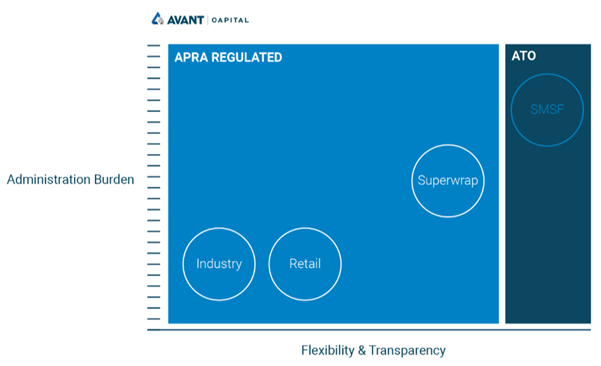

Industry Super Funds

This is the largest fund type in Australia, and includes providers like HostPlus, AustralianSuper, and HESTA. Industry funds emphasise competitive fees, however these vary between funds, and a hands-off approach to managing your super. These funds allow members to choose between their standardised growth, balanced, and conservative portfolio options, also known as Choice super options. Alternatively members can adopt a ‘lifecycle’ investment option, also known as a MySuper option, which automatically changes your risk profile based on your age and time to retirement1. Such standardised portfolios mean, though, that these funds offer minimal scope for investment strategy personalisation and direct investment choice, and do not provide tailored advice or regular portfolio adjustment consultations. Industry funds can therefore be quite impersonal, and often use dated technology and user interfaces that offer little visibility over what underlying assets your super is invested in. This has caused many industry fund members to become disengaged from their super, as they have insufficient transparency or input over their retirement savings.

Retail Super Funds

Like their industry counterparts, these funds offer standardised portfolio products typically split into growth, balanced, and conservative that members can choose between, and which provide minimal scope for customisation. These funds are operated for profit however and typically charge higher fees which can eat into returns.

Self-Managed Super Funds (SMSFs)

Under an SMSF you act as the trustee of your own super fund, providing you with full control over investment decisions and strategy, while opening up a wider array of investment options than any of the other super structures. This allows you to build a portfolio based on your individual financial goals and investment preferences, as opposed to buying the standardised investment products of an industry or retail fund. SMSFs do, however, result in increased regulatory and compliance burden, while also bringing challenges in confidently navigating financial markets if you are managing your SMSF on your own, and have limited investing experience. Many people therefore use a financial adviser to invest their SMSF, as this allows them to maintain their input in determining what their super invests in, while also accessing an experienced investing professional who can offer guidance and ongoing portfolio management.

SuperWrap

A SuperWrap account via a financial adviser allows you to overcome the compliance headaches of an SMSF without losing your investment oversight and control, however has a less broad menu of assets you can invest in. As opposed to an SMSF, a SuperWrap account has significantly less compliance-related costs and administrative burden. Instead these are handled by the SuperWrap fund, which provides the software and interface to facilitate your adviser managing your investments, and is APRA-regulated like an industry super fund. These interfaces are typically more comprehensive than an industry or retail fund, providing a breakdown of the specific assets and companies you are invested in, while enabling easy monitoring of your portfolio’s performance and associated fees.

A SuperWrap account also still facilitates the hands-on involvement in investment decision-making that industry funds lack, allowing you to build a directly owned and personalised portfolio through regular consultations with your adviser. This relationship also provides you with access to your adviser’s investing experience and recommendations, which are personalised to your unique circumstances. A SuperWrap also provides a tailored service and the scope for you to be more hands-off with your super if you wish through utilising your adviser’s expert portfolio management capability.

Public Sector Super Funds

As the name suggests, these funds are offered by the government purely for government employees, and like industry funds offer standardised portfolio options for members to choose between. Profits generated are also all put back into the fund for the benefit of members.

Corporate Super Funds

A corporate fund is established by an employer for their employees, with the employer appointing a board of trustees to oversee the fund’s investment strategies. Like industry and public sector funds, these also offer standardised portfolio options, with all profits generated similarly being put back into the fund. One of the largest corporate funds in Australia is TelstraSuper, which is available to Telstra employees and their families.

Each super fund structure offers distinct advantages and disadvantages, with their suitability dependent on a range of factors. If you would like more guidance about the different types of super funds, feel free to reach out to the Avant Capital team.

If you’re considering property investment through your SMSF, check out our SMSF loan solutions.

References

- Moneysmart, “Types of super funds,” March 18, 2025