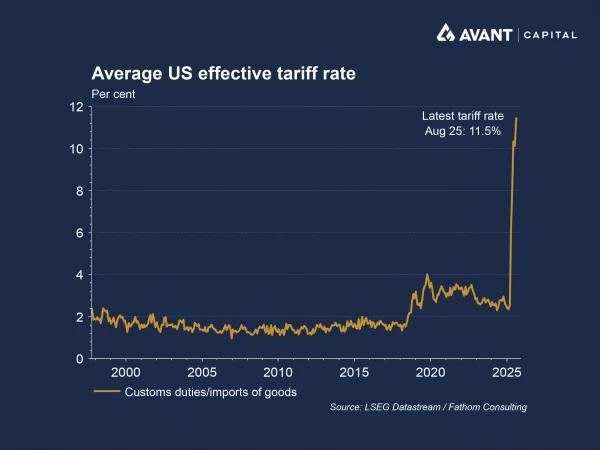

What are the current US tariff rates?

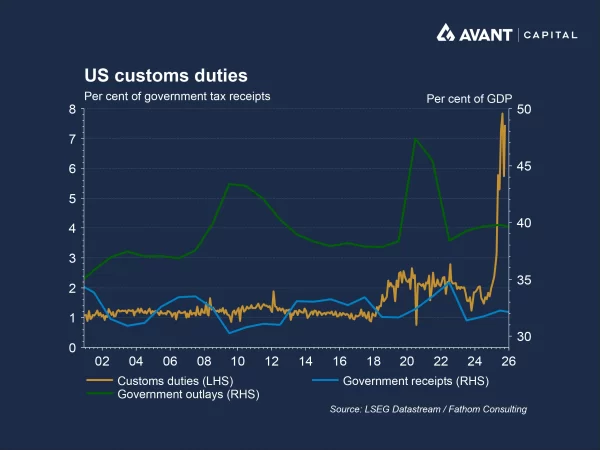

Following US President Donald Trump’s tariff announcements throughout 2025, the effective US tariff rate has risen from roughly 2.5% at the start of the year to around 11.5% by August. Trade agreements with the EU, UK, Japan, and others have helped to limit the extent of this increase, however tariffs remain well above historical norms. Levies on specific goods are particularly steep, such as 25% tariffs on autos and car parts, and up to 50% on steel1. Agricultural products such as coffee and bananas were exempted later in the year to ease grocery price pressures; however, even with these carve-outs, the US tariff regime remains the most protectionist in nearly a century2.

China was a particular focus. Earlier in 2025, average tariffs on Chinese imports briefly soared above 100%, but have since eased to around 45%. This follows an agreement in October between Trump and Xi Jinping for China to suspend its export controls on rare earths and for the US to cut tariffs on fentanyl-related chemicals3.

How have tariffs affected inflation and growth?

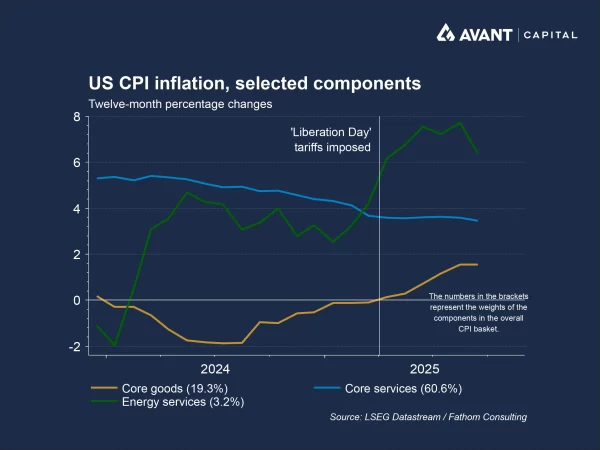

The inflationary impact of tariffs has been real, though less severe than expected. Headline CPI hovered around 2.7% in August4, above the Fed’s 2% target and up from 2.3% before Trump’s tariffs in April, but still well below the spikes many analysts had feared.

Goods inflation, which had been flat for two years, began creeping higher in mid-2025 as inventories stockpiled before tariffs were depleted. However, because goods account for only about 19.3% of the CPI basket and services, roughly 60.6%, have experienced slight disinflation, much of the upward pressure has been offset.

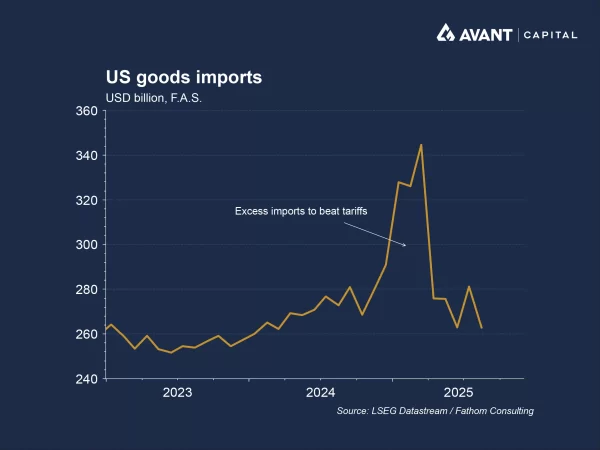

Tariffs pass-through has therefore remained limited, with retailers and importers largely absorbing tariff costs in their profit margins so far. This explains why consumer prices haven’t spiked dramatically. Businesses expected to face severe margin compression have managed better than anticipated, largely by cutting costs and leveraging pre-tariff stockpiles. However, analysts warn that as inventories further dwindle, more costs could shift to consumers in 2026.

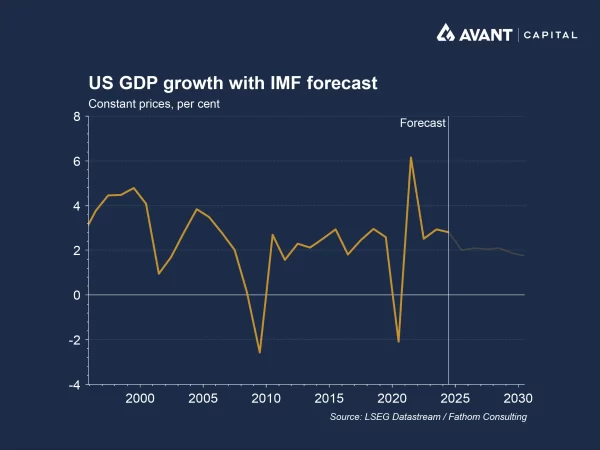

Growth has held up surprisingly well. The IMF forecasts US GDP growth of 2% in 2025, in line with the latest second-quarter figure of 2%, and expects it to remain broadly flat in 2026 as tariff effects are offset by continued AI-related capital expenditure, which reached nearly US$400 billion from Amazon, Google, Meta, and Microsoft alone in 20255.

Why has the impact been more muted than expected?

Several factors explain the resilience. Companies have largely chosen to protect market share rather than pass on full tariff costs, with Citigroup estimating consumers have borne only 30–40% of tariff costs so far6. Strong equity markets and tech profits have also helped: despite April’s market rout, the S&P 500 rebounded to record highs, and earnings growth across the broader Russell 3000 hit 11% in Q3, the fastest in four years7.

Selective carve-outs and deals have further stabilised sentiment. Trump’s partial rollbacks, such as food tariff cuts and rare earth agreements with China, helped calm markets after the April sell-off. That said, sectors like autos have suffered. General Motors, Ford, and Stellantis North America forecast a combined $US7 billion tariff-related hit to 2025 earnings, and suppliers report margin compression and rising bankruptcy risks.

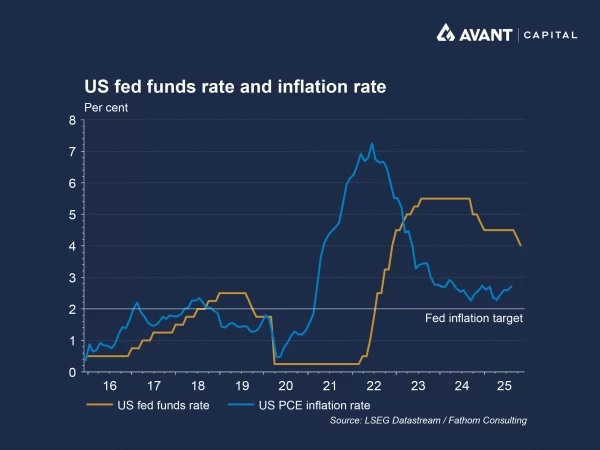

How has the Federal Reserve responded?

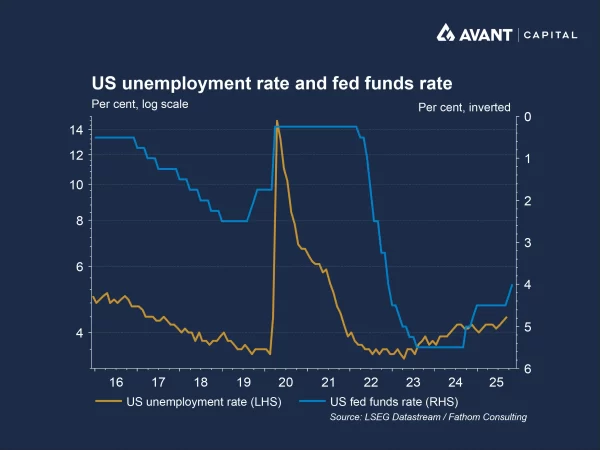

The Fed faces a delicate balancing act. Inflation remains sticky at around 2.7%, yet the labour market is cooling: unemployment ticked up to 4.4% in September, its highest since 2021, and manufacturing jobs have declined for three consecutive months8. In response, the Fed cut rates twice this year and may deliver a third 0.25% cut in December, despite hawkish concerns about reigniting inflation9.

Political pressure looms large. Trump has repeatedly attacked the Fed for “stubborn” policy and plans to replace Chair Jay Powell when his term ends in early 2026, touting Kevin Hassett as a frontrunner10. Markets worry that a more compliant Fed could undermine central bank independence, especially if Trump forces through deeper cuts to support growth ahead of midterms. While bond markets have remained calm, some analysts warn that any perception of politicised monetary policy could push Treasury yields higher, as seen during April’s sell-off.

What about the dollar and investor sentiment?

The dollar plunged after April’s tariff shock but has since clawed back losses, buoyed by Fed caution on rate cuts and equity markets’ strength. Currency volatility has subsided to pre-election levels, though global investors remain wary. Hedging of US exposure has increased, reflecting concerns over policy unpredictability and Fed independence.

What does this mean for 2026 and beyond?

The tariff story isn’t over. Some economists expect the real pain to emerge in 2026 as inventories run dry and companies pass on more costs. The WTO projects global goods trade growth slowing to 0.5% next year, down from 2.4% in 2025, with US tariffs a key culprit11. Yet Trump’s “One Big Beautiful Bill,” featuring tax cuts, alongside deregulation and AI-driven capital expenditure could cushion the blow.

US federal government tariff revenues, meanwhile, have surged in 2025, providing a modest fiscal offset to widening US budget deficits, helping calm some investors’ concerns about debt sustainability.

Legal challenges to Trump’s use of emergency powers to implement tariffs also persist, making the outlook for tariffs and their economic impact highly uncertain.

References

- Financial Times, “’This is existential’: Donald Trump’s tariffs drive US car sector into turmoil,” 12 October 2025

- The Wall Street Journal, “How Trump administration aimed tariff exemptions at rising food costs,” 29 November 2025

- Financial Times, “US and China agree one-year trade truce after Donal Trump-Xi Jinping talks,” 30 October 2025

- Financial Times, “How sticky is US inflation?” 30 November 2025

- The Wall Street Journal, “America’s tariffs jolted the global economy. Its AI spending is helping save it,” 30 November 2025

- Financial Times, “Impact of Trump tariffs is beginning to show in US consumer prices,” 5 October 2025

- Financial Times, “Corporate America posts best earnings in 4 years despite tariffs,” 9 November 2025

- Financial Times, “The bear case for 2026,” 21 November 2025

- Financial Times, “US adds 119,000 jobs in September but unemployment hits four-year peak,” 21 November 2025

- Financial Times, “Donald Trump says he will nominate Federal Reserve chair in ‘early’ 2026,” 3 December 2025

- Financial Times, “Donald Trump’s tariffs to cut into global goods trade in 2026, says WTO,” 8 October 2025