Kevin Warsh has been nominated by US President Donald Trump to serve as the next Chair of the Federal Reserve, with his term scheduled to begin when current Chair Jerome Powell steps down at the end of his tenure in May 2026. Trump’s announcement follows his sustained push for immediate and substantial interest rate cuts throughout Powell’s leadership, raising early questions over whether Warsh will follow the President’s wishes for rapid easing.

Warsh’s return to the Federal Reserve comes more than a decade after he served as a Governor during the Global Financial Crisis1. While he brings institutional familiarity, the environment he enters is far more politically charged. With inflation having eased yet still above target, and with Trump keeping monetary policy at the forefront of political debate, Warsh’s approach in his early months will shape confidence in the central bank’s independence and strategic direction.

How might Warsh approach the interest rate outlook?

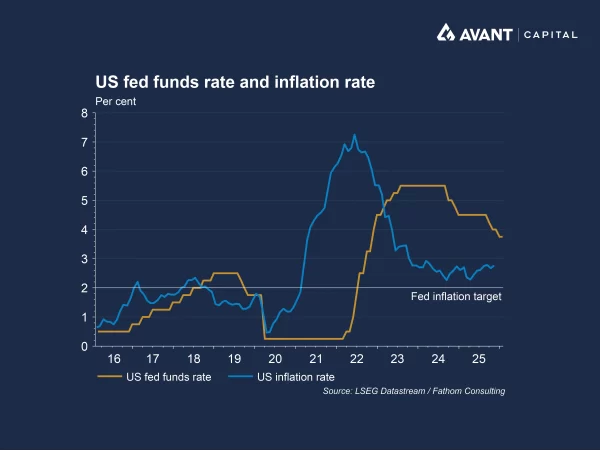

The defining policy question surrounding Warsh’s appointment is how he will manage interest rates in the face of above-target inflation and political demands. Trump has forcefully argued that rates must fall quickly, positioning monetary easing as a central driver of his economic agenda. Yet inflation, though moderated, remains at 2.8%, above the Federal Reserve’s 2% target, and cutting prematurely risks reigniting price pressures.

Warsh’s past statements suggest a cautious stance on easing when inflation is still elevated. Historically, Warsh has argued against maintaining overly loose policy in periods where inflation risks remain present. This suggests he may not move as rapidly or aggressively as Trump publicly desires. If he prioritises a conventional, data‑first framework, his early decisions may diverge from the President’s preferred timeline. Investors are attempting to interpret whether Warsh will be guided primarily by economic indicators or by the administration’s vocal demands, and this interpretive tension is likely to persist until his first major policy decisions.

Where do inflation and labour market conditions stand as Warsh steps in?

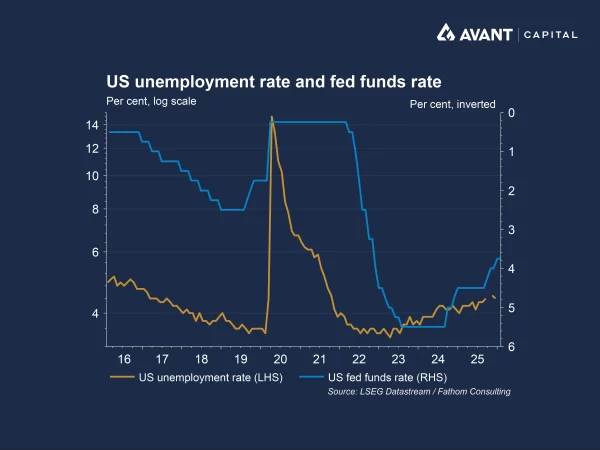

Warsh assumes leadership at a moment when the path for inflation is highly uncertain. The recent rounds of tariffs imposed across major trading partners are still flowing through into goods prices, which could raise input costs and gradually filter into retail pricing. The labour market, meanwhile, is cooling. Unemployment sits at 4.4%, marking a consistent upward trend throughout 2025. While the economy is still generating jobs, the pace has slowed meaningfully, wage growth has moderated, and the once‑tight hiring market has loosened. This softening reduces the risk of wage‑driven inflation but increases the risk of a more pronounced downturn if policy remains overly restrictive. Warsh must therefore manage a narrow policy corridor: loosen too quickly, and inflation may stall above target; tighten or delay easing, and labour‑market weakness may accelerate.

How have markets reacted to Warsh’s nomination?

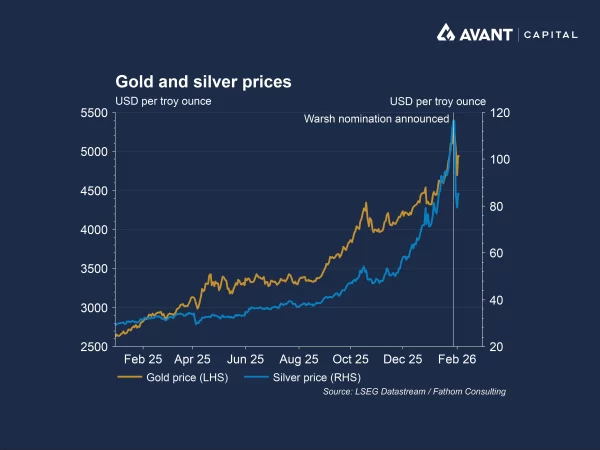

The market reaction to Warsh’s selection has been swift and dramatic, especially across precious‑metals markets. Gold had rallied aggressively in recent months, surging to nearly $5,600 per ounce amid investor fears of inflation, geopolitical turbulence, and concerns around potential dollar debasement, the idea that expansive monetary and fiscal policies might undermine the long‑term purchasing power of the US dollar. Many investors sought gold as a hedge against this scenario, driving strong gains before the nomination.

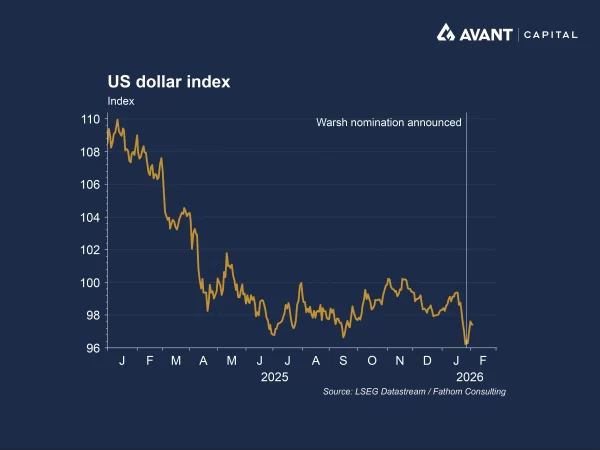

The announcement of Warsh as Fed chair abruptly reversed this surge. Gold plunged as much as 11% while silver collapsed more than 26% in a single session, and platinum similarly tumbled2. Markets read Warsh’s nomination as signalling a firmer stance on inflation than alternative candidates, softening expectations of aggressive monetary easing and thereby reducing the urgency of maintaining hedges against currency debasement. The dollar strengthened on the news, reinforcing the sense that markets believe Warsh may be less inclined to pursue the ultra‑easy policy stance gold bulls had anticipated.

The episode underscores how heavily precious‑metals markets had been trading on the inflation‑and‑debasement narrative. Warsh’s perceived orthodoxy punctured what analysts described as excessively overbought precious‑metals positioning, triggering a broad re‑rating across gold, silver, and related equities.

What might the early months of Warsh’s tenure signal?

The first months of Warsh’s leadership will determine much about the Fed’s policy trajectory and credibility. Markets will look for clarity in his communication style, particularly whether he maintains Powell’s approach of transparent forward guidance or prefers a more traditional, less pre‑committal framework. Clear signalling will be essential in shaping expectations for rate decisions at a time when both inflation and employment trends require careful calibration.

Warsh’s inaugural rate decision will carry symbolic weight. A rapid cut could be interpreted as succumbing to political pressure, weakening perceptions of Fed independence; delaying cuts risks further labour market deterioration and heightened criticism from the administration. How he navigates this dilemma will shape the Fed’s institutional reputation as much as the economic outlook itself.

Ultimately, Warsh faces the challenge of steering monetary policy through competing pressures: the President’s demands for immediate easing, inflation that remains above target, and a labour market that is cooling. His ability to communicate stability and independence will be central to the market’s confidence in the Fed’s direction.

References

- The Wall Street Journal, “Kevin Warsh and the parable of the two sons,” 2 February 2026

- Financial Times, “Gold and silver prices plunge as rally goes into reverse,” 30 January 2026