What has driven the market’s returns?

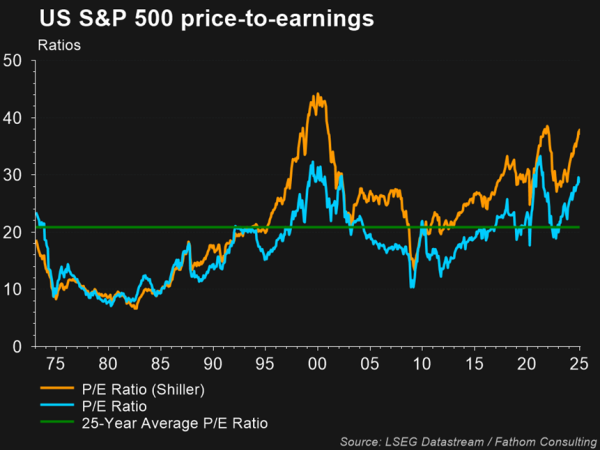

The S&P 500 has posted consecutive years of over 20% gains for the first time since the late 1990’s,[1] with the so-called ‘Magnificent 7,[2] stocks leading the charge returning 45.5% in 2024, compared to the rest of the market, often dubbed the S&P 493, returning 15.9%. For stocks and indexes like the S&P 500, the key drivers of returns are earnings and financial multiples, or in other words, earnings and what investors are willing to pay for those earnings. Financial multiples, like the Price to Earnings (P/E) ratio, are used as a measure of sentiment, and how bullish or bearish investors are about a stock or index’s future growth prospects. Around 60% of the S&P 500’s 25% return for the year can be attributed to P/E ratio expansion, with the remainder from earnings growth. While investor optimism around AI and central bank rate cuts have underpinned the market’s impressive performance, business fundamentals have also been very strong and have contributed significantly to gains against a backdrop of economic growth that was broadly as expected.

What about market concentration?

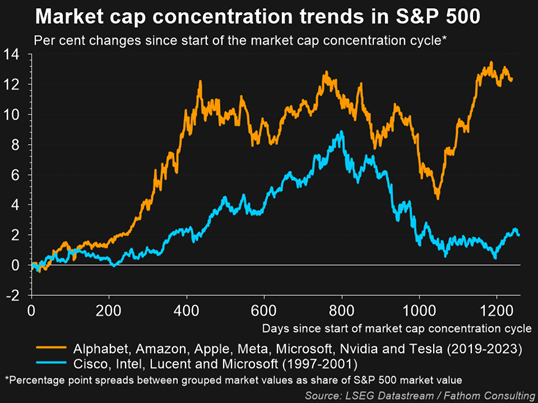

The Magnificent 7 now make up 33% of the market cap weighted S&P 500 index, which is elevated relative to history. This has caused some investors to question whether the index has become overly concentrated and lacking in diversification, with the market being too heavily invested in only a handful of companies and at risk if they experience missteps. Others argue, however, that the broad nature of the Magnificent 7’s businesses, operating across different industries and geographies, alleviates some of these concerns by diversifying their operations and enhancing greater earnings quality that other firms cannot match. Investors have also suggested that the growth outlook of the Magnificent 7 justifies these large holdings, with all of them having invested heavily in AI products that they hope to reap the rewards from over the coming years.

Is the market expensive relative to history?

The S&P 500’s P/E ratio has been getting a lot of attention from investors, as it currently trades at around 30x 12-month forward earnings, well above its historical average of 21x over the past 25 years,[3] and a level that has only been exceeded in 1998-2000 and 2020-2021, which on both occasions preceded steep bear markets.[4] As such, many have suggested that current valuations are stretched, with investor sentiment becoming too bullish and not adequately considering the risks around companies reaching the market’s lofty growth expectations. Others, however, argue that these elevated valuations are justified by the market’s superior growth outlook relative to history, which is underpinned by the continued rise of AI and productivity.

Whatever your view, it will be interesting to see whether investors begin to rotate their portfolios from the Magnificent 7 to the broader S&P 493 due to concentration risk fears, or if they remain bullish about the Magnificent 7’s future prospects and stick it out with them.

References

-

-

- Citi Research, “US Equity Strategy”, January 3, 2025

- Magnificent 7: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla

- LSEG Data stream/Fathom Consulting, “US S&P 500 Price-to-Earnings,” January 17, 2025

- Australian Financial Review, “Can Howard Marks spot a stock bubble twice?”, January 9, 2025

-