What was the Federal Reserve’s latest interest rate decision?

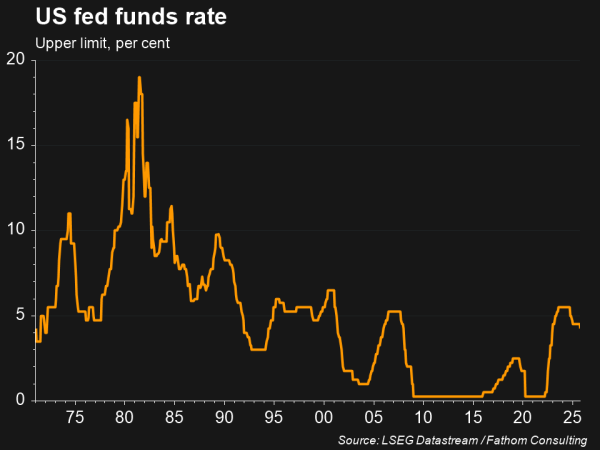

The Federal Reserve cut its benchmark interest rate by 0.25% in September 2025, reducing it to a target range of 4-4.25%, in-line with the market’s expectations leading into the decision. This marks the Fed’s first rate cut of the year, and first since December 2024, and signals a shift in the central bank’s priorities – from fighting inflation to cushioning a rapidly softening labour market1.

Chair Jerome Powell described the decision as a “risk management cut,” acknowledging that while inflation remains above the Fed’s 2% target, the deterioration in employment conditions and hiring activity poses a more immediate threat to economic stability. The decision therefore highlights the Fed’s dual mandate – maximum employment and price stability – now being in conflict with itself, as they choose between cutting rates to support the labour market, which may stoke inflation, and keeping rates on hold to curb inflation, which may hamper job creation2.

How weak is the labour market?

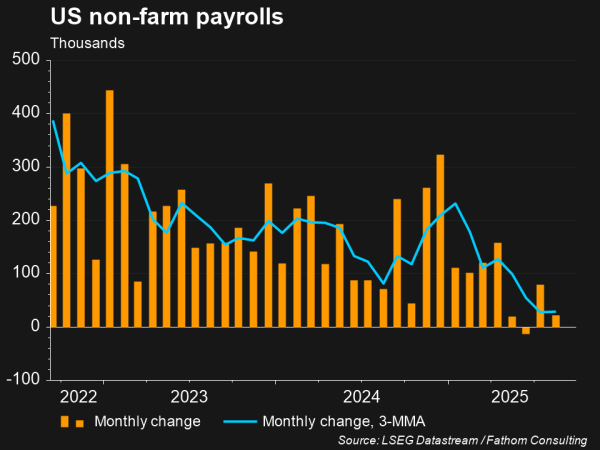

The latest US non-farm payrolls report highlighted the US added just 22,000 jobs in August, while also revealing 911,000 fewer jobs were added than previously thought in the year to March 2025 – halving the 1.8 million job growth figure originally reported with the largest downward revision on record3.

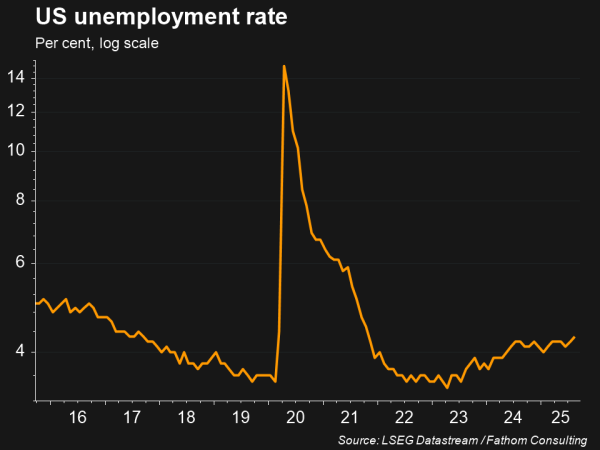

The unemployment rate also ticked up to 4.3% in August, which is still low relative to history but highlights an upward trend.

Fed-up with inflation?

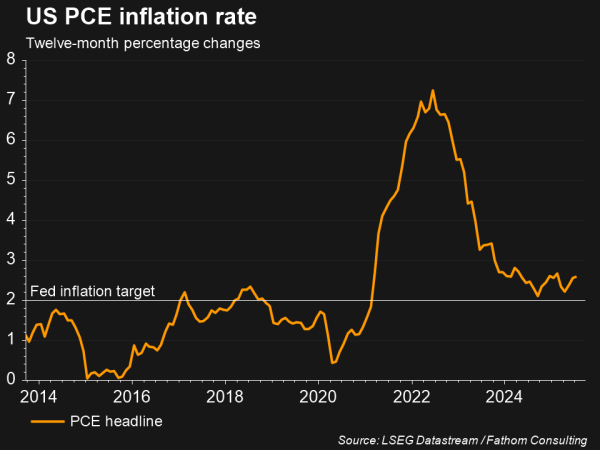

Despite the labour market slowdown, inflation remains stubbornly high for the Fed. Headline personal consumption expenditures (PCE) inflation, the Fed’s preferred measure, rose to 2.6% in July, well above their 2% target and driven in part by the lingering effects of President Trump’s tariffs on imported goods4. While Powell and other Fed officials argue that tariff-induced inflation is likely to be transitory, inflation still remains well above the central bank’s target, making them weary of excessively cutting rates.

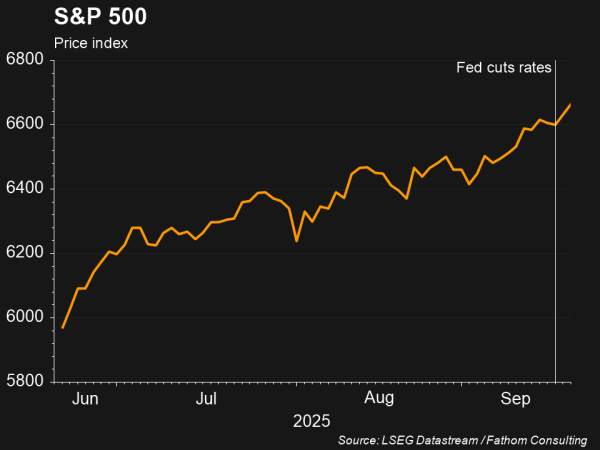

How did the market respond to the Fed’s decision?

Stock markets rose following the rate cut, with US equities hitting record highs5. Expectations for future rate cuts also increased, with futures markets now showing investors expect the Fed will cut to 3% by the end of next year, below the median expectation from Fed officials of 3.4%6. The Fed committee also expects two additional cuts in 2025, in-line with the market’s expectations.

Where to next for the Fed?

While the committee’s median expectation was for two additional rate cuts by year-end, this was pulled down by an outlier, Stephen Miran, Trump’s new appointment to the Fed, who advocated for 1.25% of cuts. Miran was also the only dissenting vote at September’s meeting, arguing for a 0.5% cut while the rest of the committee favoured 0.25%. Trump’s shadow therefore loomed large over September’s meeting through both Miran, his attempts to remove Governor Lisa Cook, and ongoing criticisms of Chair Powell, highlighting how the path for rate cuts, and Fed independence, remain highly uncertain.

References

- Financial Times, “Federal Reserve cuts rates by quarter point and signals more to come,” 18 September 2025

- Financial Times, “The Fed: Good questions, no answers,” 18 September 2025

- Financial Times, “US hiring growth revised down by 911,000 jobs in year to March,” 10 September 2025

- The Wall Street Journal, “As the Fed meets, here’s where inflation stands,” 17 September 2025

- The Wall Street Journal, “US stocks rose this week after the Fed made a rate cut and signalled more to come,” 19 September 2025

- The Wall Street Journal, “Wall Street bets rates will drop much more than the Fed’s forecasts,” 19 September 2025