How did the market react to results?

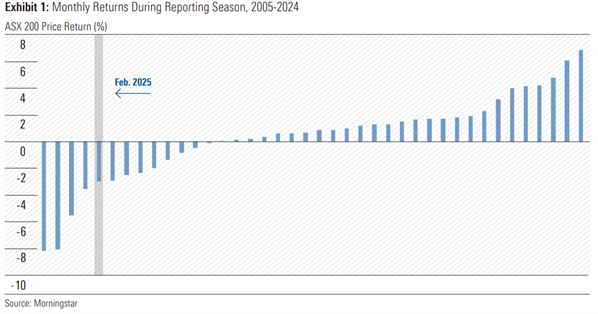

The Australian share market performed relatively poorly compared to previous half-year reporting seasons, with the ASX 200 index down roughly three per cent since the start of February, which sits in the bottom 15% of returns for February and August reporting seasons over the last 20 years1. This is despite most companies reporting solid growth and re-iterating their earnings forecasts from last reporting season.

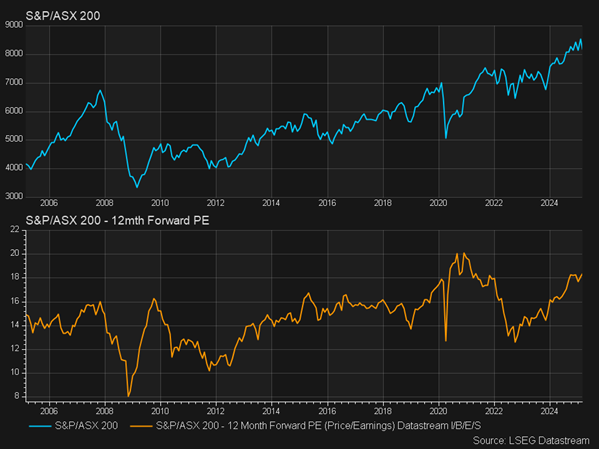

The divergence in the market’s reaction and company’s results highlights the high expectations heading into reporting season. The Price-to-Earnings ratio (P/E) is a measure of how much investors are willing to pay for a company’s earnings, with companies that have higher expected earnings growth being ascribed a higher P/E by investors. The ASX 200 currently trades on an 18x 12-month forward P/E, which is elevated relative to history and suggests plenty of good news and expected growth is baked into share prices2.

Rock bottom for miners?

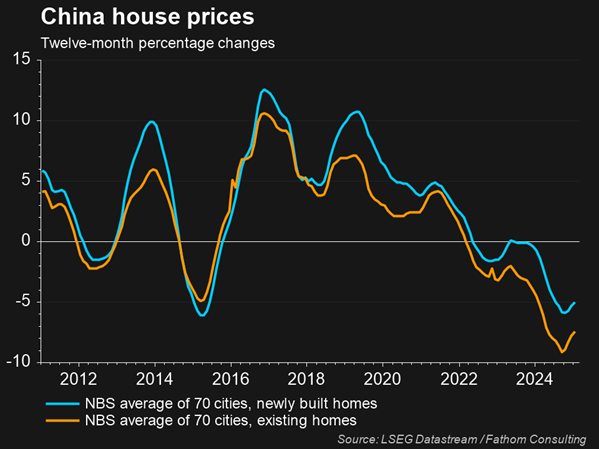

Australia’s big iron ore miners, BHP (BHP:ASX), Rio Tinto (RIO:ASX), and Fortescue (FMG:ASX), reported steep falls in profit in their first-half results, with profits decreasing 23%3, 33%4, and 53%5 on last year. Dividends also suffered, as RIO declared its lowest dividend in seven years, and BHP its lowest in eight years. The profit downgrades were largely caused by declining iron ore demand from China, which accounts for roughly 75% of seaborne iron ore trade6, with most of this being used in residential property and infrastructure construction. Both sectors are now under pressure after years of overinvestment and falling houses prices hampering building margins, causing iron ore prices to fall 15% in the last 12 months7, and miners’ profitability to suffer, as highlighted in Fortescue’s EBITDA margin falling below 50% for the first time in six years.

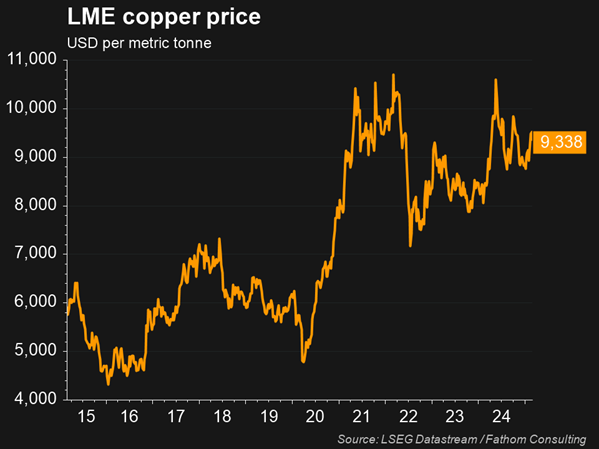

Copper was a bright spot for miners, as prices soared around 20% over 20248, resulting in BHP’s copper earnings rising 44% on last year, while RIO’s rose 75%. BHP in particular has looked to scale its copper business in recent years, with the proportion of BHP’s total group earnings from copper rising from 25% to 39% over the past year, while iron ore contributed 56%. The big Australian’s investment in copper, most notably through its acquisition of Oz Minerals in 2023 for $10 billion9, is part of its efforts to capitalise on the clean energy transition, which copper demand is heavily linked to through its use in electric vehicles and renewable energy infrastructure.

Investor views on the miners’ slump are mixed. Some argue China’s demand for iron ore will turn once the Chinese Communist Party (CCP) announces new economic stimulus measures, which will hopefully boost construction activity and steel demand. In September 2024, China announced new policies targeted at making credit cheaper and more accessible for property developers and buyers, in a bid to break the vicious cycle of excess housing supply reducing house prices, which then weighs on household wealth and further pushes down demand for new homes10. Australian resources stocks jumped on the news, hoping this would be the first in a series of stimulus packages.

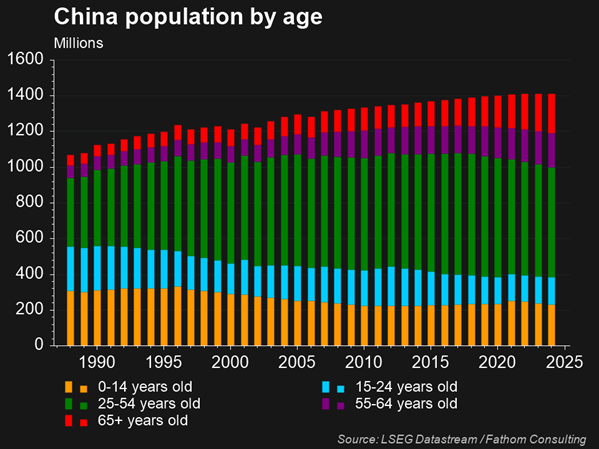

That has not occurred, however, dragging our miners back down to earth, with bullish investors arguing that more announcements are only a matter of time, and that markets are not adequately pricing these in. More bearish investors, however, point to structural headwinds in China that they say no single stimulus package can fix. China’s decreasing and ageing population, and subsequently slowing urbanisation and new infrastructure needs, are an ongoing challenge, which bears argue will hamper iron ore demand for the foreseeable future.

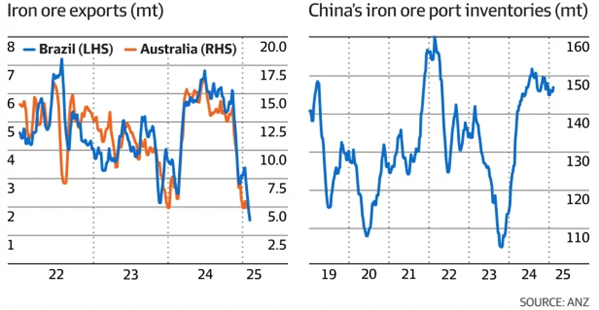

Whatever the case, Australian iron ore exports have been falling, with large inventory stockpiles at Chinese ports raising concerns they may continue to suffer.

CBA exceptionalism?

The Commonwealth Bank of Australia (CBA:ASX) continued to beat market expectations at its first-half result, posting stronger revenue growth and lower bad debt expenses than consensus forecasts. CBA’s share price rose immediately after its earnings call, however fell over the next few days as the other banks’ results disappointed the market on higher loan impairments and lower Net Interest Margins (NIMs).

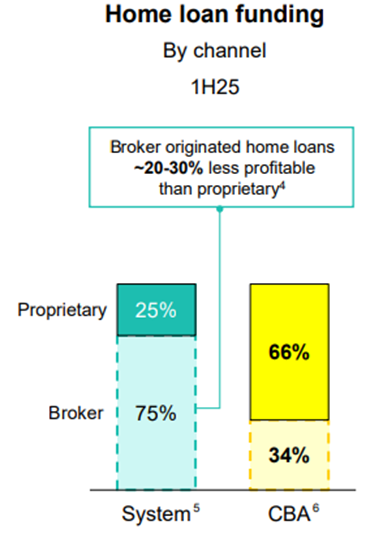

CBA shares currently trade on a forward P/E of around 25 and dividend yield of three per cent11, making it one of the most expensive mature, developed market banks in the world. This is a significant premium to its big four bank counterparts, which also trade on P/Es above their historic averages and global peers. While some investors baulk at this premium valuation, others argue it is justified, given the bank’s competitive advantages and quality through its larger deposit base facilitating lower costs of funding and higher NIMs, superior technology that leads to greater customer engagement and satisfaction, and better operating efficiency that boosts margins. CEO Matt Comyn gave an example of this in CBA’s results presentation, describing how the bank sources its home loans predominantly from its own, in-house sales teams, while the rest of the big four rely on third-party brokers to originate mortgages, allowing CBA to save on commissions and improve margins.

The RBA’s recent interest rate cut is expected to boost loan volumes for the banks, as cheaper debt encourages prospective home buyers who have been sitting on the sidelines to get into the market. The cut could also hinder NIMs, however, as banks receive less in interest payments, and the gap between what they pay out in interest on deposits and what they receive on loans narrows. This has raised concerns from some investors, who argue that the banks’ elevated valuations relative to history and global peers are not justified by their subdued earnings growth outlook, and that this leaves room for disappointment.

Stale earnings for the fresh food people?

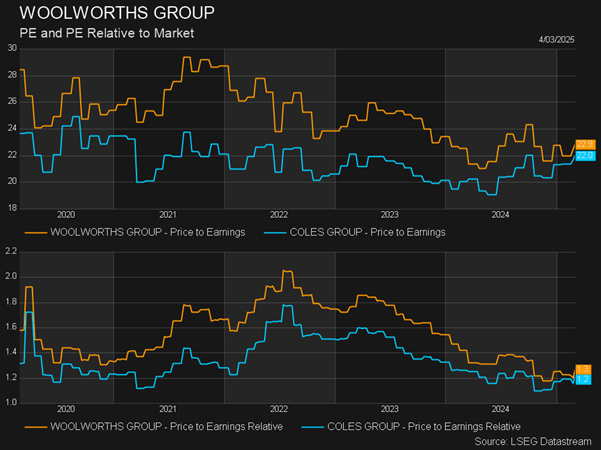

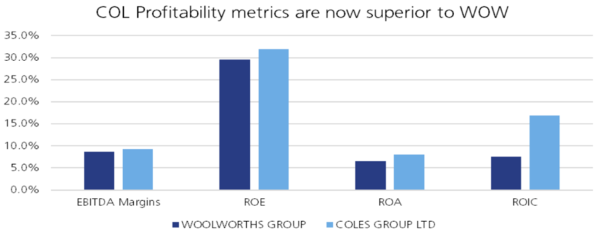

Woolworth’s (WOW:ASX) first-half 2025 profit collapsed 21% from last year, as industrial action and strikes in late-2024 wiped around $95 million from earnings12. Coles (COL:ASX) subsequently benefited from this, gaining roughly $20 million of additional earnings, with its operating margin at 5.7%, up from 5.3%, and its shares also up around 20% over the last year13. WOW’s margins sat at 5.2%, with its shares down around nine per cent over the last year. This difference in profitability and execution has caused some investors to question whether WOW’s P/E premium relative to COL is still justified, with its P/E at 22.9x compared to COL’s 22x – lower than history but still a four per cent premium.

Consumer spending picking up?

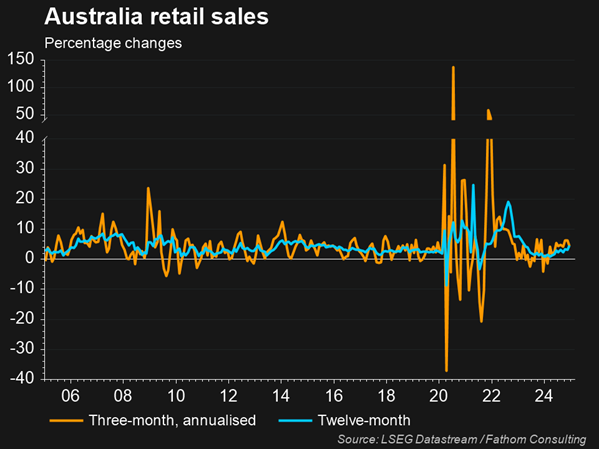

Consumers appeared to open their wallets at the back end of 2024, with Australian retail sales growing steadily and retailers posting solid gains. Highlights included JB Hi-Fi (JBH:ASX) and Harvey Norman’s (HVN:ASX) revenue growth of seven per cent14 and 15%15 respectively for their Australia segments, both above the broader electronic goods retailing industry’s three per cent growth and indicating big retailers taking share as customers seek out value. Wesfarmers (WES:ASX) also performed well, growing sales for Bunnings, Kmart, and Officeworks by 3.1%, 2%, and 4.7% respectively as its price leader model continues to resonate with customers16. Markets expect the RBA’s first rate cut in February to further support this uptick for retailers, through decreasing interest payments and consumers having more cash to spend.

Post reporting season, the ASX 200’s high P/E relative to history continues to make us weary of market expectations, and whether corporate earnings and management growth targets can continue to meet what the market is pricing in.

References

- Morningstar, “More reporting season insights: Results soften, but still mostly positive,“ February 27, 2025

- LSEG DataStream

- BHP, “Financial results,” February 18, 2025

- Rio Tinto, “Financial results,” February 19, 2025

- Fortescue, “Results and operational performance,” February 20, 2025

- Reuters, “Massive Simandou mine can end Australia’s golden iron ore age, or start new one,” February 26, 2025

- LSEG DataStream

- LSEG DataStream

- Australian Financial Review, “BHP and OZ deal sealed as traditional owners aim for unity,” April 13, 2023

- Morningstar, “China stimulus doesn’t look like a silver bullet,” October 3, 2024

- Commonwealth Bank of Australia, “Results,” February 12, 2025

- Woolworths Group, “Results and presentations,” February 26, 2025

- Coles Group, “Results and presentations,” February 27, 2025

- JB Hi-Fi, “Annual reports,” February 10, 2025

- Harvey Norman, “Reports and announcements,” February 28, 2025

- Wesfarmers, “Results and presentations,” February 20, 2025