What has been going on with Japanese bond yields?

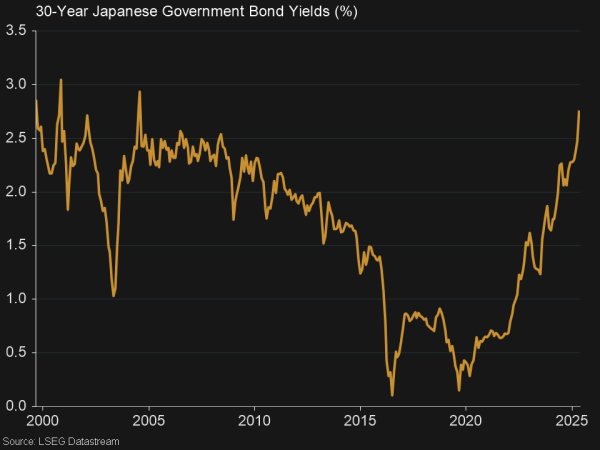

Japan’s core inflation rate climbed at its fastest rate in more than two years in April, increasing to 3.5% year-on-year, above the 3.2% in March to reach its fastest rate since January 20231. This rising inflation has caused investors to raise their expectations for Japan’s long-term interest rates, as they expect more rate hikes from the Bank of Japan. Which has subsequently caused yields on the longest-dated Japanese government bonds to surge to record highs on May 22th.

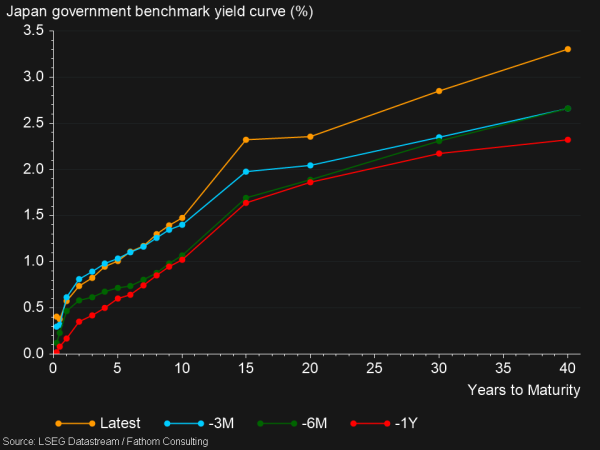

The benchmark 40-year Japanese bond yield peaked at 3.67%, up nearly a full percentage point just since the beginning of April, resulting in heavy losses over the last few weeks for holders of long dated Japanese bonds with high duration exposure. This rise in yields has corresponded to the Japanese yield curve becoming the steepest in the developed world2, meaning rates on long term bonds are significantly higher than those on short term, and highlighting investors’ new expectations for higher inflation going forward that could prop up interest rates.

Why are investors demanding higher bond yields?

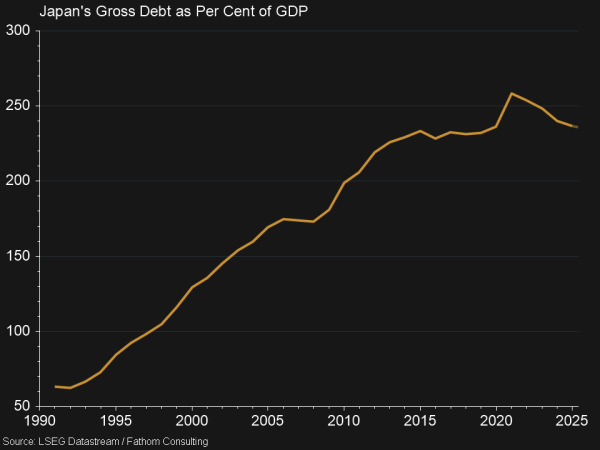

Following the collapse of Japan’s asset price bubble, Japan has accumulated massive amounts of government debt – through repeated fiscal stimulus measures in order to prop up the Japanese economy. When combined with the Bank of Japan’s similarly stimulatory low interest rates over the last few decades, this has allowed the government to rack up significant debt at relatively undemanding interest rates by global standards, fuelling further spendings. This is reflected in Japan’s S&P credit rating at A+, three notches below the US at AA+, with Japan’s Prime Minister Shigeru Ishiba also describing their fiscal position as “worse than Greece’s” during its debt crisis3.

While investors have long been aware of Japan’s challenging debt burden, this has come to a head recently as new fiscal spending initiatives caused it to reach 236.45% of GDP, compared to the US’ 125.77% of GDP, which sparked concerns around how the highest interest rates in decades, and a potential economic slowdown from US tariffs, could impact the government’s debt serviceability, as interest payments start to eat up more and more of revenues. This has resulted in markets ascribing higher risk to Japanese government bonds and demanding more yield compensation.

Investors have also put forward the Bank of Japan’s recent tapering of its Japanese government bond purchases as another reason for these rising yields, as they look to normalise their monetary policy from its current ultra-low setting by reducing their demand for government bonds, which may result in their prices falling and interest rates increasing.

What do rising Japanese bond yields mean for other markets?

Rather than holding domestic government debt that pays low yields, Japanese investors have for decades instead been sending their capital overseas to invest in higher yielding assets like US Treasury bonds and European government bonds. A rising Japanese government bond yield could reverse this trend, by making domestic debt more attractive compared to foreign debt for Japanese investors, and causing them to re-allocate their portfolios, as they also get the added benefit of removing foreign currency risk by holding Yen-denominated assets rather than assets denominated in other currencies that require hedging strategies to protect returns.

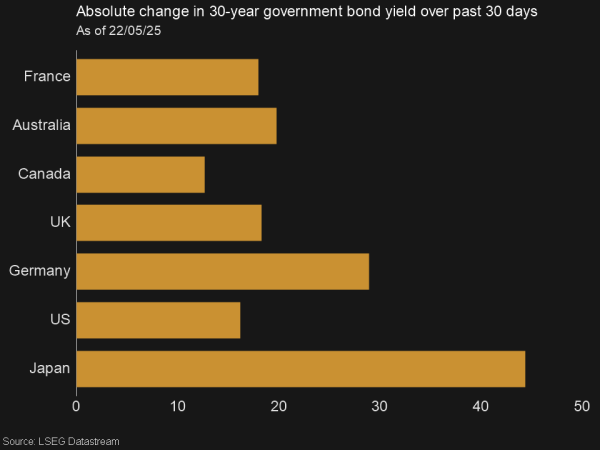

This could then result in these investors selling foreign debt securities to buy Japanese bonds, potentially reducing prices and raising yields on other governments’ bonds (as bond prices and yields move in opposite directions), which could mean losses for investors holding duration exposure on these assets, and more expensive debt financing for governments as they now have to issue new bonds at higher interest rates.

At the same time as Japan’s bond yields have rocketed, the 30-year US Treasury yield is up almost 44.4 basis points over the last month to 3.67% as at 22nd May, the highest level since the 2008 GFC, and echoing longer maturity government bonds globally falling in price and offering higher yields. As markets price in the risk that Japanese investors will sell these securities to buy their government’s long-dated bonds that are now offering comparable yields.

On the equity market side, Japan’s Nikkei 225 index remains up 2.58% year-to-date (as at 22nd May) in US dollar terms and hasn’t fallen significantly following the bond market’s recent moves, perhaps driven by most Japanese debt like mortgages and corporate debt being issued in shorter term bonds. Whose yields haven’t been significantly impacted by the recent longer term yield swings, and which means Japanese businesses and consumers haven’t faced significant changes in their interest payments that would require revisions to investor corporate earnings forecasts.

It remains to be seen whether Japanese investors will indeed start to sell foreign debt to buy their domestic government bonds, however Japan’s sticky inflation and large debt burden will no doubt cause continued bond market volatility going forward.

References

- Financial Times, “Japan inflation climbs at fastest rate in more than 2 years,” May 23, 2025

- Financial Times, “The Japanese government bond market is in trouble,” May 23, 2025

- S&P Global Ratings, “Governments,” May 26, 2025