What is private credit?

Private credit refers to any debt financing that occurs outside traditional markets, with funding typically provided by non-bank financial institutions, such as asset managers. These asset managers act as intermediaries between investors and borrowers, pooling investors’ funds and lending them to borrowers. Therefore, unlike a bank, these managers are not lending out deposits, but are instead raising money from investors seeking higher investment yields and loaning these funds to businesses and property developers.

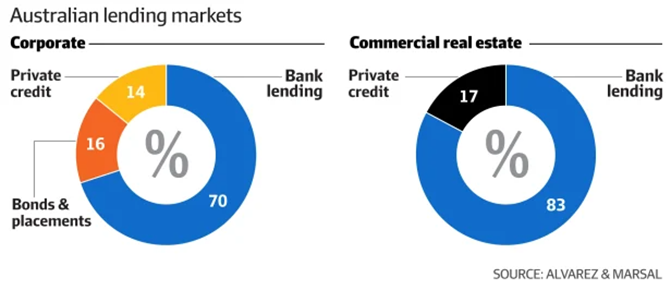

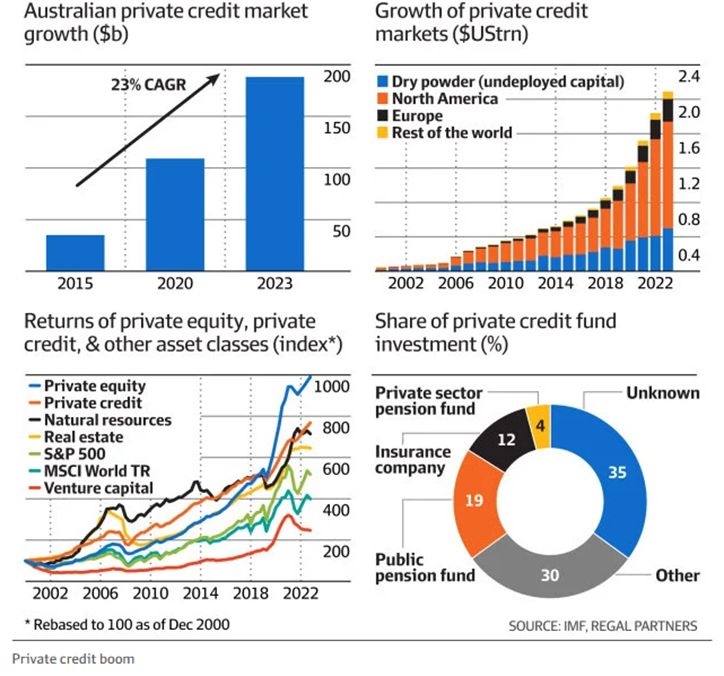

The rise of private credit as an investment option can be attributed to structural changes in the banking sector following the global financial crisis (GFC). Stricter regulations imposed on banks required them to hold more equity against their loans, making it less rewarding for banks to lend to riskier borrowers. As a result, certain borrowers were excluded from accessing loans. With less regulatory oversight, private creditors have stepped in to fill this gap, providing funding to higher-risk borrowers while charging higher interest rates. Globally, private credit assets under management quadrupled over the past decade to $US2.1 trillion in 2023, and now account for about 17% of Australia’s commercial real estate debt, according to estimates by consultant Alvarez & Marsal.

The elevated yields offered by private credit have attracted advisers, institutions, and retail investors seeking higher returns. With private credit typically structured as floating-rate loans, the “higher-for-longer” interest rate environment in Australia has pushed yields into the double digits.

However, despite the clear appeal of this asset class and its impressive growth, private credit is not without risks. Its opaque nature stems from the lack of regulation and reporting requirements imposed on private credit funds, meaning investors may find it difficult to ascertain the quality of the debt they are investing in or the underlying value of the collateral backing the loans.

What risks have regulators identified in private credit?

Private credit bulls argue that these funds are taking risk off banks’ balance sheets by lending to companies typically shunned by regulated lenders, a trend that has resulted in Australian banks’ commercial real estate exposure having reduced from about 10% of total assets in 2009 to 5.5% currently. That creates risks however, given how opaque an asset class private credit can be, with significantly less reporting and disclosure requirements around loan quality and impairments than banks.

Australian Securities and Investments Commission (ASIC): In February 2025 ASIC released a discussion paper exploring the appropriateness of current regulatory settings in private markets, including private credit[1]. The report highlighted the significant exposure retail investors have to private markets through our superannuation system, with less new companies listing on the share market, and unlisted assets now accounting for around 22% of the assets of the country’s two biggest super funds, AustralianSuper and Australian Retirement Trust, as they look to gain access to new investment opportunities that are not filtering through to public markets.

As these private assets are unlisted, their current value is not known, unlike stocks or bonds trading on a securities exchange that provides live pricing data, with this being determined based on the fund manager’s assessment of what the assets are worth and therefore at their discretion in a mark to model process. This creates risks, as these assets valuations may be inflated or inaccurate, potentially meaning the valuations investors see does not reflect what the assets would actually trade for. ASIC highlighted this lack of transparency as a concern in private credit, whereby recent increases in construction costs, and higher financing expenses, left a growing number of property developments unprofitable. Which led to more troubled loans being written down, and highlights private credit funds potentially not accurately reflecting default risks for these loans in their valuations and return forecasts. This was a particular concern for ASIC given retail investors have significant exposure to these assets through their superannuation funds, and may not adequately understand the risks around private credit given limit disclosure requirements for funds and opaque valuations.

Private credit being unlisted also means it has limited liquidity, as loans cannot be easily traded like bonds on a securities exchange. In the event of an investor wanting to redeem their investment from a fund, this can cause problems where the fund’s cash is tied up in illiquid investments, and it has insufficient cash to meet this withdrawal request. If this occurs, a fund may pause redemption requests for investors, not allowing them to withdraw their funds for a specific amount of time or until a specific window. ASIC flagged this as another concern, stating that the ability for retail and wholesale investors with limited investing experience to access private credit can create mismatched liquidity expectations, whereby they believe they can exit an investment faster and more easily than is actually possible.

ASIC therefore emphasised improving the quality and timeliness of data disclosure on private markets so investors can better monitor risks, access improved transparency, and get better information regarding risks before they invest in these assets.

Bank for International Settlements (BIS): The BIS serves as the bank for central banks like the Fed and RBA, facilitating cooperation and transactions between central banks. In March 2025, they released their Quarterly Review outlining how private credit has grown out of stricter bank regulations, causing banks to take on less higher risk loans, and lower interest rates resulting in investors seeking out higher yields beyond investment grade debt[2].

The review flagged concerns around private credit illiquidity and limited redemption flexibility that retail investors may not be aware of, and which can make it difficult for them to get an accurate picture of a fund’s risk.

The BIS also highlighted, though, that private credit can complement the existing bank-based system, by providing funding to SME and leveraged borrowers that wouldn’t qualify for loans from traditional banks. While also spreading credit risk across more parts of the financial system, rather than having a handful of banks bear all the risk. The review highlighted improved regulatory oversight and disclosure requirements for private credit funds as key going forward, and introducing more comprehensive liquidity management frameworks for non-bank lenders to improve their financial health.

European Central Bank (ECB): The ECB warned in May 2024 how adverse economic shocks can cause sharp write downs in private credit loan values, which retail investors were not being adequately told is a risk[3]. They stated that this could potentially incentivise banks to lower underwriting and credit standards to compete with private credit funds on loans, harming overall banking system stability. The article concluded that private credit provides valuable alternative funding sources and diversification benefits for investors, through accessing credit across the yield curve, but also poses risks to investors through sharp valuation corrections and liquidity mismatches that underscores the need for careful monitoring and regulation.

If there’s one certainty from ASIC, the BIS, and the ECB’s comments, it’s that private credit funds can expect a significant ramp up in regulation and disclosure in the future as these regulatory bodies seek to identify and quantify where these risks lie.

References

-

- Australian Securities and Investments Commission, “Australia’s evolving capital markets: A discussion paper on the dynamics between public and private markets,” February 26, 2025

- Bank of International Settlements, “Quarterly Review, March 2025,” March 11, 2025

- European Central Bank, “Private markets, public risk? Financial stability implications of alternative funding sources,” May 16, 2024

- Australian Financial Review, “ASIC: Regulator demands answers from private credit funds as it beefs up surveillance,” March 24, 2025