Why has Moody’s downgraded US debt?

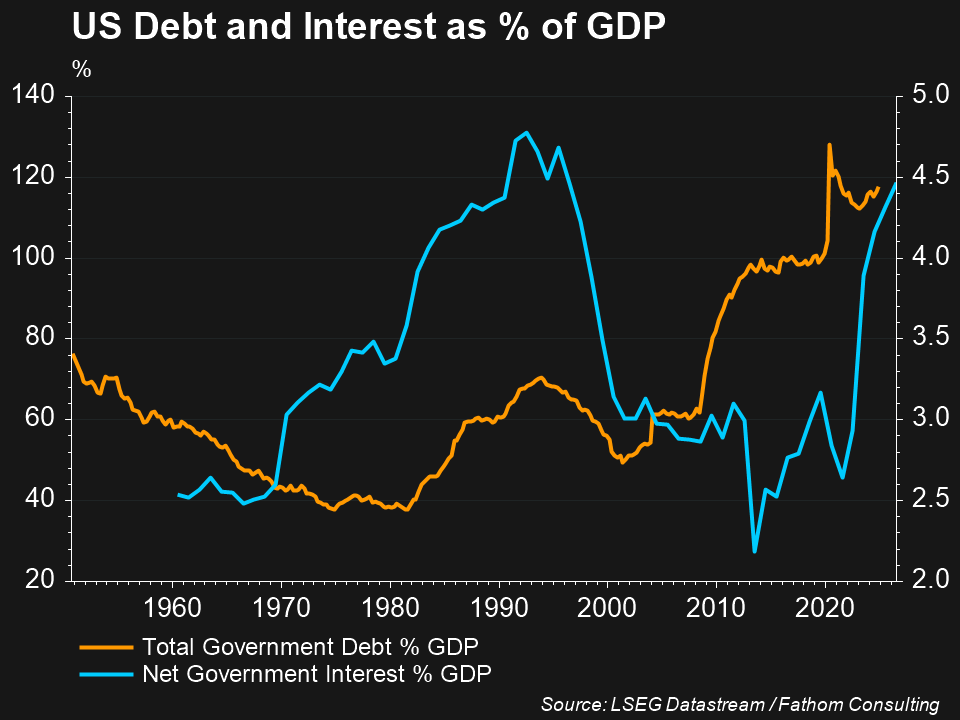

Moody’s has lowered its credit rating for US government debt from AAA – the highest investment-grade rating – to AA1, joining Fitch Ratings and S&P Global Ratings who each downgraded US debt from AAA in 2023 and 2011 respectively1. Moody’s said in a statement that the cut “reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns2,” with the move coming as interest payments chew up 12% of government revenue, up from 9% in 2021, and heading to 30% by 2035 on Moody’s forecasts3.

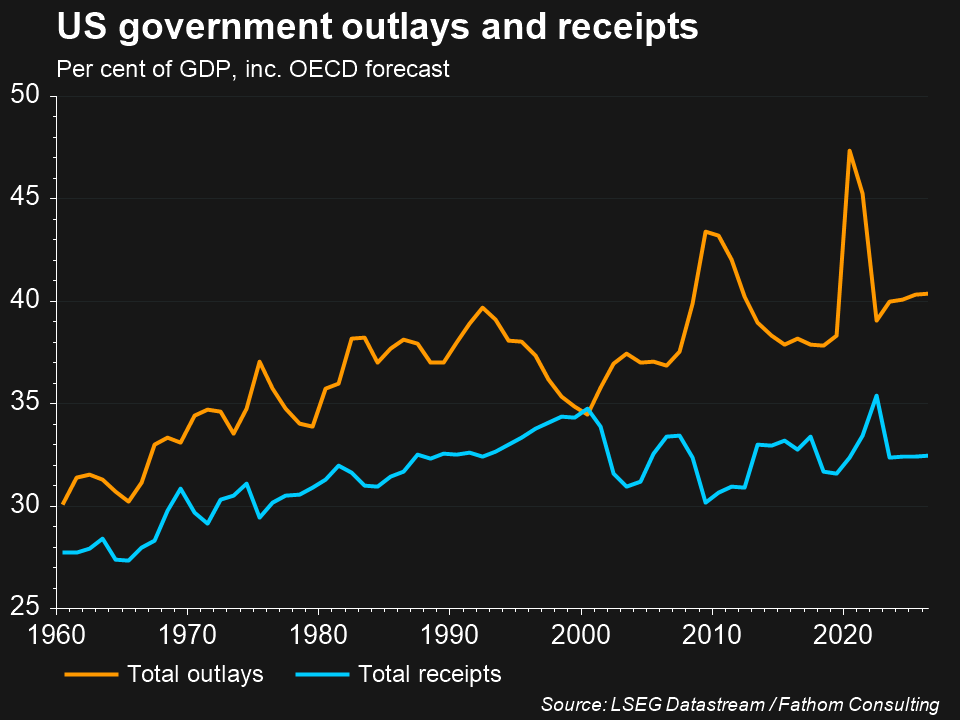

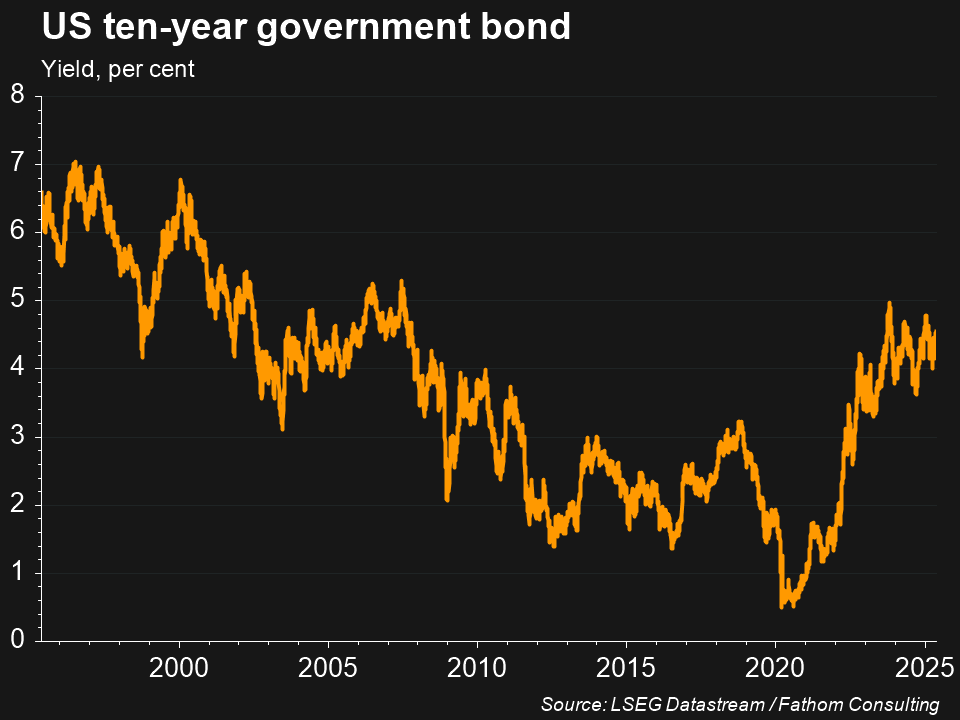

These rising payments have been due to both the US Federal Reserve’s swift interest rate increases in 2022-23, and rising government spending that has grown 60% over the last 5 years, driving up the federal budget deficit to near $US2 trillion a year, or more than 6% of GDP4, and putting increasing strain on the budget to meet these payments while raising concerns about its capacity to issue further debt to fund spending.

How did markets react?

Bond markets had a relatively muted reaction to the news, with the 10-year US Treasury yield rising slightly to 4.54% on May 22nd on the downgrade news, while the 30-year US Treasury yield nudged 5.05%. This subdued response reflects investors demanding a higher return and risk premium for holding US government debt, as they perceive greater credit risk, but also understanding that the US very likely won’t default on its debt any time soon, and that the Moody’s downgrade reveals nothing new about America’s financial position.

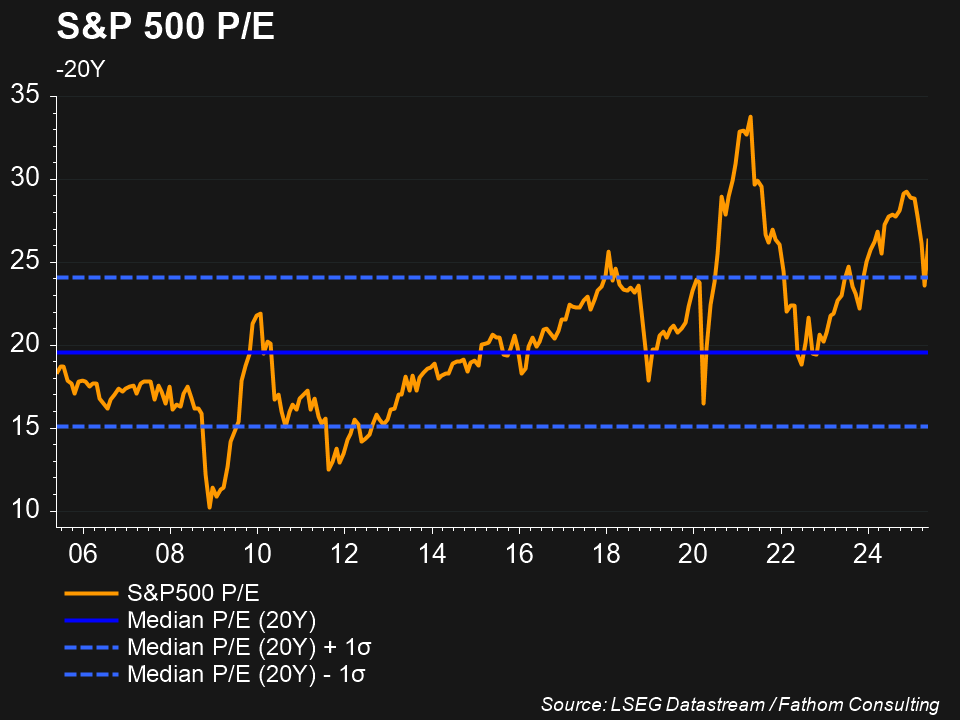

The S&P 500 has fallen -1.32% since the announcement. This compares to a 20% fall after the S&P cut in 2011, which occurred in a weak environment for the US economy and investor sentiment. The subdued investor response following Moody’s move therefore highlights the bullish backdrop that currently purveys markets, as Trump trade deals and tax cuts buoy sentiment, even amidst US debt being about $US14 trillion, or 90% of GDP, in 2011, and $US36 trillion, or 120% of GDP, currently.

Moody response from President Trump?

Before the Moody’s announcement, US President Donald Trump has continually argued that his economic agenda, centred on tax cuts, reduced regulations and sweeping tariffs to bring more manufacturing jobs to the US, would promote strong growth that raises government revenue and increases the serviceability of US debt. Steven Cheung, a spokesman for Trump, subsequently took offence at Moody’s downgrade, singling out Mark Zandi, chief economist for Moody’s Analytics, in a post on X, stating that “nobody takes his ‘analysis’ seriously” and that “he has been proven wrong time and time again.”

Critics of Trump’s agenda, though, argue that measures like his proposed permanence and expansion of the 2017 Tax Cuts and Jobs Act will only add to America’s spiralling debt, with Yale University’s Budget Lab estimating the package would increase US debt by between $US3.4 trillion to $US5 trillion by 2034, and cause the debt-to-GDP ratio to hit around 125%.

Some investors have also suggested that rising debt and interest payments will force future US administrations to bring in higher taxes and lower spending, that could cause weaker economic growth. They argue this may be a particular concern given the currently high valuations of US stocks relative to history, which are pricing in significant earnings growth in the years ahead.

References

-

- Australian Financial Review, “The US AAA downgrade means nothing, short term. Long term, it’s huge,” May 19, 2025

- NBC News, “Moody’s downgrades US credit rating on increase in government debt,” May 17, 2025

- Yahoo Finance, “Moody’s downgrades US sovereign credit rating amid fiscal pressures,” May 17, 2025

- Australian Financial Review, “White House chides Moody’s downgrade to US credit rating,” May 17, 2025