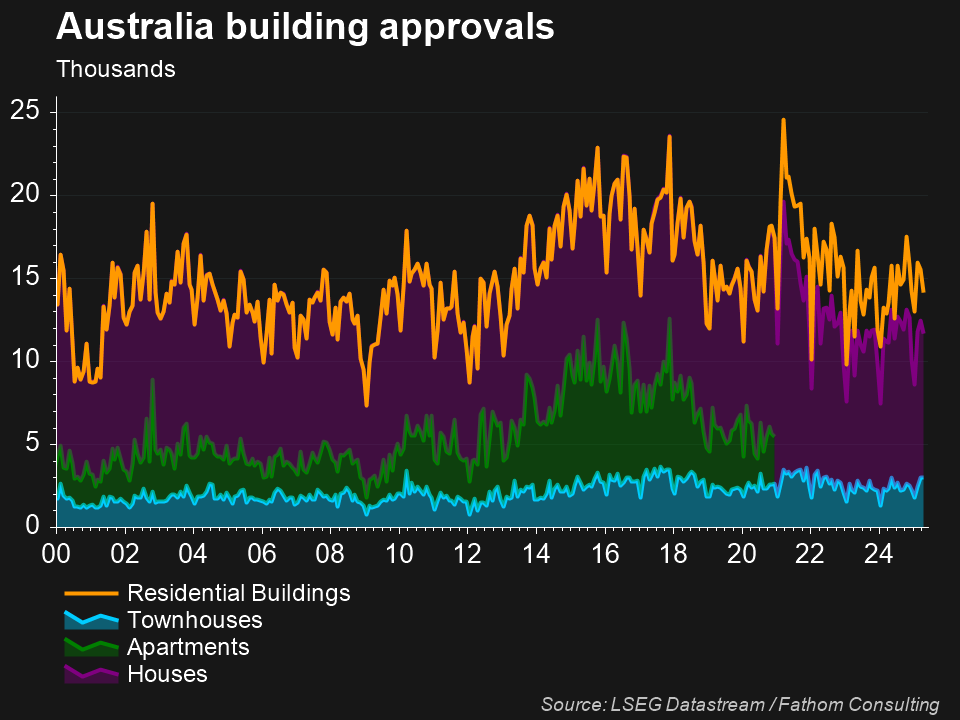

Supply shortfalls in new homes may have been a driver of recent house price rises, with building approvals falling since the COVID-19 pandemic, as construction costs rise and make the margins on new property developments less attractive for developers, while zoning restrictions limit the land in high-demand areas available for development. This has raised concerns that Australia will fall short of the 1.2 million new homes by mid-2029 target that federal and state governments set in 2023 under the National Housing Accord, with the Property Council of Australia projecting in June we will fall 462,000 homes behind the target, potentially adding further pressure to housing affordability4. Some argue demand pressures have then escalated these supply issues, through population growth outpacing housing supply growth and tax incentives like negative gearing that make property an attractive investment vehicle.

What policies has the government introduced to improve access to housing?

During its 2025 election campaign, the federal Labor government announced a $10 billion spending commitment to build up to 100,000 new homes exclusively for first home buyers, while also committing to allow first home buyers to buy a home with a 5% deposit under its First Home Guarantee scheme, with the government guaranteeing the rest to get the borrower up to the minimum deposit thresholds (typically 20%) to avoid lenders mortgage insurance5. Some, however, have argued that such measures aimed at lowering deposit requirements for home buyers will continue to drive-up house prices in the long run, by giving more people access to the market at a faster rate than supply growth can keep up with.

Housing affordability will no doubt continue to dominate political and economic discussions in Australia in the future, particularly if demand continues to outpace new housing supply, presenting further pressure for homebuyers.

Explore how first home buyer incentives can help you enter the market.

References

- ABC News, “Facing the figures: Australia’s housing affordability is worsening,” 9 June 2025

- Chapman University, “Demographia International Housing Affordability,” 13 May 2025

- Australian Bureau of Statistics, “Total value of dwellings,” 10 June 2025

- Property Council of Australia, “Smarter incentives, more homes,” 18 March 2025

- Australian Labor Party, “Labor to deliver 5% deposits for all first home buyers and build 100,000 homes,” 13 April 2025