What are the three big messages for investors in 2026?

As we enter 2026, markets are buoyed by optimism but shadowed by risk. AI-driven investment and fiscal stimulus continue to power growth, yet stretched valuations, policy uncertainty, and tight credit spreads leave little margin for error. For investors, the challenge is clear: how to capture upside while managing downside risks. Here are three key themes to keep front of mind.

- Growth drivers are strong, but valuations are vulnerable

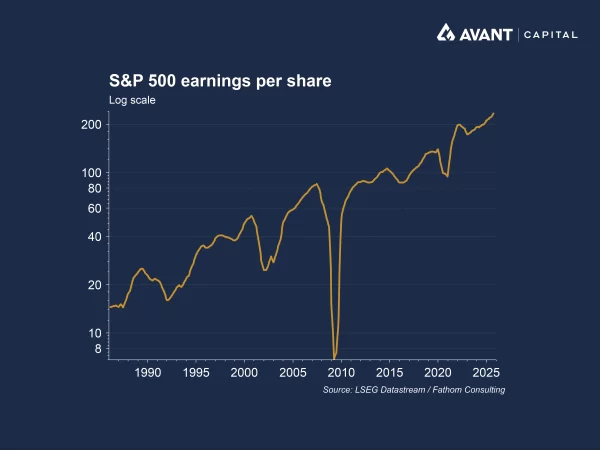

The global economy is entering 2026 with solid momentum. US corporate profits remain resilient, supported by historic levels of AI-related capital expenditure and robust consumer spending. The top five US hyperscalers, Microsoft, Meta, Amazon, Oracle, and Alphabet, are projected to invest over US$500 billion in AI infrastructure this year, a 35% increase from 20251. This investment cycle, one of the largest in history, is rippling through adjacent sectors such as construction, energy, and semiconductors, creating a powerful economic tailwind.

Fiscal stimulus adds another layer of support. The One Big Beautiful Bill Act delivers front-loaded tax cuts and infrastructure spending, potentially lifting US GDP by 0.4–0.5% in 2026. Corporate tax rates could fall from 21% to as low as 12%, bolstering profitability2. Deregulation, particularly in banking, also aims to unlock lending capacity and spur credit growth.

Yet, these positives come with a key risk: valuations are stretched. The S&P 500 trades near record highs, with forward P/E ratios well above historical averages. Market leadership remains narrow, concentrated in the “Magnificent Seven” tech giants. This concentration risk means any earnings disappointment or slowdown in AI-related spending could have an outsized impact on broader market performance. For investors, the upside is compelling, but the margin for error is slim.

- Inflation and policy uncertainty could upset rate-cut expectations

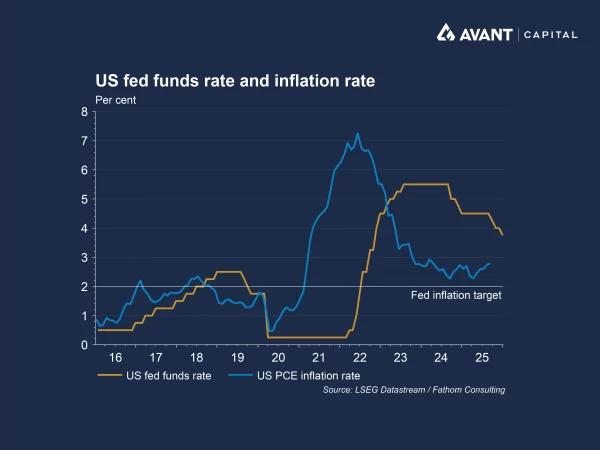

Markets are pricing in two to three Federal Reserve rate cuts in 2026, but the outlook remains highly uncertain3. Inflation is still running above the Fed’s 2% target, driven by tariffs, fiscal largesse, and wage pressures. While goods inflation from tariffs has been partly offset by easing services inflation, headline CPI continues to hover above target.

The Fed faces a delicate balancing act. If inflation proves sticky, rate cuts may be fewer than expected, or even paused. Conversely, political dynamics could push the Fed toward more aggressive easing, particularly with President Trump set to appoint a new Fed Chair mid-year. Importantly, the evolving Fed may be more flexible on its 2% inflation target, with growing speculation it could adjust or even abandon that target, leaving room to cut rates to support the labour market despite inflation being persistently above 2%4.

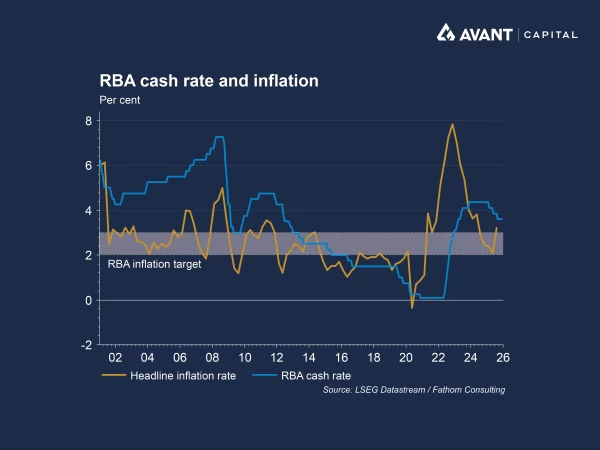

This uncertainty is mirrored in Australia. Inflation accelerated at the end of 2025, reversing earlier disinflationary trends and leaving markets unclear whether the Reserve Bank of Australia will hold rates steady or resume hiking in 2026, a sharp shift from prior market expectations of cuts. The RBA’s hawkish bias contrasts with anticipated Fed easing, shifting interest rate differentials and adding complexity for currency and bond markets.

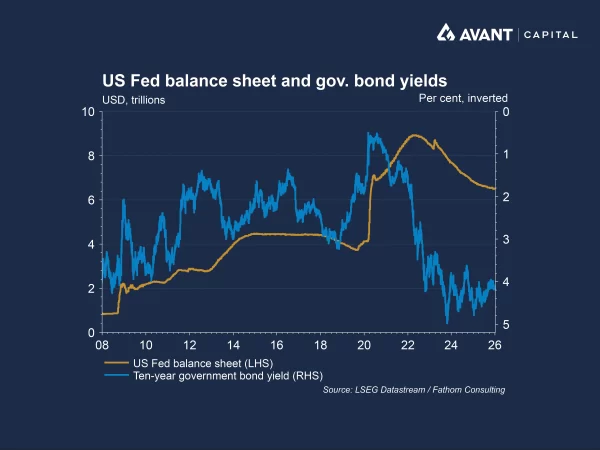

Long-dated government bond yields surged in 2025 amid fiscal sustainability concerns. While the Fed’s new Treasury buying programme may help anchor yields, persistent inflation risk could keep them elevated5. For investors, this evolving policy backdrop underscores the need to prepare for volatility across equities, bonds, and currencies.

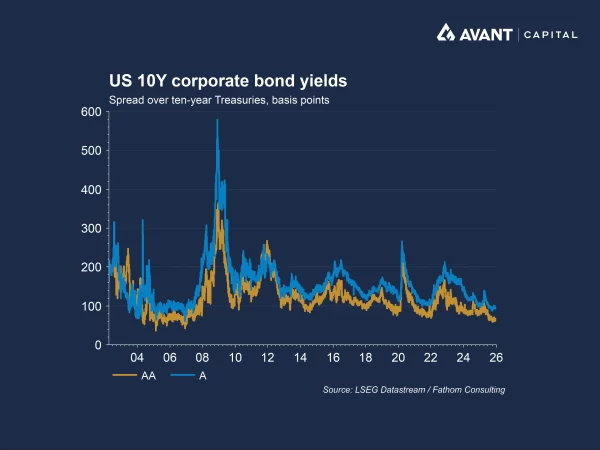

- Diversification is essential amid tight credit spreads and volatile alternatives

Credit markets enter 2026 with spreads at historically tight levels, leaving little buffer if conditions deteriorate. Private credit adds further vulnerability due to its illiquidity, higher leverage, and opaque structures. In Australia, ASIC’s recent review flagged widespread concerns around transparency, valuation practices, and liquidity stress testing, highlighting that rapid growth in this $200 billion market has outpaced governance standards. Rising defaults or redemptions could therefore trigger sharp repricing and cause spreads to widen across credit markets. At the same time, government debt continues to climb, fuelling volatility in long-dated bonds despite central bank efforts to stabilise yields.

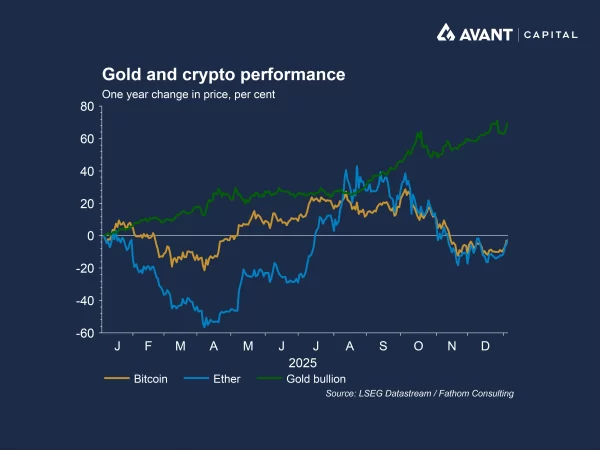

Alternatives offer mixed signals. Gold surged to record highs in 2025 as geopolitical uncertainty and fiscal concerns drove safe-haven demand. Crypto, by contrast, slumped late in the year as risk appetite faded. Both remain sentiment-driven, underscoring the need for caution.

Markets therefore enter 2026 with optimism tempered by high valuations, as AI-driven investment and US tax cuts continue to underpin economic growth, yet stretched equity valuations and historically tight credit spreads leave little margin for error.

References

- Mutual Trust, “Quarterly outlook,” 15 December 2025

- Bell Potter, “2026 outlook,” 15 December 2025

- Financial Times, “2026 predictions, part two,” 7 January 2026

- Financial Times, “Why it might be the time to repeal the Fed’s dual mandate,” 18 September 2025

- Financial Times, “Fed eases debt concerns with plan to end QT and buy more bonds,” 31 October 2025