What caused bitcoin to fall?

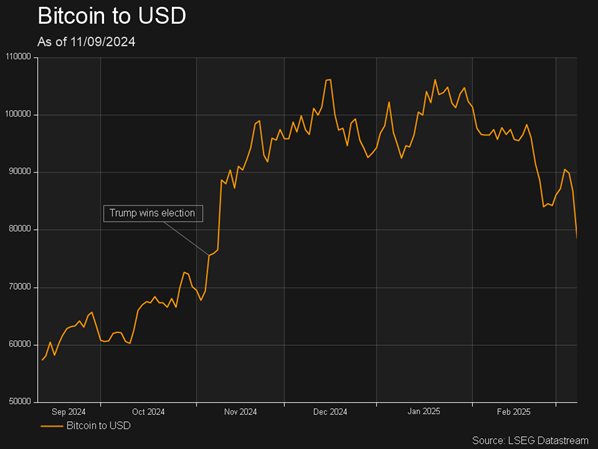

Following US President Donald Trump’s election win, bitcoin surged over 45%, from $US75,000 on election day to a record high of $US109,000 in January. The world’s largest cryptocurrency has now fallen 25% from its record high to around $US80,000, officially entering a bear market, as investor sentiment has been hit by the biggest crypto hack in history, which saw $US1.5 billion of crypto assets stolen from trading platform Bybit1.

The recent collapse of several high-profile meme coins, volatile cryptocurrencies originating from a joke or cultural trend, has also hit confidence in the asset class. This began with Trump’s meme coins, $TRUMP and $MELANIA, which launched in mid-January and quickly reached $US75 and $US13, and market capitalisations of $US15 billion and $US2 billion. Both coins are now languishing around $US13 and $US0.8, with prices having fallen 83% and 94%, bringing huge losses for investors and causing bitcoin owners to take profits and sell down their holdings as they look to avoid potential price volatility in the broader crypto sector. The issuance of the coins also sparked criticism from Trump’s political opponents, who suggested they could be used as an avenue for corruption and bribes given how heavily their values are linked to Trump’s own net worth.

Argentina’s president, Javier Milei, is also facing similar meme coin scandals, as he promoted a cryptocurrency called LIBRA on X in February, which subsequently quadrupled to a total worth of $US4 billion before crashing by more than 85% and handing speculators huge losses. The coin’s creators, and the Argentinian president, have been accused of crypto fraud and a “rug pull” scheme, where the initial investors in a cryptocurrency lure in other investors to inflate the price, before quickly withdrawing funds.

What are Trump’s plans for crypto?

Trump promised significant cryptocurrency deregulation throughout his election campaign, as he looked to position the US as a leader in the sector. Taking to his social media platform Truth social in early March, Trump announced the US government would buy strategic crypto reserves of Bitcoin, Ethereum, Solana, ADA and XRP. The US has confiscated over $US18 billion of crypto assets through law enforcement actions that could be used as the initial assets in the reserves2.

If the US government implements a crypto stockpile, it would be one of the first nations to do so, following institutional investors like AMP locally and several large US pension funds, which have started buying bitcoin and adding it to their asset allocation frameworks. These investors argue that bitcoin can be used to offset risk from assets like stocks and bonds, whose returns are more heavily correlated with the economic cycle and interest rate movements. They suggest that bitcoin, as a decentralised currency not associated with any government, will perform well during periods of financial system disruption from events like bank failures, rising government debt, or currency weakness when other assets typically underperform, as investors look for a store of wealth not linked to governments or traditional financial institutions. Others, however, are more sceptical of bitcoin’s diversification benefits, pointing to its tendency to move with stock indices like the Nasdaq 100 as investors become bullish and adopt a risk-on mindset, buying into more volatile and speculative assets like stocks and crypto.

While not directly buying bitcoin, the Venezuelan government has accumulated a significant fund of crypto assets through seizures from illegal activities. The country has also faced hyperinflation and currency devaluation in recent decades, causing many citizens and businesses to lose confidence in their financial system and adopt bitcoin as their primary currency for transactions and savings. Bullish investors point to this as a practical example of bitcoin’s use as a store of wealth, not linked to any specific government or country.

How do investors value bitcoin?

Some investors argue bitcoin can’t be accurately valued, as it is an asset that doesn’t generate cash flow like a stock or bond, and doesn’t have a physical use that drives demand like jewellery or electronics manufacturing for gold. Others, however, believe that bitcoin’s scarcity and adoption as a means of exchange gives it implicit utility and value, that will grow as people use it more.

Putting aside the qualitative discussion of whether bitcoin should have value, a common valuation model currently being used is the cost of production method. This assumes that the price of bitcoin should tend to gravitate around the cost of mining, or bringing into existence, a new bitcoin. To mine a new bitcoin, significant computational resources and energy consumption is required, with this becoming more intensive as the number of people trying to simultaneously mine increases.

The cost of production method asserts these mining costs, like electricity, set a floor for bitcoin’s value, as if the price fell below the cost of mining, miners would stop, and the rate of new bitcoin issuance would decrease, driving the price higher. The method also implies that prices will go up as interest in the cryptocurrency rises and more people try to mine new bitcoins, as this raises the costs of mining, by making it require more computational power, which then increases the price floor. A criticism of this method, however, is that it doesn’t consider how changes in market demand impact bitcoin’s value, through it being used more in transactions and as a speculative investment.

Another bitcoin valuation method is the total addressable market approach, which compares bitcoin to other assets that fulfill the properties of money like gold and central bank reserves, estimating its value based on expected market penetration. For example, if an investor believes bitcoin will capture a certain percentage of the gold market, its value would be calculated based on its percentage of the total gold market’s value.

In comparison, the stock-to-flow model values bitcoin based on its scarcity, using the ratio between the current stock (total amount of bitcoin in circulation) and the yearly production of new bitcoin mined. It assumes bitcoin’s limited supply and decreasing inflation rate determine its value, with a higher stock-to-flow ratio indicating a scarcer and more valuable asset.

Metcalfe’s law, another crypto valuation method, values bitcoin as a network rather than a scarce asset. It suggests that its value grows with the number of users, using active addresses as a proxy for user count. As the user base grows, the network becomes more valuable because there are more transactions and interactions between users, which sparks greater demand and utility for bitcoin.

Digital assets will no doubt continue to divide investors and capture their attention throughout Trump’s presidency. However, it’s adoption by institutional investors as a legitimate asset class is increasing rapidly, prompting all investors to reconsider their asset allocation strategies.

References

- Australian Financial Review, “Hackers steal more than $2b from crypto exchange Bybit,” February 22, 2025

- Australian Financial Review, “Trump’s ‘strategic’ crypto reserve is just another grift,” March 3, 2025