How has China’s economy been performing?

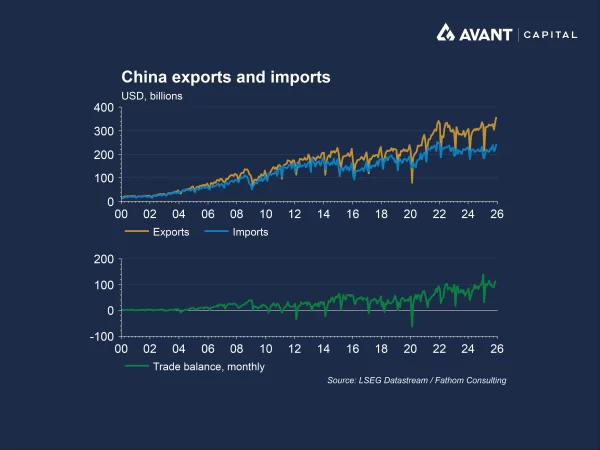

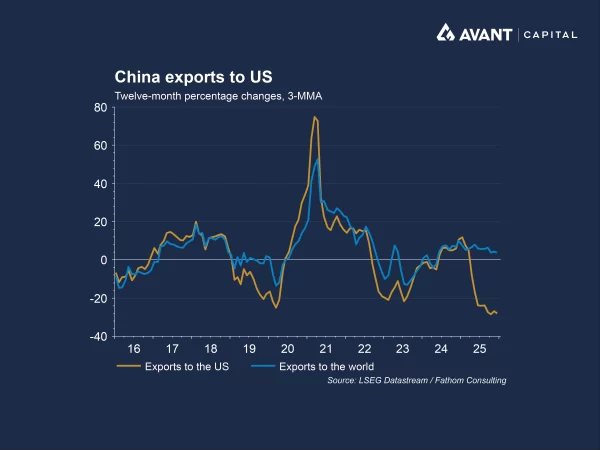

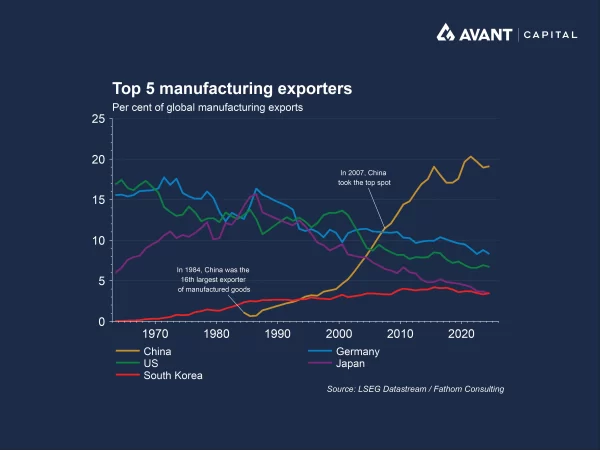

China closed 2025 with a record trade surplus of $US1.19 trillion, defying expectations that US tariffs would cripple its export machine1. Exports grew despite shipments to the US falling significantly, as Chinese manufacturers pivoted to Southeast Asia, Africa, and Latin America, where exports surged by double digits. Persistent producer-price deflation made Chinese goods even more competitive globally, reinforcing its dominance in manufacturing.

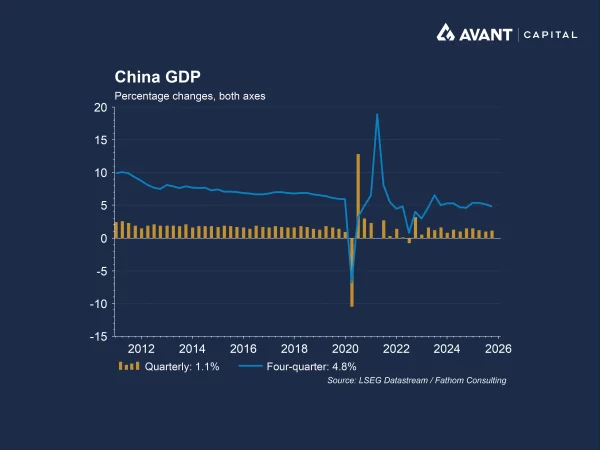

China’s economy still grew 5.0% in 2025, which was positive compared to global peers, largely thanks to strong exports and government-led infrastructure spending2. However, domestic demand remains anaemic, weighed down by a prolonged property slump, high youth unemployment, and falling wages. Retail sales grew just 1.3% in November, the slowest pace since late 20223. The IMF has repeatedly urged Beijing to shift from an investment-and-export-led model to consumption-driven growth, warning that China is “too big to rely on exports” alone4.

How have tariffs shaped China’s strategy?

The tariff war with Washington intensified in 2025, with levies reaching as high as 145% before being eased later in the year5. While the Trump administration accused Beijing of unfair practices in semiconductors, it delayed further tariff hikes until mid-2027. China responded by doubling down on its export-led model and leveraging its chokehold on critical supply chains, such as rare earths and battery components, to maintain bargaining power in negotiations.

This resilience underscores a key reality: China’s manufacturing ecosystem is deeply embedded in global supply chains. Even when production shifts to Vietnam or Mexico, Chinese components often remain indispensable. Some analysts warn that this structural advantage makes tariffs a blunt instrument, as they risk triggering recessions in importing economies without significantly denting China’s global export volumes.

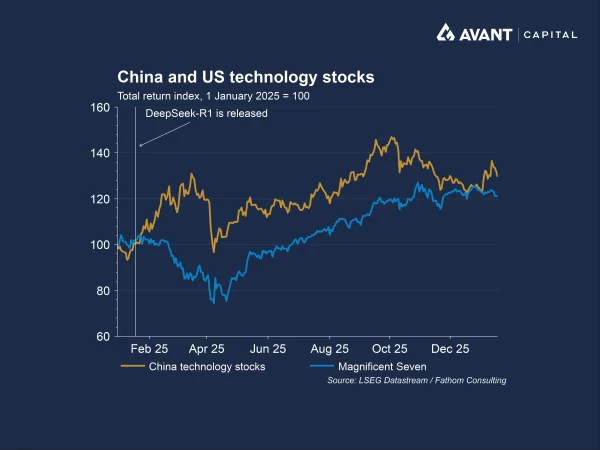

Despite tariff headwinds, Chinese tech stocks staged a spectacular comeback. The Hang Seng Index soared, outpacing the NASDAQ 100 and S&P 500. The rally was catalysed by breakthroughs in artificial intelligence and Beijing’s push for chip self-sufficiency. Giants like Alibaba, Tencent, and Baidu saw particularly sharp share price gains.

How is China competing in the global AI race?

2025 marked a turning point in the US-China AI race. Initially hampered by US export controls on advanced chips, Chinese firms pivoted to efficiency and openness. DeepSeek stunned the industry with its R1 model early in the year, matching the reasoning performance of leading US models at a fraction of the cost. Its open-source approach, contrasting sharply with the closed strategies of OpenAI and Google, accelerated adoption worldwide, particularly in emerging markets, and allowed developers to customise and enhance the model for specialised applications.

DeepSeek’s latest experimental model, unveiled in September, introduced a “sparse attention” technique that halves Application Programming Interface (API) costs, APIs are tools that allow different software applications to communicate, making AI more accessible for developers and enterprises6. This cost advantage, combined with Beijing’s subsidies and energy incentives for data centres, has helped Chinese AI models gain scale and traction in Africa, the Middle East, and parts of Asia7.

Industry chatter suggests DeepSeek 2 could launch before the Lunar New Year, following delays linked to Huawei’s Ascend chips8. While training still relies heavily on Nvidia hardware, DeepSeek is optimising its models for domestic processors, a strategic move to reduce dependence on US technology. China’s broader AI blueprint, dubbed “AI Plus”, aims for integration of AI across 70% of the economy by 2027 and 90% by 20309.

What does this mean for global markets?

The AI boom has buoyed equity markets globally, but China’s approach, open-source, cost-efficient, and state-backed, poses a formidable challenge to US incumbents. While American firms dominate in cutting-edge research and chip technology, China’s strategy of rapid diffusion and affordability could win the adoption race.

For investors, the strong performance of China’s tech sector in 2025 underscores its rapid progress toward closing the gap with US competitors, driven by open-source AI models and extensive state-backed initiatives that have accelerated innovation and adoption.

References

- The Wall Street Journal, “China’s record trade surplus defies expectations for tariff-driven slowdown,” 13 January 2026

- The Wall Street Journal, “Global economy records stronger growth, but is on course for a weak decades, says World Bank,” 13 January 2026

- Financial Times, “China’s industrial profits plunge as weak demand and deflation bite,” 27 December 2025

- The Wall Street Journal, “China is too big to rely on exports for growth, IMF chief warns,” 10 December 2025

- Financial Times, “US accuses China of unfair chip trade practices,” 24 December 2025

- The Wall Street Journal, “China’s DeepSeek unveils new AI model that could halve usage cost,” 30 September 2025

- Financial Times, “Nvidia’s Jensen Huang says China ‘will win’ AI race with US,” 6 November 2025

- Financial Times, “Microsoft warns that China is winning AI race outside the west,” 13 January 2026

- The Wall Street Journal, “The AI Cold War that will redefine everything,” 10 November 2025