What’s changing in banking regulation under Trump and the Federal Reserve?

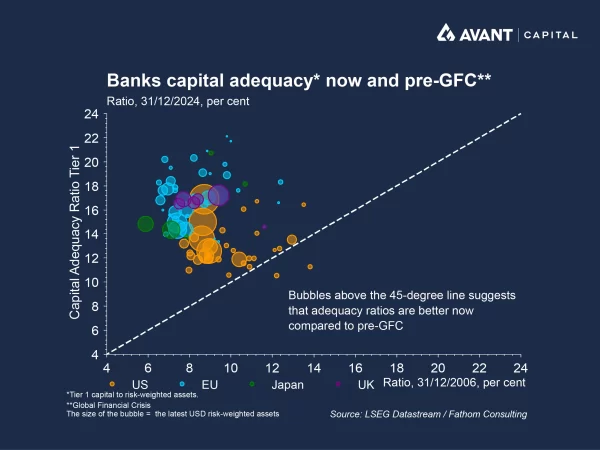

The US Federal Reserve, with the support of the Trump administration, has proposed significant changes to post-2008 financial crisis rules, particularly those governing capital requirements. At the heart of the proposed changes is a reduction of the Supplementary Leverage Ratio (SLR), a regulatory rule introduced in 2014 that requires large banks to hold a minimum amount of Tier 1 capital, such as ordinary equity and retained earnings, against their total leverage exposure1. This is done to ensure banks maintain a strong buffer of high-quality capital to absorb losses and protect depositors.

Total leverage exposure includes all on-balance sheet assets, like loans, cash, and securities, as well as off-balance sheet items such as loan commitments and derivatives, which represent potential future obligations. Importantly, low-risk assets like US Treasuries are included in this calculation as securities, meaning that holding them increases a bank’s total exposure under the SLR. Bank lobbyists have long argued that the SLR unfairly discourages them from holding these safer assets, as their inclusion in the exposure base can make a bank’s leverage ratio appear weaker unless it raises additional capital.

The Federal Reserve’s proposed reforms would reduce the required SLR for the largest US banks from 5% to a range of 3.5% to 4.25%, aligning it more closely with international standards. Lowering the required ratio allows banks to unlock new lending capacity, as they can hold more assets (like loans) without needing to raise proportionally more capital, freeing up capacity at a time when demand for financing, particularly for AI capital investment, is rising.

How could deregulation impact Wall Street banks?

The deregulatory push is widely seen as a tailwind for large Wall Street banks. By reducing capital constraints, banks like JPMorgan, Goldman Sachs, and Bank of America can expand their balance sheets, increase lending, and take on more trading risk. According to Alvarez & Marsal, the reforms could unlock $US2.6 trillion in additional lending capacity, boosting earnings per share by up to 35% for some institutions2. JPMorgan, the largest US bank, is set to be one of the main beneficiaries, with the easing of restrictions forecast to release $US39 billion of capital, lifting its earnings per share by 31% and its return on equity by 7%.

Deregulation therefore presents a meaningful potential tailwind for Wall Street banks. Wall Street’s biggest banks posted strong results in US third quarter 2025 reporting season, driven by booming trading revenues, a rebound in dealmaking, and resilient consumer activity. JPMorgan and Goldman Sachs reported a 12%3 and 37%4 rise in profits respectively, supported by elevated market volatility and shifting interest rate expectations that boosted client trading activity.

What does deregulation mean for US economic growth?

Deregulation could stimulate economic growth, by enabling banks to extend more credit to businesses and consumers. This could then encourage spending and feed into financing for large-scale investments in infrastructure, artificial intelligence, and energy, which are sectors being prioritised by the current US administration. Treasury Secretary Scott Bessent has long flagged the administration’s commitment to deregulation, stating in April 2025 that “deregulation unfortunately takes longer to kick in, but when it does, it’s going to be powerful5.”

How could deregulation impact demand for US Treasuries?

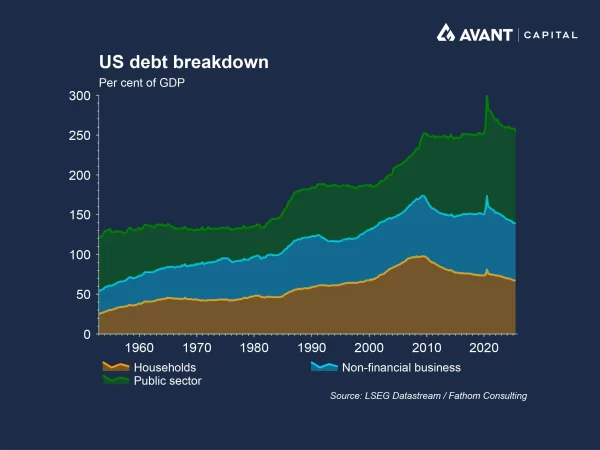

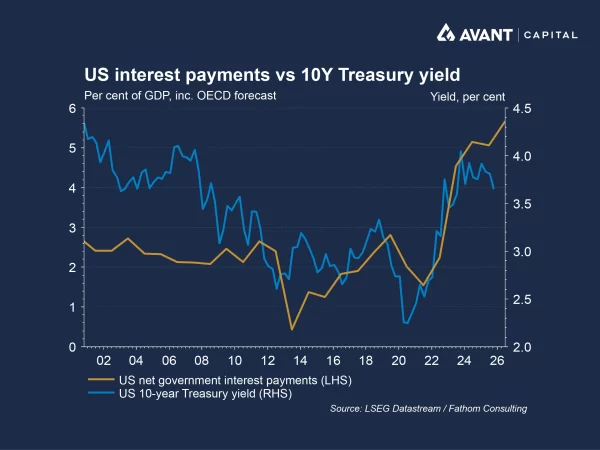

SLR reform also has the potential to boost demand for US Treasuries, through reducing the capital charge associated with holding low-risk assets, and giving banks more capacity to increase their Treasury holdings. This aligns with the Trump administration’s broader goal of reducing US borrowing costs, by making banks larger, more durable buyers of Treasuries, causing prices to rise and yields to fall. The US government may then be able to issue new Treasuries at lower interest rates, easing their debt-servicing burden and freeing up funds for other initiatives.

The impact of SLR deregulation therefore remains to be seen, but will no doubt significantly impact bond markets and the banks’ performance in years to come.

References

- Financial Times, “Federal Reserve unveils plans to reduce capital rules imposed after 2008 crisis,” 26 June 2025

- Financial Times, “Bank deregulations set to unlock $2.6 trillion of Wall Street lending capacity,” 12 October 2025

- The Wall Street Journal, “JPMorgan’s profit jumps as business booms on Main Street, Wall Street,” 14 October 2025

- The Wall Street Journal, “Goldman Sachs plans layoffs despite surging profits,” 14 October 2025

- The Wall Street Journal, “Bessent says lighter regulation on banks will help offset short-term effect of tariffs,” 9 April 2025