What’s driving the IMF’s more optimistic tone?

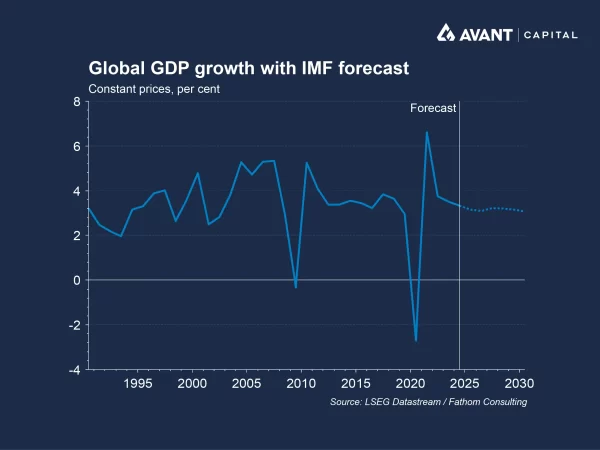

The International Monetary Fund (IMF) has revised its global GDP growth forecasts in its latest World Economic Outlook, lifting its 2025 projection to 3.2% from the 3.0% it predicted in July, and forecasting 3.1% growth for 20261. This upward revision comes as the impact of President Trump’s tariffs has been less severe than initially feared, and as several offsetting factors have helped cushion the global economy from trade-related shocks.

What is the IMF?

The IMF is a global financial institution designed to promote international monetary cooperation and financial stability, providing economic analysis and policy advice to its 190 member countries. While the IMF’s economic forecasts are widely used by governments, central banks, and investors, they have been subject to significant revisions in recent years. The Fund has underestimated growth in recent years, with some market participants viewing it as slow to incorporate economic shifts such as the AI investment boom, the resilience of consumer spending, and the impact of Trump’s tax and trade policies.

Why has the IMF upgraded its growth forecast?

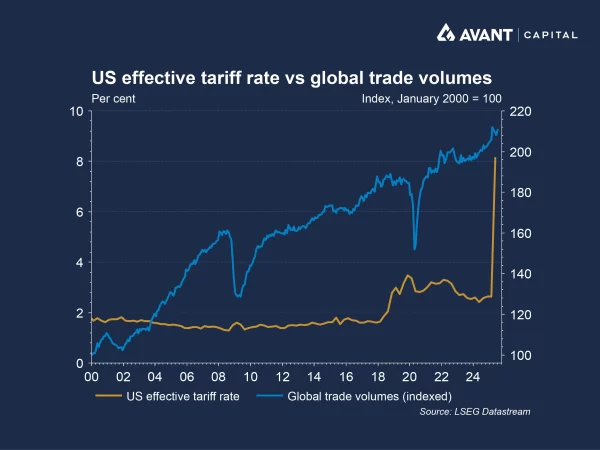

The most important factor influencing the IMF’s more optimistic outlook is the global economy’s surprising resilience in the face of trade shocks and tariffs, particularly those stemming from the renewed US-China trade war. Despite President Trump’s imposition of the highest US tariffs in decades, global growth and trade activity have not collapsed2. Instead, the impact of tariffs has been softened by businesses and households frontloading spending ahead of tariff deadlines, while many firms have absorbed tariff costs rather than passing them on to consumers. The Fund therefore feels confident in the global economy’s ability to continue weathering tariff volatility, even in light of Trump’s recently announced 100% tariffs on Chinese imports and China’s new export controls on rare earths3.

How Is AI Investment supporting growth?

The AI investment boom has also played a significant role in supporting growth, especially in the US. Companies have poured billions into AI infrastructure, bolstering expectations for productivity gains while also driving up equity markets and boosting consumer wealth4. The IMF flagged this wealth effect as a tailwind for consumer spending, helping to offset some of the drag from trade uncertainty and its impact on consumer confidence. However, the Fund also warned of investor complacency, with financial assets trading at elevated valuations, presenting risks of a sharp correction if AI’s productivity gains disappoint or if market sentiment shifts.

What role are central banks playing?

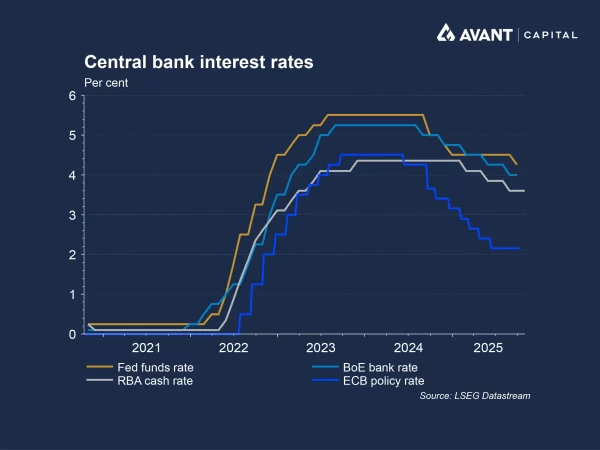

The IMF also flagged ongoing central bank rate cuts as a key reason for its growth revisions, by easing pressures on household budgets and supporting spending. Although it recognised inflation as an ongoing risk, the IMF noted that price pressures from tariffs have so far remained contained, but could increase if tariff pass-through accelerates. The Fund also highlighted that inflation expectations remain broadly anchored in many economies, giving central banks room to act, though it cautioned that further easing must be balanced against long-term price stability.

What is happening on the fiscal front?

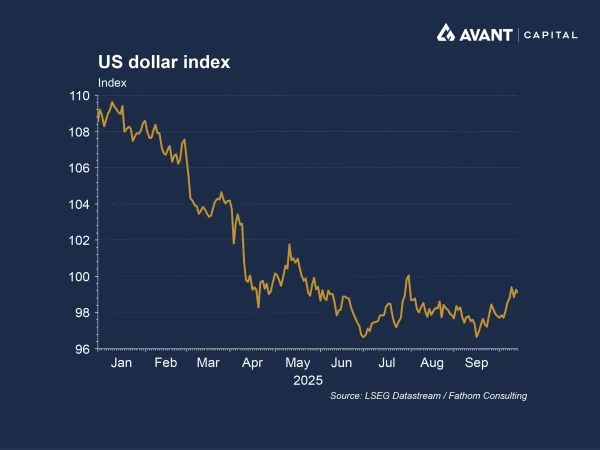

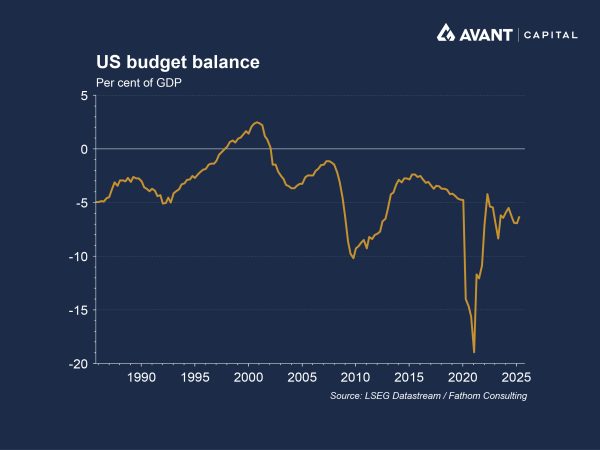

On the fiscal side, the US dollar’s recent depreciation has helped to ease financial pressures on countries with dollar-denominated debt and interest payments, which the IMF views as supportive for short-term fiscal spending and stimulus measures. However, the Fund also warned that this relief may be temporary, and that longer-term debt sustainability concerns could drive up government bond yields and put pressure on borrowing costs. The IMF also noted that elevated public debt levels and short maturities in some countries could amplify these fiscal vulnerabilities if financial conditions tighten quickly.

The Fund, however, neglected to flag the US government’s tax cuts and deficit spending measures through its One Big, Beautiful Bill Act, alongside its deregulation agenda, as material GDP growth drivers going forward. Some investors believe this may undermine the accuracy of the IMF’s forecasts, by not adequately considering the government’s wider policy agenda beyond tariffs.

Whether the IMF’s more optimistic growth outlook proves justified remains to be seen. However, the global economy’s performance has no doubt exceeded the Fund’s expectations in the face of considerable uncertainty.

References

- Australian Financial Review, “IMF warns of dim outlook as US and China ramp up trade war,” 15 October 2025

- The Wall Street Journal, “IMF chief sees global growth slowing ‘only slightly’ in face of higher tariffs,” 8 October 2025

- Financial Times, “Donal Trump threatens extra 100% tariff as he retaliates against China,” 12 October 2025

- Financial Times, “AI investment boom shielding US from sharp slowdown, says IMF,” 15 October 2025