What are hybrids?

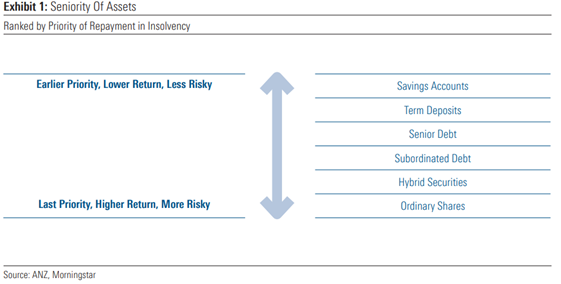

Also known as Tier 1 Capital, hybrids are securities predominantly issued by banks to raise capital, that combine elements of both debt and equity. Hybrids offer periodic distributions, like bonds, that provide higher yields than most other credit products, and are generally fixed at a pre-determined rate above benchmark interest rates (e.g. RBA cash rate plus 3%). However, like shares, if the bank faces extreme financial stress, the capital value of its hybrids can be significantly impacted. In terms of risk, hybrids rank below most other forms of debt in being paid out if a bank winds up—but above ordinary shares. This also means that the distributions on hybrids need to be paid before a bank can pay dividends.

The end of Australian bank hybrids:

Announced December 2024, the Australian Prudential Regulation Authority (APRA) announced that it would be winding down Australia’s $43 billion hybrids market, by banning banks from issuing new hybrid with call dates past 2032, effectively ending the market over the next 7 years[1]. APRA cited concerns around retail investors owning 20-30% of all hybrids on the ASX, which is unusual compared to the rest of the world, as the key motivator of its decision[2]. The Australian bank regulator believes retail investors do not adequately appreciate the risks around hybrids relative to other credit products, which have been brought into the spotlight recently following Credit Suisse’s 2023 collapse that saw hybrid holders bailed-in and wiped out. This was due to the Swiss regulator writing off the value of the hybrids to 0, rather than converting them into ordinary shares, which was their other available course of action. Hybrid holders subsequently received nothing for their holdings, while shareholders received some compensation for their stock in the subsequent $4.5 billion UBS takeover, even though hybrids rank ahead of ordinary shares in repayment priority. Such an outcome cannot occur for Australian hybrid holders however, as here in the event of a bank wind down the regulator can only convert hybrids into equity, and cannot write them off entirely[3].

For Australia’s banks, the phasing out of hybrids will force them to replace the 1.5% of capital funding they receive from these securities, which they will likely do by issuing new tier 2 securities like subordinated debt and new ordinary shares. Responding to the change in the AFR, banks expect its toll on their funding costs to be negligible. Some retail investors and investment advisers, on the other hand, have expressed anger at APRA’s decision, no doubt disappointed to be losing access to hybrid’s high yields. They argue that Australian banks are much better positioned than their European counterparts like Credit Suisse, and that APRA’s move will push retirees and retail investors seeking high yields into riskier products[4]. Other retail investors and advisers have been supportive of the decision, however, arguing that the move protects many retirees from continuing to inadvertently take more risk than they intend to by buying hybrids, which they mistakenly view as having a similar risk profile to other types of credit.

Alternatives to hybrids:

APRA’s decision has left many investors looking for other investment options to fill the role of hybrids in their portfolios, we step through some potential candidates below.

- Bank Ordinary Shares: Shares are exposed to greater risk than hybrids in the event of the bank going out of business, and come after all bondholders in being paid out from the bank’s assets in the event of insolvency. Dividend payments can also be volatile based on changes in a bank’s operational performance, compared to hybrids’ distributions which are paid at a fixed pre-determined rate that is only impacted by extreme moves in a bank’s viability such as insolvency, and moves in benchmark interest rates. Another consideration is price volatility. Bank share prices reflect the outlook for earnings, which can change depending on the economy and the bank’s performance. Such considerations, unless extreme, do not impact the bank’s ability to make good on hybrid distributions however, and thus do not significantly impact their hybrids’ capital values.

- Tier 2 Capital & Credit Funds: Tier 2 capital is defined as fixed income securities with maturity of at least 5 years, and ranks above equity and hybrids in the event of a wind up, with some product examples being subordinated debt and senior debt. Unlike shares, banks do not have discretion over whether to pay tier 2 capital distributions, with payments being obligated. These securities’ distributions offer lower yield than hybrids however, as investors are bearing less risk, and are also unfranked. Retail investors cannot access tier 2 capital directly, but can get access through a credit fund via providers like PIMCO and VanEck.

- European CoCos: European and Asian banks also issue hybrids, which they call contingent convertible bonds or CoCos. These function in much the same way as Australian bank hybrids, however in some jurisdictions may carry provisions where they can be subordinated to ordinary equity in the event of insolvency, which is what occurred in Credit Suisse’s case as their CoCos popped. CoCos may also bring more or less risk depending on whether you perceive the financial health of their issuers as better or worse than that of the Australian banks.

The phasing out of hybrids will not doubt result in many investors having to make changes to their portfolios, and is a continuing development that we will monitor with great interest.

References

-

-

-

- Australian Financial Review, “Asset managers see opportunities in APRA’s bank hybrid ban”, January 12, 2025

- Australian Financial Review, “APRA winds down $43b bank hybrid market, angering investors”, December 9, 2024

- Australian Financial Review, “Bank hybrids face confidence test as traders assess bail-in risk,” March 20, 2023

- Australian Financial Review, “Hybrid ban will force retail investors to take more risk”, December 17, 2024

-

-