How did big tech perform and how did markets react?

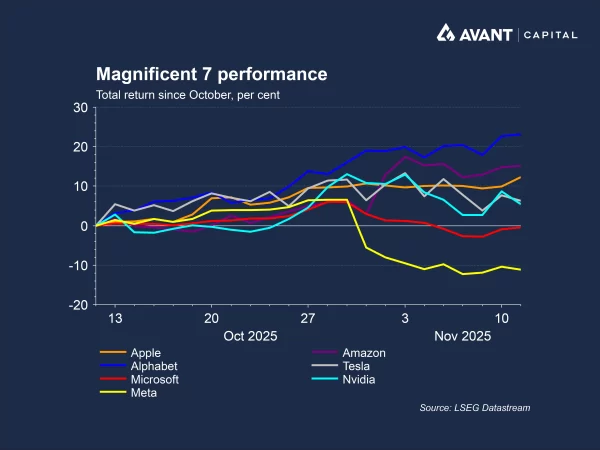

The third-quarter 2025 US earnings season delivered robust earnings growth, particularly in the technology sector, but market reactions were mixed. While the so-called Magnificent Seven, Meta, Microsoft, Alphabet, Amazon, Apple, Nvidia and Tesla, posted strong headline figures, investor sentiment was tempered by concerns over the sustainability of their capital expenditure, especially in artificial intelligence (AI).

Meta reported record quarterly revenue of over US$50 billion, up 26% year-on-year, and operating income of US$20.5 billion1. However, its announcement of up to US$72 billion in capital expenditure for 2025, with even higher spending flagged for 2026, triggered an 11% drop in its share price on results day2. Microsoft, despite beating earnings expectations with US$77.7 billion in revenue and 40% growth in its Azure cloud business, saw its shares fall nearly 4%, driven by concerns over its US$34.9 billion quarterly capex and a US$3.1 billion charge related to OpenAI3. Alphabet, by contrast, saw a 16% revenue surge to US$102.3 billion, with net income up 33%, and its shares rose more than 6% in after-hours trading4.

Amazon delivered a positive surprise, with a 13% revenue jump to US$180 billion and a 39% rise in net profit5. Its cloud division, AWS, grew 20%, and its shares surged over 10%. Nvidia, meanwhile, is yet to report results but recently became the first company to reach a US$5 trillion market capitalisation, underscoring the market’s enthusiasm for AI-linked growth6.

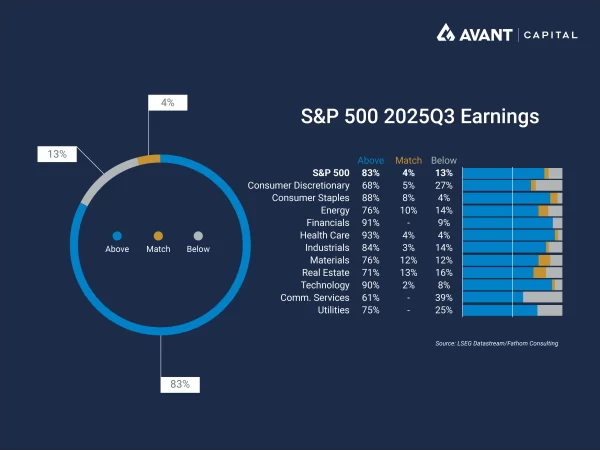

Overall, the technology sector delivered 28.5% earnings growth as at 7 November 2025, with 90% of results exceeding market expectations7.

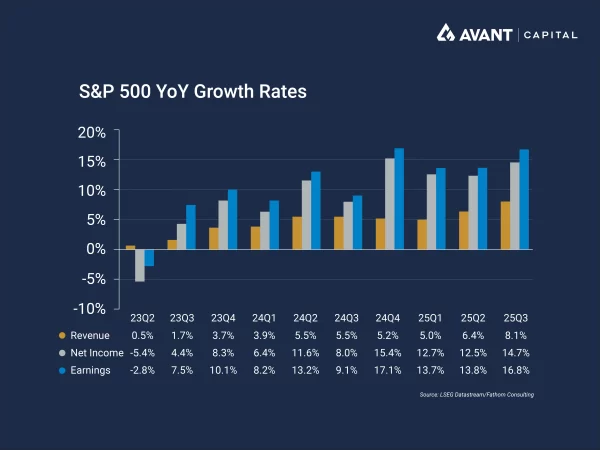

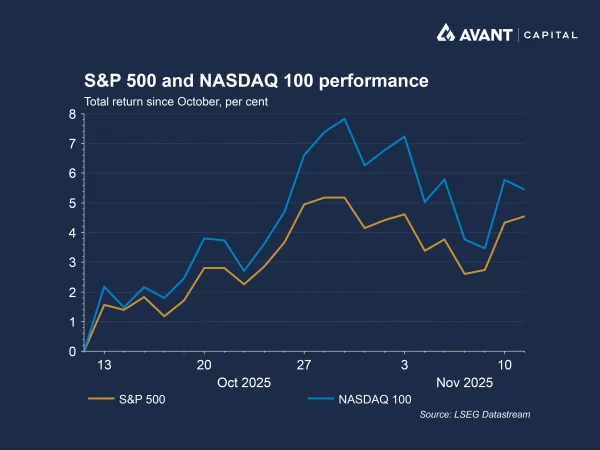

The broader S&P 500 posted 16.8% earnings growth, with 83% of companies beating forecasts. Revenue growth was more muted, with the technology sector and the broader index delivering 1.8% and 2.3% growth respectively. Margin expansion was the primary driver of profit growth. Despite these strong results, the NASDAQ 100 and S&P 500 have posted more modest gains since third-quarter reporting season began, as investors reassess valuations and the sustainability of AI-related spending.

Why are investors concerned about AI spending?

Investor sentiment has become increasingly sensitive to the scale and timing of AI investments. While the long-term potential of AI is widely acknowledged, markets are now scrutinising whether, and when, these investments will yield sufficient returns.

Meta’s capital expenditure, for example, is expected to reach 37% of its revenue this year, the highest among its peers. This has raised concerns about how such spending is eroding current free cash flow and how it may impact future profitability, particularly if returns on this investment disappoint. Capitalised AI infrastructure spending is depreciated over time, meaning its impact on profit margins will grow in future quarters. This has prompted investors to shift their focus from purely growth to capital discipline and returns on investment.

What did earnings season reveal about the US economy?

Beyond tech, the broader earnings season was surprisingly strong. Third-quarter earnings for the consumer discretionary, financials, an industrials sectors came in above expectations at 11.8%, 9.2%, and 15.6% respectively, with all the S&P 500 sectors delivering positive earnings growth. Banks such as JPMorgan, Citigroup and Goldman Sachs posted particularly bumper profits, helped by a resurgence in deal-making and strong trading income.

Why aren’t markets rewarding strong earnings?

Despite the robust earnings season, markets have not rewarded companies as generously as in previous quarters. While over 80% of S&P 500 companies beat earnings estimates, the median stock outperformed the index by just 0.3% the day after reporting, well below the historical average of 1%8.

Several factors explain this caution. After months of rallying, investors are wary of stretched valuations, particularly in the technology sector. The S&P 500’s price-to-earnings (P/E) ratio has been well above its long-run average throughout 2025, highlighting that investors had already priced in significant profit growth ahead of third-quarter results. While some argue that the AI-driven growth potential supports higher multiples, others point to concentration risks, with the Magnificent Seven now accounting for 38% of the S&P 500’s market capitalisation and their performance critical for broader market returns9.

Critics also warn that the market is pricing in too much optimism. The sheer scale of AI-related capital expenditure, projected to exceed US$400 billion this year10, has raised questions about whether returns will materialise quickly enough to justify current valuations. Meta’s spending, for instance, is being funded in part through debt issuance, and its lack of clarity on monetisation timelines has unsettled investors.

Ultimately, the market delivered another quarter of strong earnings growth, following similarly stellar results in quarter two, but appears to be entering a phase of greater discernment. Investors are no longer rewarding growth opportunities alone; they want clarity on profitability, capital discipline and return on investment.

References

- The Wall Street Journal, “Meta still has a lot to prove in AI race,” 30 October 2025

- The Wall Street Journal, “Tech earnings send Nasdaq lower,” 30 October 2025

- The Wall Street Journal, “Microsoft to double data centre footprint in two years,” 29 October 2025

- The Wall Street Journal, “Google revenue soars to record as AI boom lifts cloud business,” 29 October 2025

- The Wall Street Journal, “Amazon shares surge on 13% revenue jump, strong cloud sales,” 30 October 2025

- The Wall Street Journal, “Nvidia is now the world’s first $5 trillion company,” 29 October 2025

- LSEG, “S&P 500 earnings scorecard,” 7 November 2025

- The Wall Street Journal, “Corporate earnings were great this quarter. Wall Street is still not impressed,” 9 November 2025

- The Wall Street Journal, “What investors learned from tech earnings, in charts,” 1 November 2025

- The Wall Street Journal, “Big tech is spending more than ever on AI and its still not enough,” 30 October 2025