What is the offer for Santos (ASX:STO)?

The Abu Dhabi National Oil Company (ADNOC), the state-owned oil company of the UAE, and led by its investment arm XRG, has made a$36 billion takeover offer for Santos, Australia’s second largest natural gas producer after Woodside Energy (ASX:WDS). The bid comes at $8.89 per share, representing a premium of 28% over Santos’ last closing price1. The Santos board has confirmed it intends to unanimously recommend the offer to shareholders. The offer follows Santos rejecting a $14.4 billion takeover bid from Harbour Energy in 2018, citing the offer as too low following energy price falls that had depressed its share price2.

Santos Clause arrives early for shareholders?

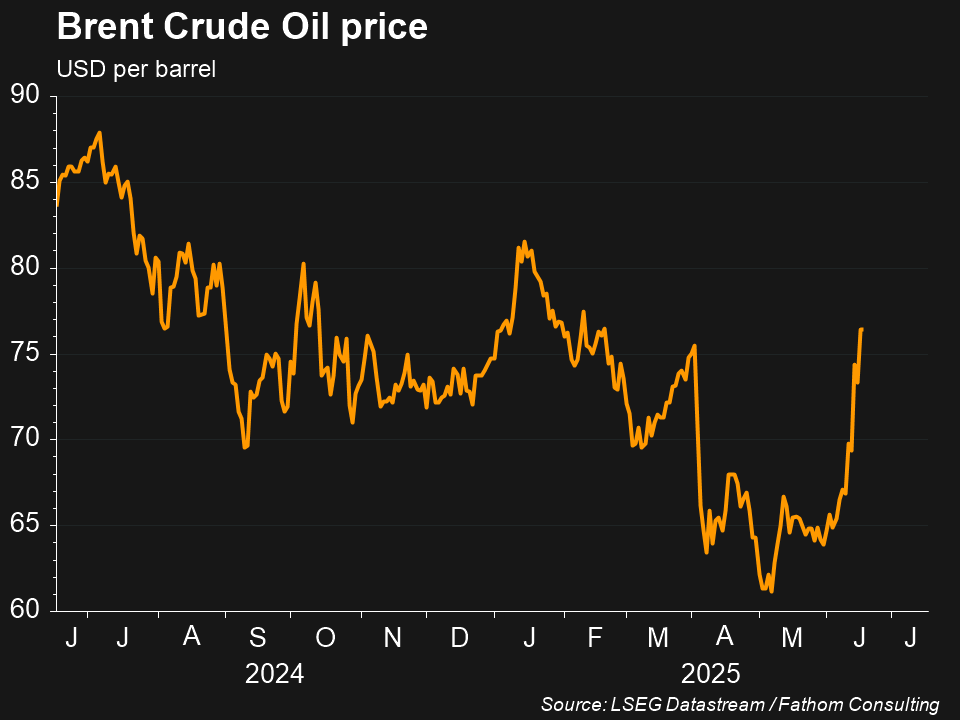

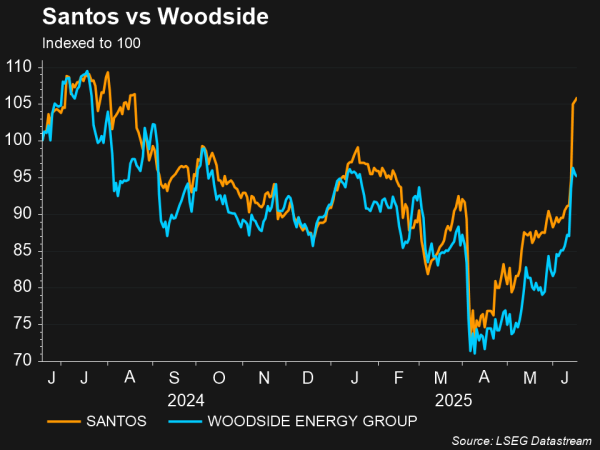

Prior to the offer announcement, share prices in oil and gas producers had been surging globally after a spike in crude oil prices following the escalation of the conflict in the Middle East between Israel and Iran. Iranian oil exports amounted to around 2% of global consumption in May according to Bernstein, a broker, however the bigger concern for investors is if Iran weaponised its control of the Straits of Hormuz, a key waterway that transports nearly 20% of global oil supply, by disrupting tanker traffic3. Santos and Woodside Energy’s share prices have risen significantly following this news and Santos’ takeover bid announcement, up 10.92% and 1.61% respectively.

Will the offer get regulatory approval?

A key hurdle for the bid getting through will be Australia’s Treasurer Jim Chalmers and Foreign Investment Review Board (FIRB), who assess and approve all major foreign investment proposals based on whether they’re contrary to Australia’s national interest. Santos’ ownership of key Australian critical gas infrastructure, and the potential transfer of control of these assets to a company state-owned by the UAE, may raise concerns for FIRB on national security concerns and the security of Australia’s future energy supply. From an economic perspective, Santos is also a significant pillar in South Australia’s corporate landscape and is one of the state’s biggest taxpayers, presenting a risk if Santos’ new owner based the company in a new location. Santos’ price increase of 10.92% post the offer announcement, compared to ADNOC’s offer price of $8.89 per share, highlights investors pricing in the risk of FIRB rejecting the deal. In an attempt to pre-empt these concerns however, ADNOC has committed to keep Santos’ headquarters in Adelaide and retain its brand.

How does LNG fit into Australia’s energy transition?

Despite being a fossil fuel, natural gas has a significantly lower carbon footprint than coal and many other traditional energy sources. For Australia in particular, this makes it an important source of electricity in our energy transition, to bridge the gap between our renewable energy sources that are still being developed, and our coal power stations that are ageing and shutting down.

Some in the industry have therefore questioned state and federal government’s reluctance to approve new gas developments, which they argue will result in more coal consumption and an adverse environmental outcome. Victoria and NSW both banned new gas project exploration and development in the early 2010s, which some say has resulted in higher energy prices as insufficient new supply comes online to meet ageing gas and coal facilities going offline. Victoria subsequently lifted this ban in 2021, in response to the dwindling of offshore supplies from the Bass Strait.

The federal government has also adopted a mixed attitude to natural gas in the past. In May, Environment Minister Murray Watt granted federal approval of Woodside’s application to extend the life of its North-West Shelf LNG processing facility in Western Australia, after Woodside’s initial submission of its application for this in 20184. The facility originally opened in 1984, with the extension proposal facing significant opposition from environmental groups concerned about the facility’s carbon footprint. Santos’ flagship $5.8 billion Barossa gas project in the Timor Sea has faced similar hurdles, being granted its last major regulatory approval in April, with the company initially acquiring and expecting the project’s final go-ahead in 20205. Drilling, however, has had to be paused amidst legal action with environmental groups, who opposed the project on carbon footprint and Indigenous heritage concerns, and were ultimately unsuccessful.

These delays highlight the intense scrutiny the government has placed on natural gas amidst strong backlash from environmental groups. Recent project approvals, however, suggest the government may be adopting a more pragmatic approach to the energy source going forward, as they recognise its role as a stopgap in the energy transition while renewable energy capacity picks-up. Regardless of whether Santos’ takeover bid goes through, the deal therefore reinforces to the government its importance going forward and shows global investors taking notice of this.

Further reading

Learn how Environmental, Social, and Governance risks are weighed in our Responsible Investing framework.

References

- Australian Financial Review, “Abu Dhabi oil giant, Carlyle lob $30b takeover bid for Santos,” 16 June 2025

- Santos News & Announcements, “Santos rejects Harbour proposal and terminates discussions,” 22 May 2018

- Financial Times, “An Iran oil shock would put global growth on a slippery slope,” 13 June 2025

- Australian Financial Review, “North West Shelf green light signals warming to gas,” 28 May 2025

- Australian Financial Review, “Santos gets the final green light for $5.8b Barossa gas project,” 22 April 2025