Why is nuclear energy back in the spotlight?

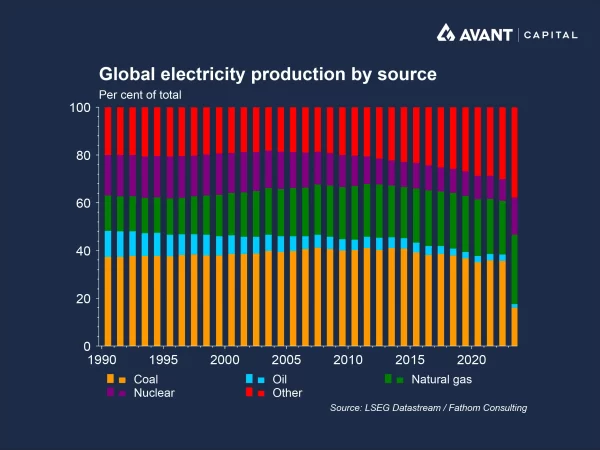

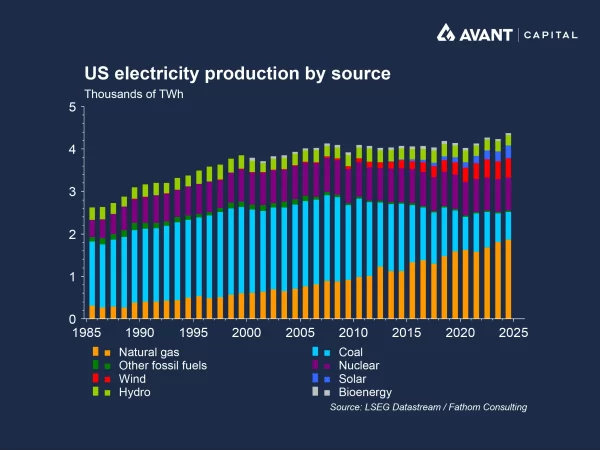

In 2025, nuclear energy has re-emerged as a central pillar of global energy policy. Once sidelined by safety concerns and cost overruns, it is now being embraced by governments as an attractive alternative to other renewable energy sources. The reasons are diverse: the urgent need to meet energy transition targets, the geopolitical imperative for Europe to reduce their reliance on Russian gas, and the surging power demands of AI infrastructure.

How is AI accelerating the nuclear revival?

The AI boom has turbocharged electricity demand. Data centres, particularly those supporting generative AI and cloud computing, are energy-intensive and require stable, round-the-clock power. Nuclear energy, with its high capacity factor and zero-carbon emissions, is uniquely positioned to meet this need, compared with other renewable sources like wind that have more intermittent power supply and require backup energy sources1.

Tech giants like Google, Microsoft, and Amazon have signed deals to power their data centres with nuclear energy. Google, for example, is partnering with NextEra Energy to restart the Duane Arnold nuclear plant in Iowa, aiming to bring it online by 20292. Meanwhile, Microsoft has backed the revival of the Three Mile Island facility and invested in small modular reactor (SMR) developers.

What role is the US government playing?

Under President Donald Trump, the US has launched an aggressive push to quadruple its nuclear capacity by 2050, as a part of its broader strategy to improve America’s energy security3. In May 2025, Trump signed executive orders to fast-track reactor approvals, reform the Nuclear Regulatory Commission (NRC), and boost domestic uranium production. A landmark $US80 billion deal with Westinghouse, Cameco, and Brookfield in October 2025 aims to build eight new AP1000 reactors, with the US government taking a profit-sharing stake in the venture4. This comes after the World Bank’s June 2025 decision to lift its decades-long ban on nuclear financing, further signalling the shift in global policy towards nuclear energy in 20255.

Why is Europe turning to nuclear?

Europe’s pivot to nuclear has been driven by the energy crisis sparked by Russia’s invasion of Ukraine. Countries like France, Sweden, and Poland are expanding their nuclear fleets, while Germany has reversed its long-standing opposition, aligning with France to treat nuclear on par with renewables in EU legislation6.

However, Europe’s nuclear renaissance faces hurdles. A report by Global Energy Monitor found that nearly 40% of proposed nuclear projects globally have been cancelled, with long lead times and cost overruns remaining persistent issues in getting nuclear reactors up and running7.

How is the uranium market responding?

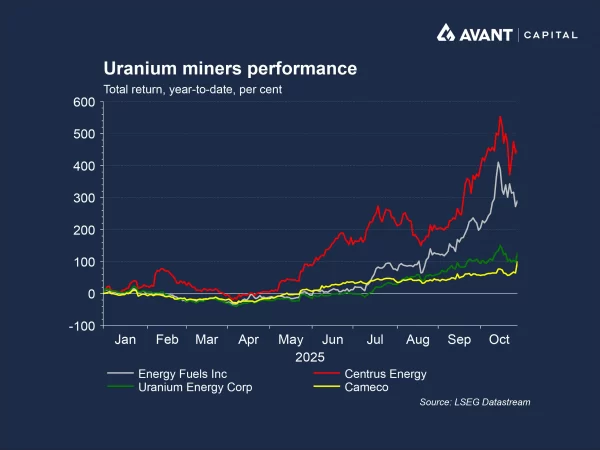

The nuclear revival has triggered a surge in uranium demand and prices. Global uranium requirements are projected to rise by a third to 86,000 tonnes by 2030 and nearly double to 150,000 tonnes by 20408. Yet, output from existing mines is expected to halve over the same period, creating a potential supply gap. This has seen uranium prices soar in 2025.

Uranium miners and fuel suppliers have been among the biggest beneficiaries of these higher prices, which have been propelled by increasing investor expectations for nuclear energy usage going forward. The uranium supply chain is also fragile, with Kazakhstan, the world’s largest uranium producer, increasingly directing exports to China and Russia9, raising concerns about Western access and potential supply constraints, which has been a further tailwind for uranium prices.

Therefore, while the momentum behind nuclear power and uranium is undeniable, the path forward for demand, supply, and ultimately prices is highly uncertain.

Further Reading

Read how we integrate Environmental, Social, and Governance factors into portfolio decisions in responsible investing.

References

- Financial Times, “Uranium prices hit record as thirsty AI data centres add to market squeeze,” 12 January 2025

- The Wall Street Journal, “A dormant nuclear plant in Iowa is poised to power Google’s energy needs,” 27 October 2025

- Financial Times, “Donald Trump issues directive to fast-track nuclear energy development,” 24 May 2025

- Financial Times, “US government and Westinghouse strike $80 billion nuclear reactor deal,” 28 October 2025

- Financial Times, “Why the World Bank embraced nuclear energy – and what comes next,” 17 June 2025

- Financial Times, “Germany drops opposition to nuclear power in rapprochement with France,” 19 May 2025

- Financial Times, “Nuclear roadblocks could hinder the EU’s climate goals,” 4 September 2025

- Financial Times, “Uranium shortfall threatens nuclear energy renaissance, industry warned,” 5 September 2025

- Financial Times, “Uranium prices hit record as thirsty AI data centres add to market squeeze,” 12 January 2025