Why did global equities rally despite tariffs and inflation?

Importantly, the rally broadened beyond the Magnificent Seven. Consumer spending proved resilient despite tariffs, and Q3 earnings across the Russell 3000 grew 11% year-on-year, the fastest in four years2.

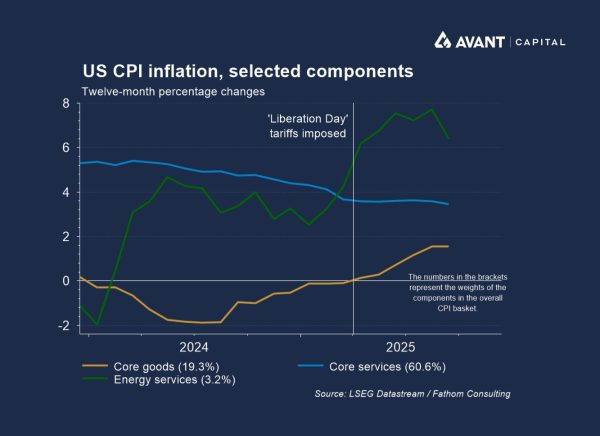

Tariff impacts on inflation were far more muted than expected. Goods inflation ticked higher mid-year as inventories depleted, but retailers absorbed much of the cost rather than passing it on to consumers. Services inflation even softened slightly, cushioning headline CPI.

Which regions outperformed the US?

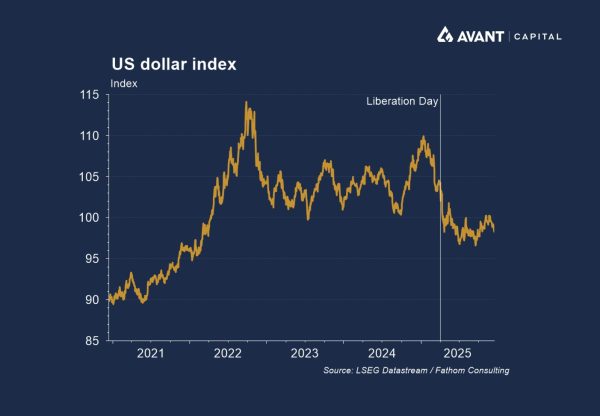

Emerging markets like China and South Korea were standout performers. South Korea’s Kospi index led global indices with a 74% gain, driven by Samsung and SK Hynix riding the AI semiconductor boom. Broader emerging market strength reflected cheap valuations entering 2025, urbanisation trends, and a weaker USD, which reduced debt-servicing costs and attracted foreign inflows. China’s tech sector rebounded on AI breakthroughs like DeepSeek, even as property woes lingered, with the Hang Seng index posting a 28% gain. However, structural deflation and demographic headwinds remain risks.

Among developed markets, Europe outperformed, aided by a rotation into defence stocks amid NATO’s pledge to lift spending to 5% of GDP4. German defence budgets surged, while aerospace and cybersecurity names rallied. Cheaper valuations and fiscal stimulus added tailwinds, helping the Stoxx Europe 600 rise over 13%. Japan also delivered a strong year as corporate governance reforms drove record buybacks and dividend hikes. Companies unwound cross-shareholdings and improved capital efficiency, lifting valuations. Exporters benefited from a weaker yen, which hit multi-decade lows despite BoJ rate hikes, reflecting investor concerns over Japan’s towering debt burden.

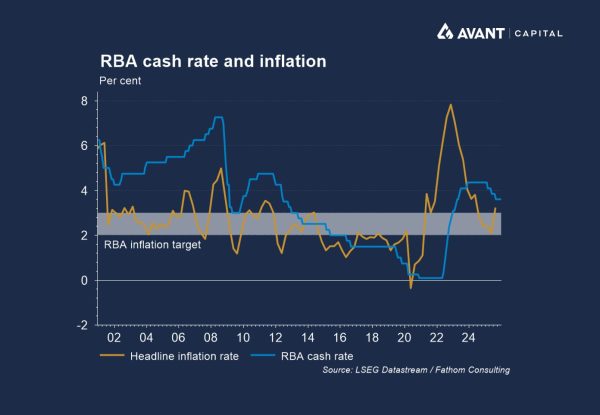

Australia, by contrast, lagged. The ASX 200 posted modest gains despite a second year of declining corporate profits. Banks delivered stable results but pulled back along with tech stocks late in the year on valuation concerns. Commodities were a mixed story: iron ore prices were broadly flat for the year despite bouts of volatility, while copper and lithium posted strong gains, helping big Australian miners that have been diversifying into these areas to offset slowing Chinese steel demand. However, sentiment was capped by concerns over Guinea’s Simandou mine, expected to add significant iron ore supply in the years ahead5. Property prices posted modest gains amid high mortgage rates and less RBA rate cuts materialising than the market expected heading into the year.

How did currency moves influence equity performance?

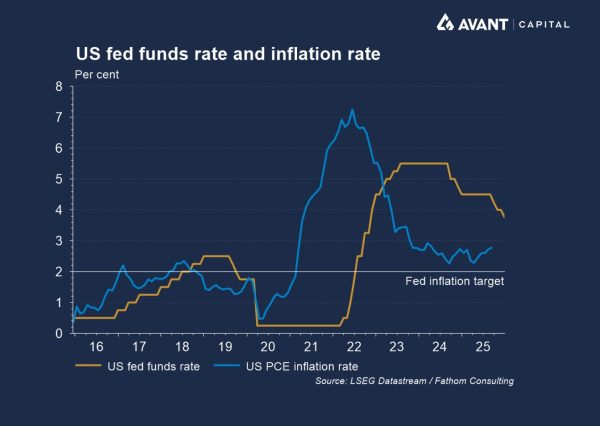

Interest rate divergence drove FX volatility. The Fed cut rates three times to 3.5–3.75% as labour markets softened, while the RBA turned hawkish after inflation spiked to 3.8%.

The USD weakened on fiscal concerns and political pressure on Fed independence, boosting emerging markets by lowering debt-servicing costs. Meanwhile, the yen slid despite Bank of Japan rate hikes, underscoring debt sustainability fears and amplifying Japan’s export competitiveness.

What investment themes defined 2025?

Defence and cybersecurity outperformed in 2025, fuelled by rising geopolitical tensions and NATO’s pledge to boost military spending. Nuclear energy gained traction as nations sought energy security, while AI-related infrastructure, especially data centres, boomed on surging demand for computing power. In contrast, healthcare lagged on earnings downgrades, and high-valuation tech names, while posting strong gains, faced volatility as investors questioned the pace of AI monetisation.

Why were bonds a mixed bag?

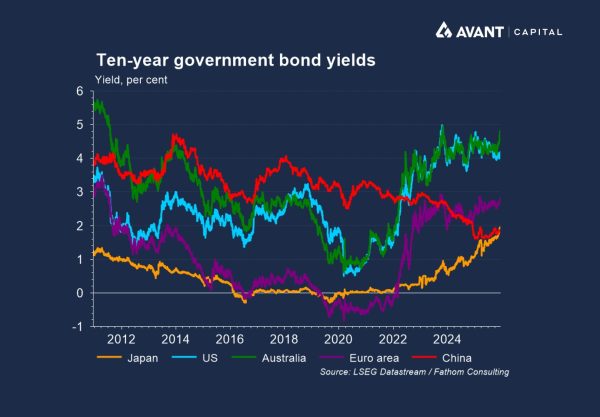

The Federal Reserve cut interest rates three times in 2025 as unemployment climbed to 4.6% and job creation slowed, even as inflation remained above target at 2.8%. In contrast, the Reserve Bank of Australia, which also cut rates three times earlier in the year, turned hawkish after headline inflation surged to 3.8%, signalling possible hikes in 2026. Meanwhile, the market expects the Bank of Japan to raise rates to 0.75%, its highest in 30 years, in December, amid inflation holding above 2% for a third consecutive year. These moves underscored diverging policy paths and heightened volatility across global bond markets.

Despite rate cuts in the US and Australia, long-dated bond yields rose sharply on concerns over ballooning government debt and fiscal dominance, the fear that central banks might keep rates artificially low to ease government debt burdens, eroding real returns. US and Japanese debt sustainability worries in particular pushed 10-year yields higher, hurting duration-sensitive portfolios.

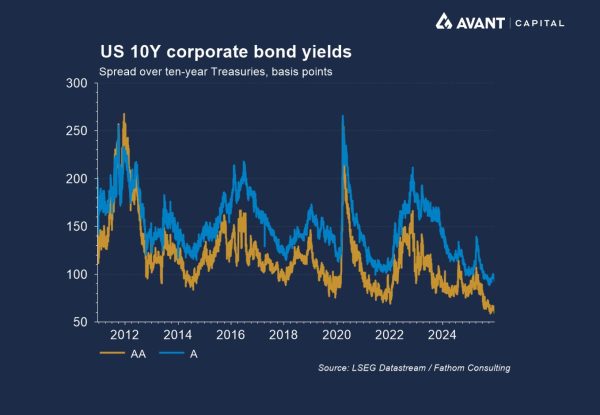

Conversely, emerging market bonds rallied. Improving governance and inflation-targeting frameworks lowered perceived risk, while a weaker USD reduced risk premiums by making dollar-denominated debt cheaper to service and boosting foreign investor returns. This dynamic tightened spreads and attracted capital even as US yields climbed. Credit spreads stayed historically tight, reflecting confidence in corporate balance sheets and economic growth despite private credit stress, such as Blue Owl’s aborted merger and rising redemption pressures.

What happened in alternatives?

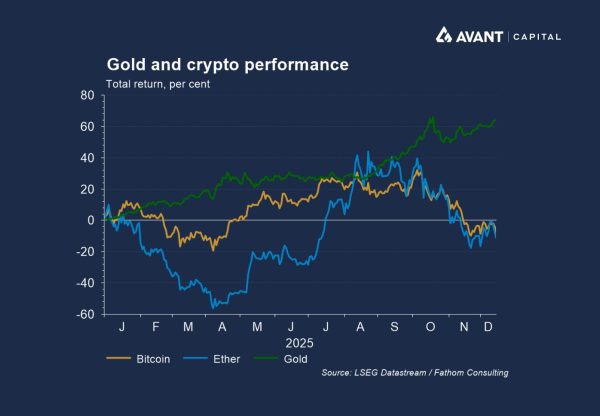

Gold surged on safe-haven demand amid tariff uncertainty and strong ETF inflows, while central bank buying added support. Crypto, however, endured a difficult year, with Bitcoin falling around 8% after leveraged positions unwound during tariff shocks, underscoring its correlation with risk assets. Infrastructure and real estate posted modest gains, aided by falling discount rates and AI-driven demand for data centres.

What’s the outlook for 2026?

The path ahead is uncertain. Continued AI investment and Fed easing could sustain US earnings growth, but valuations are near historic highs, leaving little margin for disappointment. Australia faces a more hawkish RBA and benign growth prospects for banks and miners, while China’s property malaise lingers. With fiscal risks elevated and inflation lingering, markets may remain volatile, but for now, the AI-driven bull market shows few signs of fatigue.

References

- Financial Times, “Nvidia becomes world’s first $5tn company,” 29 October 2025

- Financial Times, “Bank deregulation set to unlock $2.6tn of Wall Street lending capacity,” 12 October 2025

- Financial Times, “Corporate America posts best earnings in 4 years despite tariffs,” 9 November 2025

- Financial Times, “NATO allies agree on 5% defence spending target,” 25 June 2025

- Financial Times, “How the world’s biggest mining project is a win for China,“ 11 November 2025