What have Trump and Powell said about rate cuts?

Late last week, US President Donald Trump called on Federal Reserve Chair Jerome Powell to cut rates after the European Central Bank (ECB) did the same at its April 17th meeting. By the weekend, White House economic adviser Kevin Hassett was telling reporters the administration was exploring legal ways to remove Powell, and on Monday night, Trump added fuel to the fire with another social media rant, stating that the US has “virtually no inflation” and calling Powell “a major loser.”

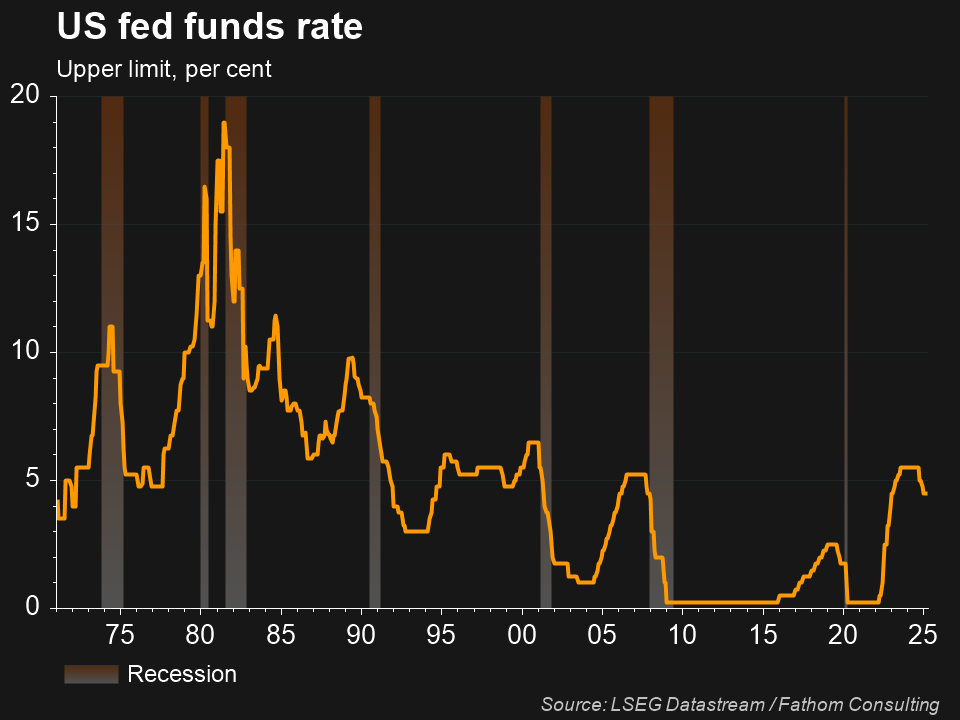

This follows the Federal Reserve (the Fed) sharply raising rates in 2022 and 2023 to slow borrowing and spending and tame inflation, which has dropped steadily from a 9.1% peak in 2022 to 2.4% last month, slightly above the Fed’s 2% target and prompting them to cut rates 3 times at the end of last year.

But since then, Powell has underscored they’re keeping rates on hold because of the uncertainty created by Trump’s sweeping tariffs, including a 10% levy on all imports and 145% on those from China. In remarks on Wednesday April 16th in Chicago, Powell reiterated the Fed was waiting on greater clarity before making any rate moves, and that tariffs are “likely to generate at least a temporary rise in inflation” while slowing growth and boosting unemployment as consumer and business spending falls.

This introduces a dilemma for Powell, as he looks to prop up falling economic growth due to Trump’s tariffs, but potentially can’t do this as inflation simultaneously rises, creating tension between his dual mandate of maximising employment and maintaining stable prices. Powell also explicitly stated, in his Chicago speech on April 16th, that there were no plans for a so-called “Fed put,” whereby the central bank cuts rates to give the market some support, reinforcing the Fed chair’s hawkish tone.

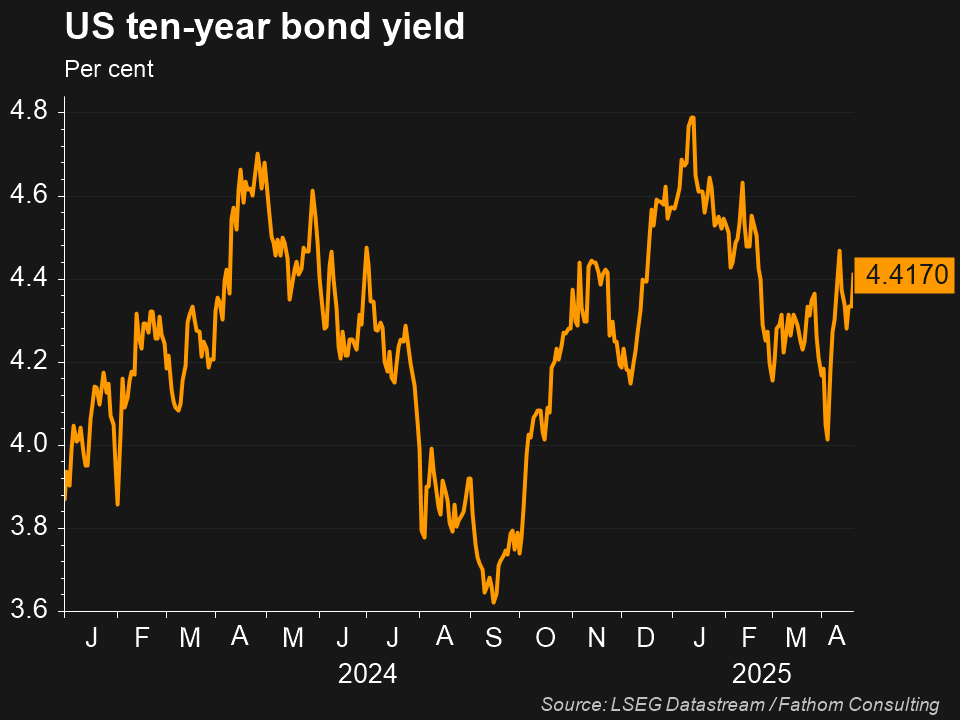

What about the US 10-year Treasury Yield?

The price of long-term US government bonds, like 10-year treasuries, typically appreciate in times of financial market crisis, as investors trust their credit worthiness and anticipate that the Fed will cut interest rates sharply to support the economy, boosting the value of bonds. Investors have aggressively dumped long-term US government bonds since Trump’s April 2nd Liberation Day tariff announcements however, in a historic loss of faith in global markets’ most coveted safe haven asset amid fears higher inflation caused by tariffs could prevent rate cuts by the Fed, causing future US government bonds to be issued at higher than previously thought coupons. This has resulted in increased volatility in the bond market, as prices for long-end bonds that are more sensitive to interest rate changes move around due to interest rate expectations changing, causing their yields to also experience volatility as coupon payments remain fixed while prices change. As a result, the US 10-year Treasury Yield has risen from 4.2% on April 2nd to around 4.4% currently.

The 10-year Treasury Yield represents the interest rate the US government pays on its debt, while also impacting broader borrowing rates in the economy like mortgage rates. For investors, it also functions as the risk-free rate in the discount rate used for valuing assets based on future cash flows, meaning that increases in the 10-year Treasury Yield can reflect consumers, businesses, and the government spending more on interest payments, and higher discount rates being applied to future cash flows for investments, reducing their valuations.

The future path for the 10-year Treasury Yield and Fed rate cuts remains highly uncertain however, as even if Trump’s tariffs cause an economic growth slowdown, it will be difficult for the Fed to cut rates, no matter how much Trump pressures them, if these also bring an inflation resurgence. This could spell trouble for investors, as despite a 9.04% sell-off since Liberation Day on April 2nd, the S&P 500 is still trading at a P/E of more than 19.2, while the ASX 200 is at about 17x, both well above long-run averages with plenty of economic growth and Fed rate cuts priced in.