What’s keeping US mortgage rates elevated?

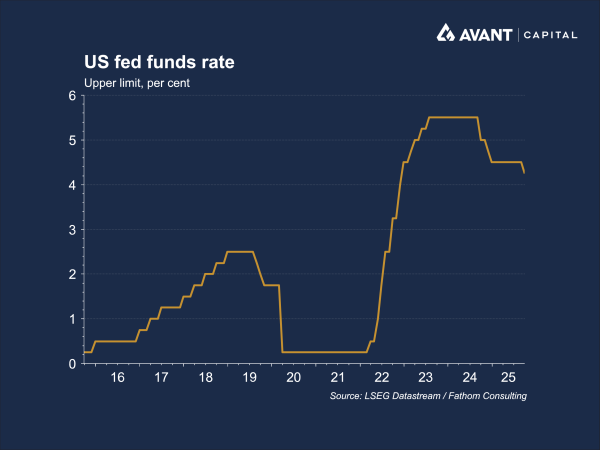

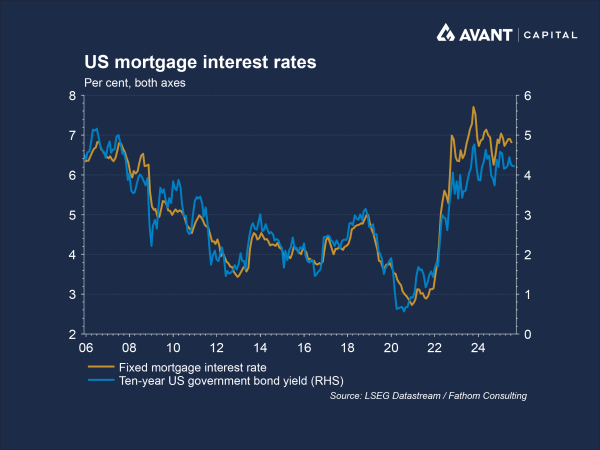

Despite the Federal Reserve’s recent interest rate cuts, including at its September 2025 meeting, US mortgage rates remain stubbornly high. Unlike credit cards or auto loans, which are closely tied to short-term interest rates set by the Fed, the standard 30-year fixed mortgage in the US is influenced primarily by long-term US government bond yields1. These longer-dated yields reflect investor expectations about inflation, fiscal policy, and the overall risk of lending to the US government over the long term.

Why can’t the Fed control mortgage rates directly?

The Fed’s benchmark interest rate affects short-term borrowing costs. Mortgage rates, however, are priced off longer-term government bond yields, particularly the yield on 10-year US Treasuries, which is about the expected amount of time a homeowner might hold a 30-year mortgage before moving or refinancing. This means that even if the Fed cuts short-term rates, mortgage rates may not follow suit if long-term yields remain elevated, as has occurred throughout 2025.

Why have long-dated US Treasury yields been high?

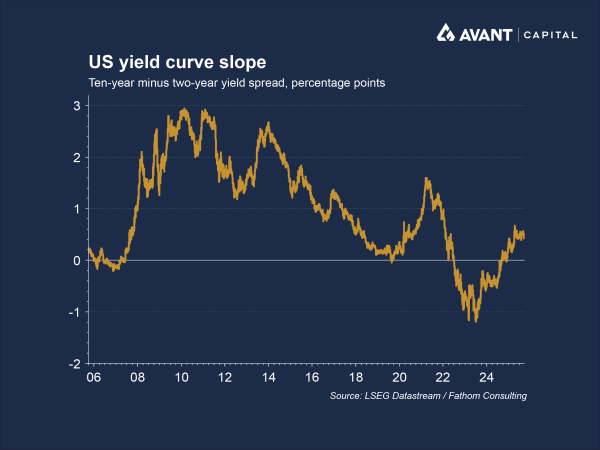

One key reason long-term yields are staying high is the term premium, which is the extra yield investors demand for holding long-term bonds over short-term bonds due to uncertainty about inflation, government debt levels, and future interest rates2. This premium has been rising as investors grow more concerned about the sustainability of US government debt and has been reflected in the rising yield spread between 10-year and 2-year Treasuries.

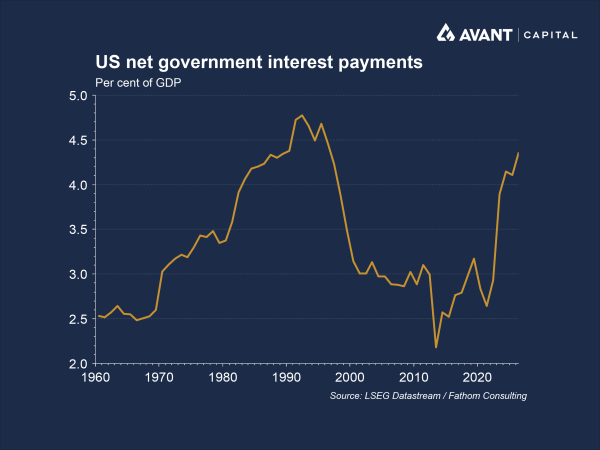

Investors fear that the US government will need to issue more long-term debt to finance its rising budget deficits, increasing supply and pushing down long-dated bond prices, which subsequently raises yields. This deteriorating fiscal position has corresponded with investors assigning more default risk to US government debt and demanding greater yield compensation for holding these securities.

What about inflation expectations?

Another key reason for mortgage rates remaining elevated is rising expectations for long-term inflation, which are priced into long-dated US Treasury yields. Investors who lend to the US government over 10 or 30 years by buying Treasuries lock in a fixed interest rate return on their investment and need to be confident this will be enough to keep up with inflation. Therefore, if these investors expect long-term inflation to be higher than what they previously thought, they will demand higher interest rate compensation to ensure their return keeps up with this.

This is what has occurred throughout 2025. Some investors believe that fiscal dominance, where a central bank keeps rates low to reduce the government’s interest costs, may constrain the Fed’s willingness to increase rates to combat inflation in the future, given the US government’s ballooning debt pile3. These investors have therefore demanded more yield compensation for holding long-dated US Treasuries, given they expect higher long-term inflation, causing mortgages rates to also remain elevated.

This dynamic has also been exacerbated by political pressure on the Fed from President Trump, who has repeatedly criticised Fed Chair Jerome Powell for not cutting rates aggressively enough, and has floated replacing him with more dovish candidates. Such interference has raised concerns about the Fed’s independence, and its ability to raise rates to combat inflation going forward when this may be politically unpopular.

What have high mortgage rates meant for the housing market?

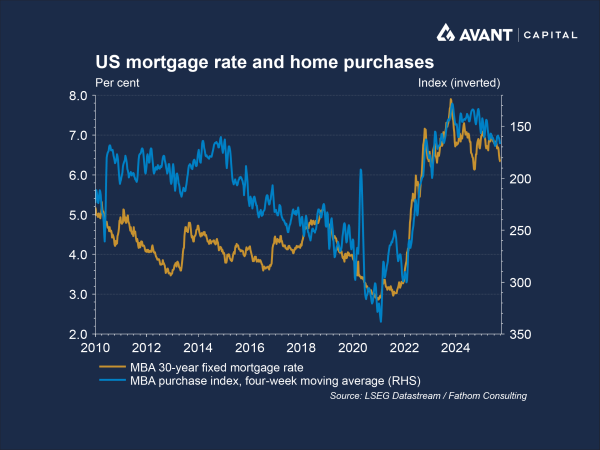

Persistently high mortgage rates have caused US home purchases to fall, as homeowners who locked in low mortgage rates before the Fed’s tightening cycle in 2022 are reluctant to sell and move, knowing they’d face higher borrowing costs on a new home.

A similar effect has also occurred with first-time house buyers, who now make up just 25% of the market, the lowest on record, reflecting their being put-off by high mortgage rates4. This has then reduced new home sales volumes, causing an oversupply of new homes that has resulted in falling building permits and construction activity.

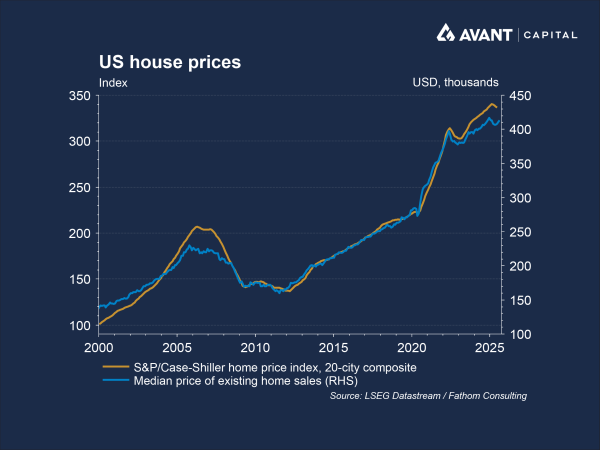

Despite these headwinds, house prices for existing homes still remain near record highs, as homeowners are reluctant to sell properties with low locked-in mortgages, constraining supply even as demand weakens5.

The path for the US housing market and mortgages rates is therefore highly uncertain, and dependent on long-dated US government bond yields and investor expectations for inflation, government debt, and Fed independence.

References

- The Wall Street Journal, “What decides where mortgage rates go from here,” 18 September 2025

- The Wall Street Journal, “Why the Fed rate cut won’t ease the government’s debt problem,” 19 September 2025

- Financial Times, “Global bonds rally after poor US economic data,” 4 September 2025

- Financial Times, “The Fed: good questions, no answers,” 18 September 2025

- The Wall Street Journal, “Home sales fell in August, slowed by high home prices,” 25 September 2025