When did Trump’s bill pass?

Following the US senate’s 51-50 approval of Trump’s ‘Big, Beautiful Bill’ earlier in the week, the US house of representatives has also voted 218-214 last night to pass the 940-page legislation, with all Democrats opposed and two Republicans, Massie and Fitzpatrick, also voting against it1. Their objections echo broader Republican party infighting over the bill, with one side pushing for more Medicaid spending and tax cuts, while the other demands less Medicaid spending cuts and more funding for clean energy subsidies.

The bill includes Trump’s tax cut, immigration, and military spending priorities, proposing around $US4.5 trillion in tax cuts over the next decade by extending the president’s 2017 Tax Cuts and Jobs Act, due to expire at year-end, while proposing new provisions that eliminate income tax on tips, overtime pay, and social security benefits.

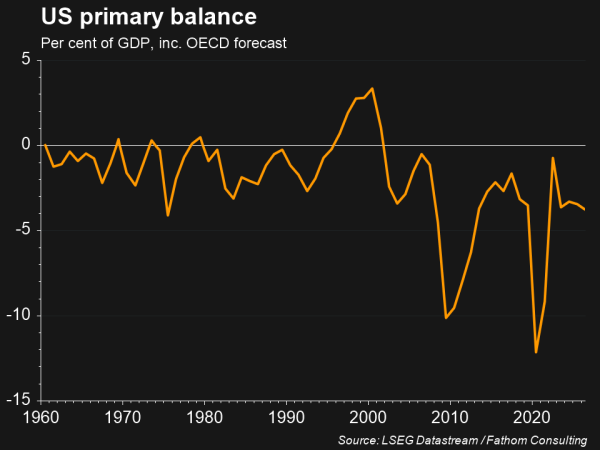

Passage of the bill, though, has seen significant amendments inserted to sure up Republican support, including increases to defence spending, and raising caps on how much state and local taxes Americans can deduct from their federal taxable income. This has resulted in the bill now adding $US3.3 trillion to federal deficits over the next 10 years, as opposed to $US2.4 trillion previously at its initial house vote in May2. Which has drawn concerns from budget conservatives on both sides of the political isle.

Not so beautiful bill for markets?

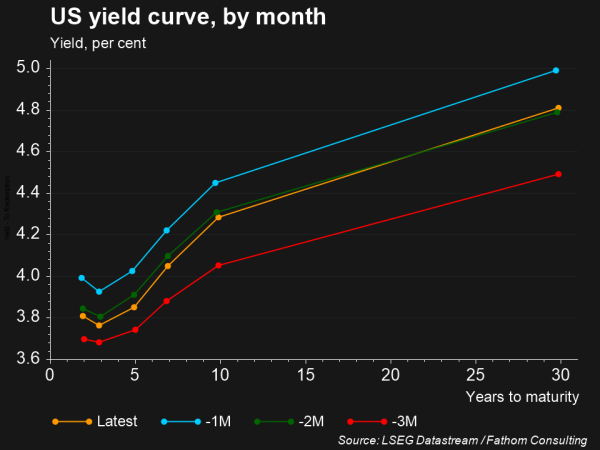

Over the last several months, the US yield curve has steepened as bond investors price in the bill’s passage, and view its compounding federal deficits as increasing US default risk. This has caused them to demand higher yield compensation for holding US government debt, and seen long-dated bond yields rise. Which has then forced the US government to issue new bonds at higher interest rates in the latest Treasury auctions, adding billions of dollars to US interest payments.

Stock market investors have echoed these concerns, arguing that while the bill’s tax cuts will support short-term economic growth, this results in higher borrowing costs and interest payments that may curb future government spending – providing a longer-term headwind to equity valuations.

Stock market investors have echoed these concerns, arguing that while the bill’s tax cuts will support short-term economic growth, this results in higher borrowing costs and interest payments that may curb future government spending – providing a longer-term headwind to equity valuations.

Therefore, while the bill may have a short-term benefit for American consumers, the government’s mounting interest bill means they’ll be paying the price for this for years to come.

References

- Financial Times, “House of Representatives approves ‘big, beautiful bill’ in victory for Donald Trump,” 4 July 2025

- The Wall Street Journal, “House passes Trump’s megabill in GOP triumph,” 4 July 2025