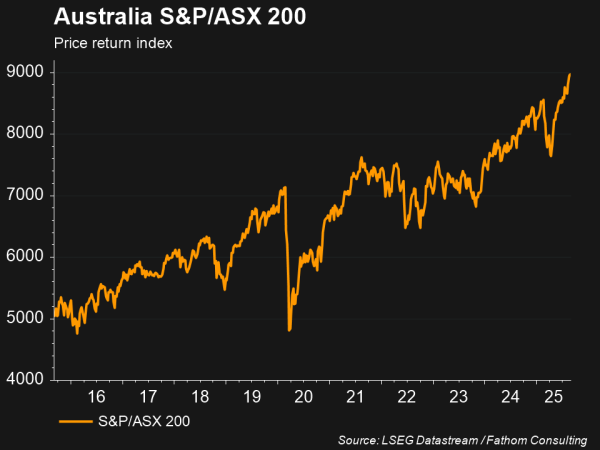

The ASX 200 rose 3% over the August 2025 reporting season, reaching record highs despite another year of declining corporate profits. This was driven by slightly better-than-expected earnings across much of the index, as cost control softened the impact of falling revenues. Beneath the surface, however, the incremental index gain masked one of the most volatile earnings seasons in recent memory, with several large-cap stocks experiencing large sharp price swings on results day1.

Who were the reporting season winners and losers?

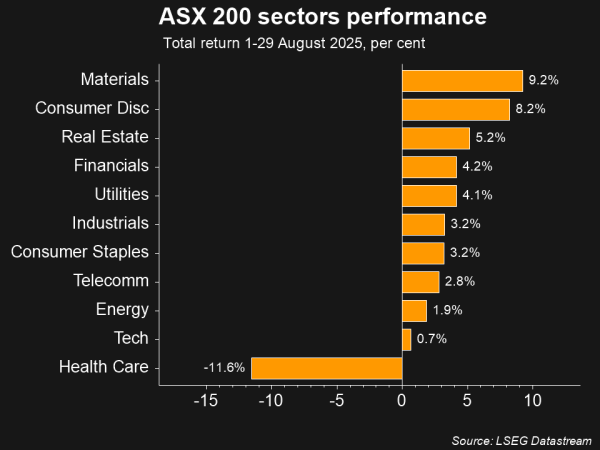

Financials, particularly the major banks, were standout performers, delivering solid results supported by stable net interest margins and low bad debts. Industrials and select consumer discretionary companies also fared well, with disciplined cost control helping several names exceed market expectations despite muted consumer spending growth.

Conversely, healthcare was a notable laggard, largely due to CSL’s earnings downgrade and its announcement to spin off its vaccine division. The stock fell over 15% on results day—its worst single-day performance since listing in 1999. The materials sector also reported weaker earnings, impacted by softer volumes and pricing pressures. Yet, share prices in the sector rose, reflecting investor optimism around an iron ore price recovery.

What about volatility?

While the magnitude of earnings beats and misses was broadly in line with previous earnings seasons, the market’s reaction to earnings disappointments was significantly more extreme. Several of Australia’s largest companies—including Woolworths, James Hardie, and CSL—experienced single-day share price declines of 15% to nearly 30%, levels not seen in decades2.

These outsized reactions underscore the growing influence of passive investing and algorithmic trading, which can magnify price volatility as mechanical strategies respond swiftly to earnings surprises. The ASX’s increasingly concentrated structure has further amplified this effect. The 10 largest companies now account for nearly half of the ASX 200’s market capitalisation, and with IPO activity subdued and more companies being taken private, the number of listed firms has fallen to its lowest level since 20103. This has meant that earnings disappointments among large-cap names can disproportionately impact market sentiment, driving outsized trading reactions for these stocks.

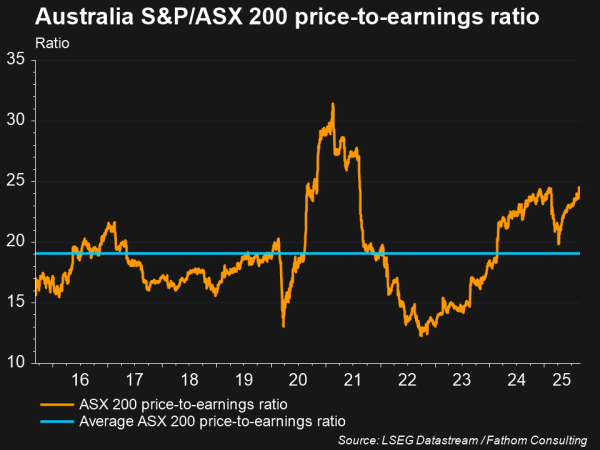

How do valuations look post reporting season?

Despite another season of negative profit growth, the ASX 200 continued to climb, driven by a rising price-to-earnings ratio. This reflects investors’ expectations for stronger future earnings and a growing disconnect between asset prices and the real economy.

The market’s resilience, despite lacklustre earnings, highlights the role of valuation expansion and investor willingness to pay a premium for future earnings growth.

Explore our full analysis of the Federal Budget 2025–26 and policy impacts.

References

- Australian Financial Review, “Inside the wildest profit season, from blue chip pain to endless rally,” 29 August 2025

- Australian Financial Review, “Blue-chip gloom sets in after ‘once-in-a-generation’ profit season,” 29 August 2025

- Australian Financial Review, “4 charts that show why earnings seasons are becoming so volatile,” 29 August 2025