What has happened to the USD and bond yields?

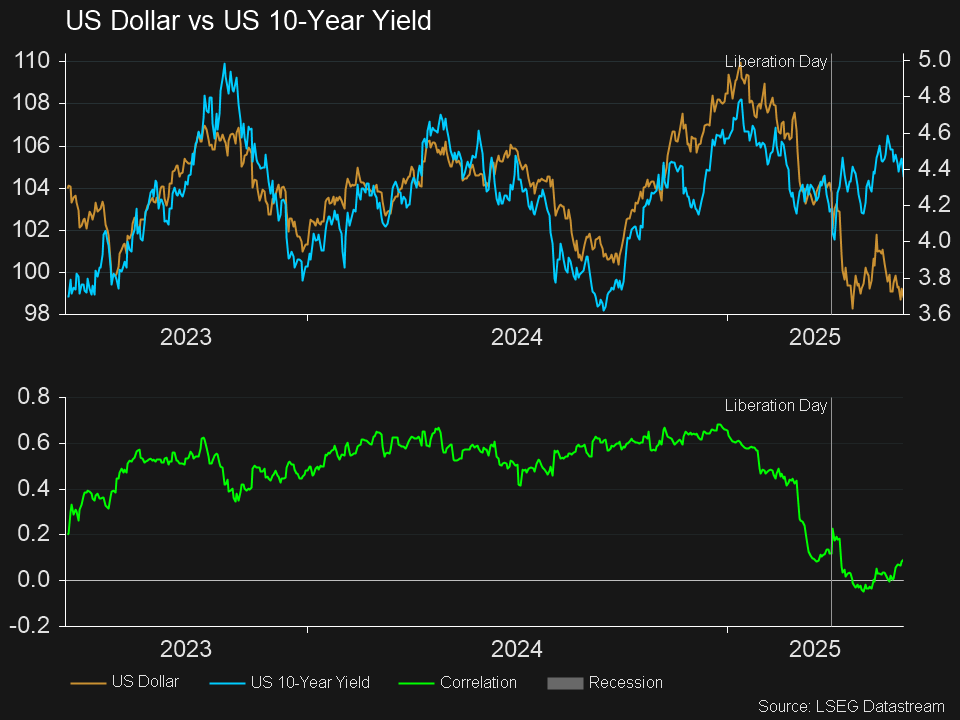

The US dollar and US government bond yields have typically tended to exhibit a positive relationship in recent years, as higher yields attract foreign capital that needs to convert into the greenback to buy US-denominated assets, while typically signalling the US Federal Reserve keeping interest rate higher due to a strong economy. This relationship has, however, broken down over the last few months, as US President Donald Trump’s tariffs have caused government bond yields to rise from 4.184% to 4.361% since his April 2nd Liberation Day, while the greenback has retreated 4.84%.

Why have investors been selling the USD?

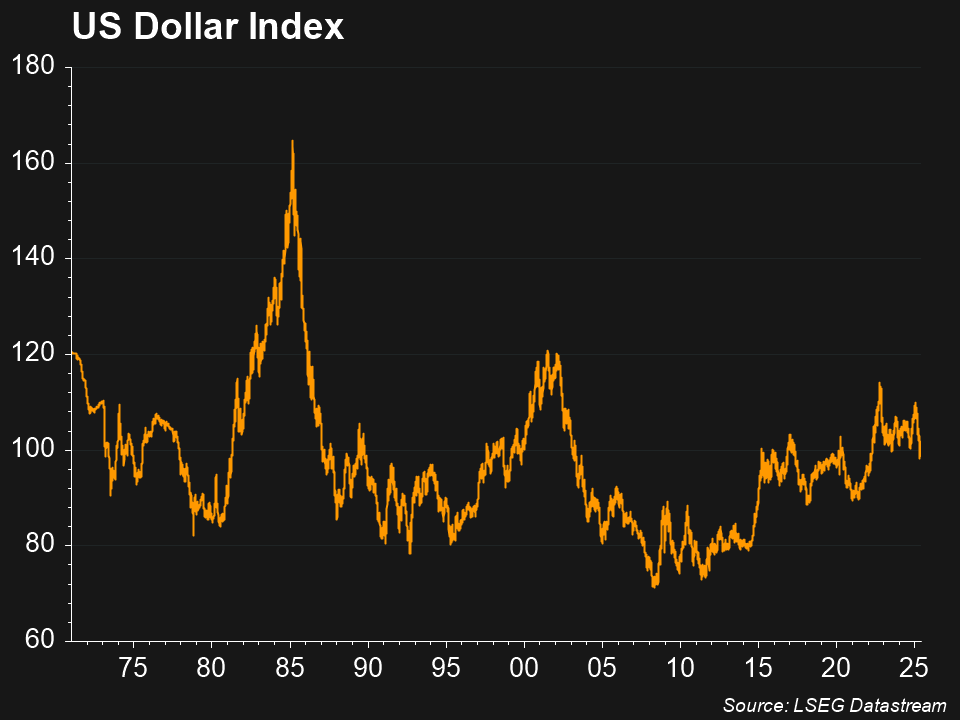

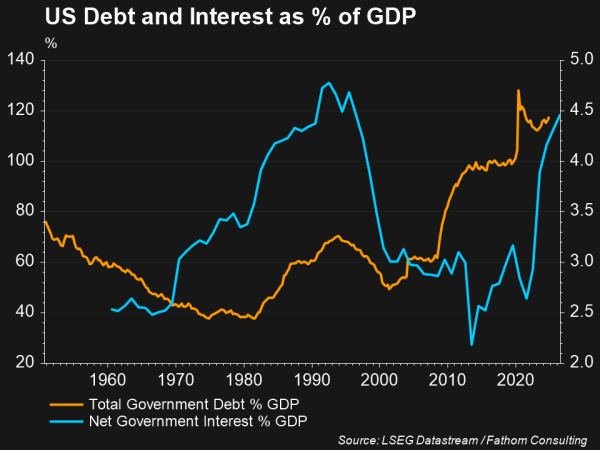

Some have suggested the move highlights investors ascribing greater risk to US government debt, as Trump’s permanence and expansion of the 2017 Tax Cuts and Jobs Act continues to progress through the senate, and is expected to add $US2.4 trillion to US government debt by 2034, raising concerns about further ballooning of budget deficits and the sustainability of this debt burden. These fears have then seen the US dollar fall, as investors sell US assets on economic growth and fiscal position uncertainty. This is a pattern typically seen during periods of recession and in emerging markets where rather than reflecting central bank rate hikes and a strong economy, higher yields indicate greater risk premiums in the face of macroeconomic or political uncertainty. Which then pushes down domestic currency values as investors sell their assets and shift their capital to other regions.

The volatility created by Trump’s tariff policies and attacks on Federal Reserve Chair Jerome Powell have also caused some investors to increase their portfolio’s US dollar hedging and short the greenback. As they question America’s traditionally stable regulatory landscape, and the dollar’s role as a safe haven asset and the world’s reserve currency.

Regardless of whether the US dollar regains its positive relationship with government bond yields or continues to diverge from this, volatility is not doubt going to continue purveying both assets’ prices, as Trump’s tariff policies and pressure on the Federal Reserve further spook investors.

References

-

- Financial Times, “Dollar’s correlation with Treasury yields breaks down” Jun 1, 2025