Where has the US attacked?

President Trump announced on Sunday that US forces have hit three Iranian nuclear facilities, including the uranium enrichment site at Fordow, which officials previously said could only be targeted by GBU-57 Massive Ordnance Penetrator bombs, otherwise known as ‘bunker busters,’ due to its location under a mountain1.

The move comes after Israel’s prior attacks on Iranian nuclear sites over the past couple of weeks, with President Trump describing the attacks as “very successful,” while raising the possibility of regime change in Iran that he says could “make Iran great again2.”

How have markets responded?

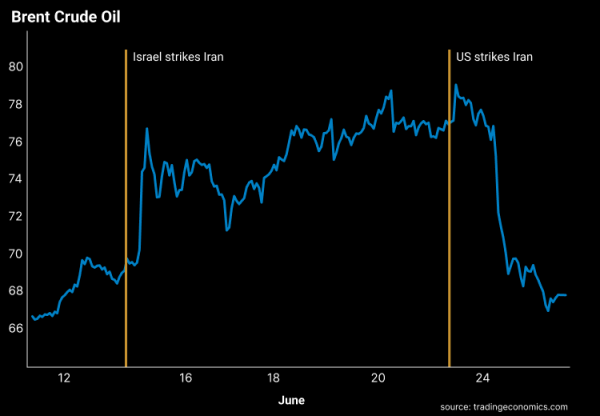

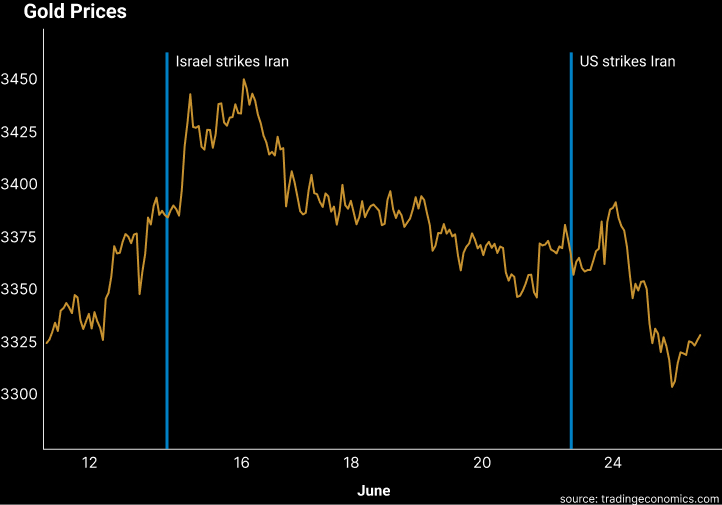

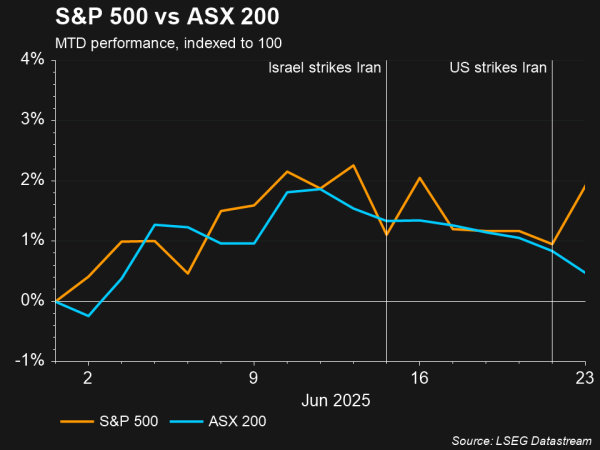

Oil prices spiked following news of the strikes, up significantly on the Monday following America’s attack on Sunday, but fell Tuesday on Iran’s response to the attack proving more subdued than expected, as they fired missiles at a US air base in Doha and gave warning to the US before the attack (resulting in no casualties or injuries). Oil prices are now back where they were before the escalation of the Israel-Iran conflict on June 13, with major stock market indices also being broadly flat. Which highlights investors not currently pricing in a significantly higher geopolitical risk premium or long-term oil price, and believing the conflict may be resolved via negotiation, with President Trump stating on Tuesday that he had negotiated a ceasefire and mitigated oil supply impact risks. After sharp spikes, gold has also retreated back to its pre-June 13 levels, as investors reduce their allocation to the traditional safe-haven asset, which they had been buying to limit their exposure to future market volatility in the event of the conflict escalating.

What next for markets and the global economy?

While Iran only exports 2% of the world’s global oil consumption, the bigger risk for the global economy is if the conflict escalates further and they decide to weaponize their control of the Strait of Hormuz, which 20% of the world’s oil passes through from countries like Saudi Arabia and the UAE3. If this were to occur, oil prices may remain higher for longer, pushing up inflation around the globe as transport and energy costs rise, which then increases input costs for businesses that they may pass on to consumers.

China is also specifically at risk of a disruption to Iran’s production, being the main buyer of Iranian oil which accounts for 15% of their total crude imports, while also importing most of their crude (outside Russia) from Saudi Arabia, whose shipments pass through the Strait of Hormuz4.

Iran’s parliament, according to state media, approved a measure on June 22 endorsing the closure of the Strait of Hormuz, however this is ultimately up to the country’s Supreme Leader, Ali Hosseini Khamenei, and whether the conflict escalates beyond Iran’s relatively muted strike on the American air base in Doha5. Iran hasn’t closed the strait in any prior Middle East conflict, however it remains to be seen whether the most severe strike by the US on Iranian soil may trigger further retaliation, and whether the US Navy’s Fifth Fleet, currently patrolling the strait, may deter or prevent major disruptions.

References

- Australian Financial Review, “‘Full payload of bombs’: Trump launches major strikes on Iran,” 23 June 2025

- Financial Times, “Trump suggests regime change could ‘Make Iran Great Again,’” 23 June 2025

- Australian Financial Review, “Trump’s attack on Iran could wipe up to 10pc off equity markets,” 22 June 2025

- Financial Times, “China’s bet on Iranian oil and Middle East influence turns sour,” 20 June 2025

- Australian Financial Review, “US signals willingness to renew Iran talks and avoid a prolonged war,” 23 June 2025