Private Credit’s Market Expansion

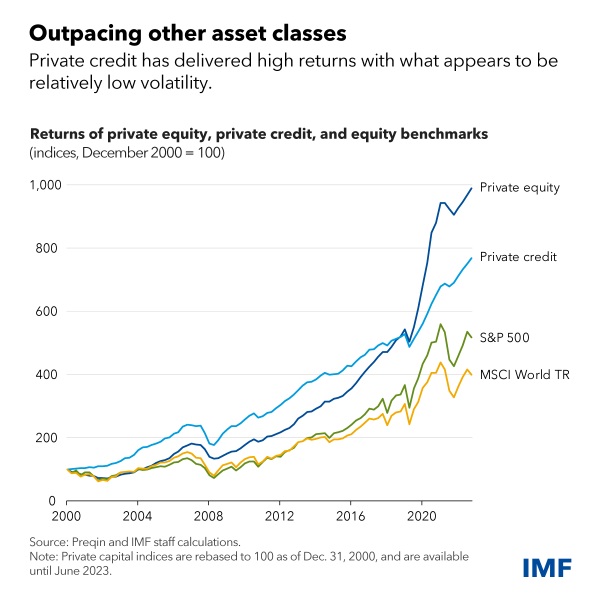

The past three years have witnessed the rapid growth of private credit as an alternative investment to traditional fixed income, with the market size increasing from $621 billion in 2017 to $1.5 trillion in 2024.[1] The private credit sector in Australia has mirrored this trend, achieving a compounding annual growth rate (CAGR) of 23% in funds under management between 2015 and 2023.[2]

Private credit refers to any debt financing that occurs outside traditional markets, with funding typically provided by non-bank financial institutions, such as asset managers. These asset managers act as intermediaries between investors and borrowers, pooling investors’ funds and lending them to borrowers. [3]

Drivers Behind the Growth

The rise of private credit as an investment option can be attributed to structural changes in the banking sector following the global financial crisis (GFC). Stricter regulations imposed on banks required them to hold more equity against their loans, making it less rewarding for banks to lend to riskier borrowers. As a result, certain borrowers were excluded from accessing loans. With less regulatory oversight, private creditors have stepped in to fill this gap, providing funding to higher-risk borrowers while charging higher interest rates.

The elevated yields offered by private credit have attracted advisers, institutions, and retail investors seeking higher returns. With private credit typically structured as floating-rate loans, the “higher-for-longer” interest rate environment in Australia has pushed yields into the double digits. The average yield on newly issued private credit loans has reached 10.3%. [4]

Understanding the Risks

Despite the clear appeal of this asset class and its impressive growth, private credit is not without risks. Its opaque nature stems from the lack of regulation and reporting requirements imposed on private creditors. Investors may find it challenging to ascertain the quality of the debt they are investing in or the underlying value of the collateral backing the loans. [5]

Private credit investments often require long-term commitments, with capital lockups and limited redemption windows. This illiquidity could present challenges for investors during market downturns or unforeseen financial circumstances. [6]

Additionally, while the current higher interest rate environment supports attractive yields, it also places greater stress on borrowers due to increased interest repayment obligations. Given the smaller and more leveraged nature of the companies that utilise private credit, this environment heightens the risk of defaults, which could erode investor returns.

Private credit remains a compelling addition to modern portfolios, offering higher yields and diversification benefits beyond traditional fixed income. However, understanding the intricate risks and complexities of this asset class is essential. A well-considered approach to allocation, alongside diligent fund selection and risk assessment, can enable investors to capitalise on opportunities while mitigating potential downsides.

As the private credit market continues to evolve, staying informed is crucial to navigating this dynamic landscape. Should you wish to explore private credit further or discuss how it may align with your investment strategy, please do not hesitate to contact our team.

https://www.imf.org/en/Blogs/Articles/2024/04/08/fast-growing-USD2-trillion-private-credit-market-warrants-closer-watch

References

- Citi Wealth, “Investment Strategy Bulletin”, January 4, 2025

- Australian Financial Review, “Private credit is booming but do investors realise it’s a two-way street?”, July 1, 2024

- Reserve Bank of Australia, “Growth in Global Private Credit”, October 17, 2024

- Citi Wealth, “Investment Strategy Bulletin”, January 4, 2025

- Australian Financial Review, “Private credit is booming but do investors realise it’s a two-way street?”, July 1, 2024

- International Monetary Fund, “Fast-Growing $2 Trillion Private Credit Market Warrants Closer Watch”, April 8, 2024