What are tariffs?

Tariffs are taxes imposed by a government on imported goods or services. They are used to make imported products more expensive, encourage consumers to purchase domestic products to protect local industries and raise government revenue. While tariffs can support demand for domestic companies, they can also lead to higher prices for consumers.

What tariffs has Trump announced?

On February 1st, Trump announced 25% import tariffs on Mexico and Canada, causing a market selloff and a spike in volatility. This soon reversed however, as on February 3rd, Trump agreed to delay the tariffs by a month, after both countries’ leaders promised stricter border control at their US borders, in a bid to crackdown on illegal immigration and drug trafficking – both key policy points from Trump’s election campaign.

On the same day as his Mexico and Canada tariffs, Trump announced a 10% increase to existing US tariffs on Chinese imports, with China retaliating on February 4th with a 15% tariff on US coal, oil and gas imports. This is a sliver of what Trump targeted and highlights Beijing adopting a markedly different approach to their engagement with Trump compared with his first term. Both countries went tit-for-tat on tariffs, matching each other in scope and economic impact.

While yet to provide any insight on specifics, Trump has also promised to hit the EU with tariffs next and has flagged a potential universal tariff on all imported products to come into effect in April1.

What is the expected US impact?

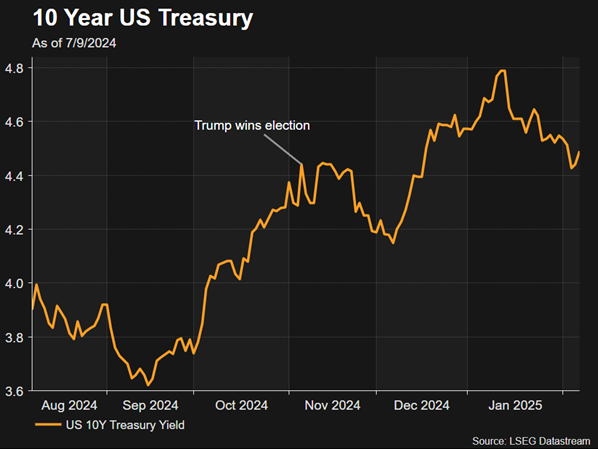

At the January Federal Reserve meeting, Fed chairman Jerome Powell kept interest rates on hold, citing the central bank was in no rush to cut, and that rates would remain on hold until his officials could adequately assess the uncertain impact of Trump’s tariffs and other proposed policies2. Powell’s comments echo fears from many investors that the president’s tariffs could reignite inflation, by causing US-imported products to become more expensive and disrupting supply chains. This thesis has seen investors push out their expectations for Fed rate cuts, increasing treasury yields as many now expect rates to be higher for longer.

US companies who import from China’s profit margins have also been front of mind for investors, with many expecting margins to suffer as companies absorb tariffs. Companies with sustainable pricing power may have a degree of protection, through their ability to pass on higher costs to customers, without substantial loss in sales volumes and therefore maintain margins.

What about Australia?

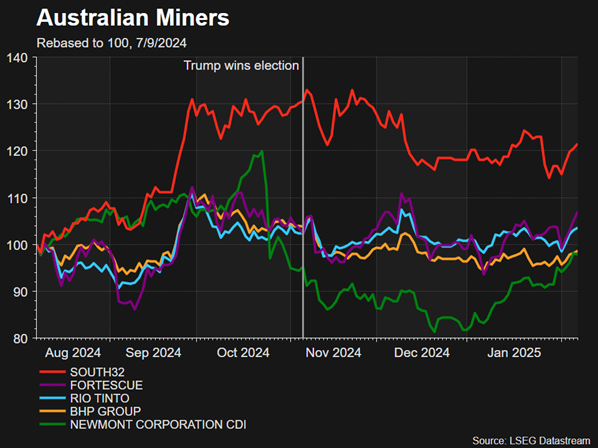

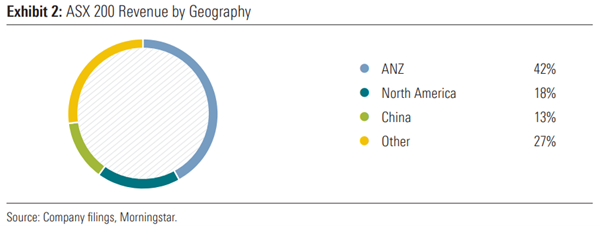

Tariffs specifically targeted at Australia are unlikely, given our trade deficit with the US. This makes us a less obvious target for tariffs, compared to countries running a trade surplus such as Canada and China. However we will likely see an impacts from tariffs on China, which is our largest trading partner and accounts for 8.3% of Australia’s GDP3, due to their importing of Australian iron ore and other minerals. This leaves Australia vulnerable to a tariff-induced economic slowdown in China, which could result in less of our iron ore being purchased and lower global prices. Markets appear to be considering these risks however, with basic material stocks falling significantly since Trump’s election win.

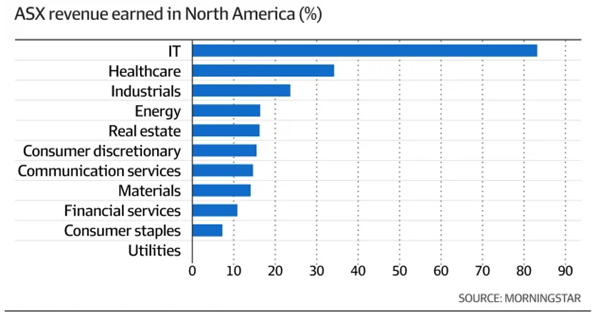

Australian exports may also get caught in the crossfire if Trump implements a blanket universal tariff on all imported goods coming into the US, with Australian companies earning around 18% of their sales from North America. This figure is, however, dragged up by Australia’s software companies, which earn around 80% of their revenue from the US but are not exporting any goods into the country.

On February 10th, Trump announced a universal 25% tariff on steel and aluminium imports, which may impact several Australian exporters. In 2018 the Turnbull government was able to negotiate an exemption for Australia when Trump implemented this policy during his first term, due to Australia’s trade surplus with the US and our close defence ties. Trump stated on February 11th, after a phone call with Australian PM Anthony Albanese that such an exemption was “under consideration” for Australia.

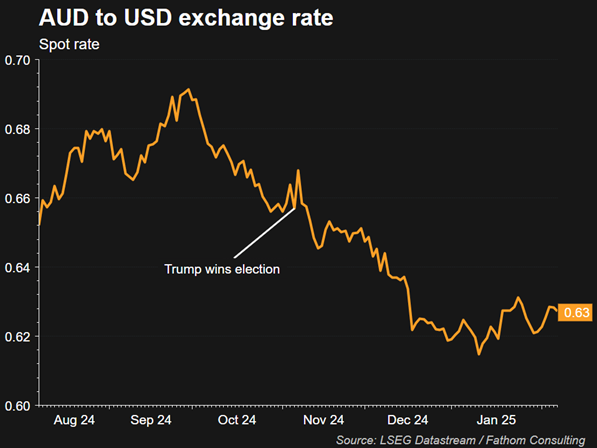

How has the AUD responded to Trump’s tariffs?

The AUD has declined significantly relative to the USD since Trump’s election win, particularly due to his promises of aggressive tariffs on China that could reduce its demand for Australian iron ore. This has been compounded by the USD’s strength due to the resilience of its local economy and expected future increases in domestic manufacturing, as tariffs make manufacturing and importing goods from overseas less attractive to US companies. For the Australian consumer, this has made travelling to the US and importing products from the US more expensive, but also it has been a boon for exporters who are paid in USD and whose products are now comparatively cheaper for foreign buyers.

We will continue to monitor Trump’s tariff plans, and its impact on financial markets and the global economic landscape with great interest.

References

- Morningstar, “Our exposure to a Trade War,” February 6, 2025

- Australian Financial Review, “Trump lashes Powell after Fed keeps rates on hold,” January 30, 2025

- Department of Foreign Affairs and Trade, China, October 2024