What triggered the RBA’s change in tone on interest rates?

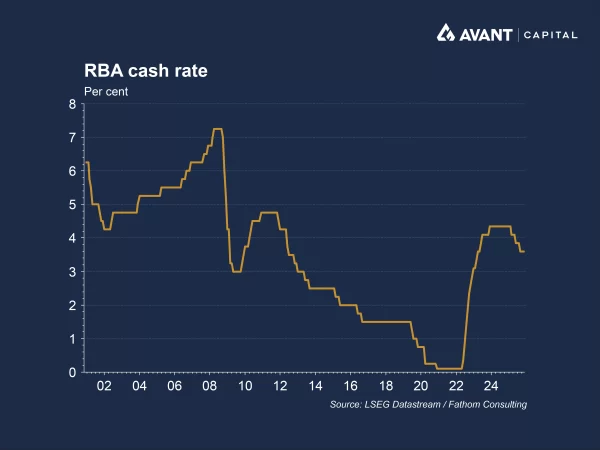

The Reserve Bank of Australia (RBA) held the cash rate steady at 3.6% at its November meeting on Melbourne Cup Day.

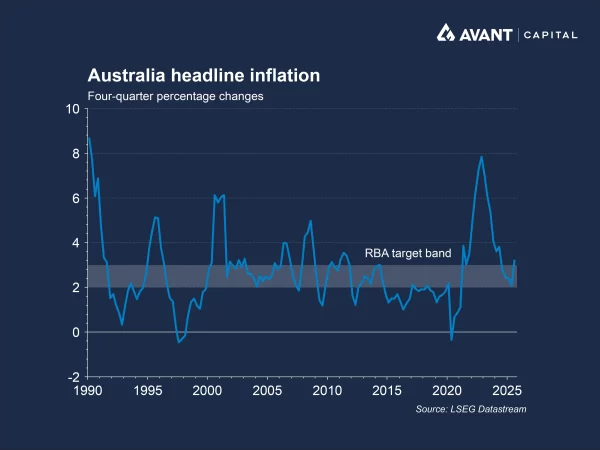

The move followed a surprise spike in inflation in the September quarter, which saw headline inflation climb to 3.2%, exceeding the RBA’s target band of 2-3%1.

Governor Michele Bullock acknowledged that the central bank had “misjudged the gap” between supply and demand in the economy. The RBA’s updated forecasts now expect headline inflation to peak at 3.7% in mid-2026, well above the August forecast of 3.1%, and not return to the midpoint of its target range until mid-20272.

Why did inflation spike in the September quarter?

The September quarter inflation surge was driven by a combination of temporary and structural factors. One of the most immediate contributors was the expiry of state government energy rebates in Queensland, Western Australia and Tasmania, which led to a sharp 23.6% increase in electricity prices3. The federal government’s $150 cost-of-living rebate is also set to expire at the end of the year, which could further lift prices4.

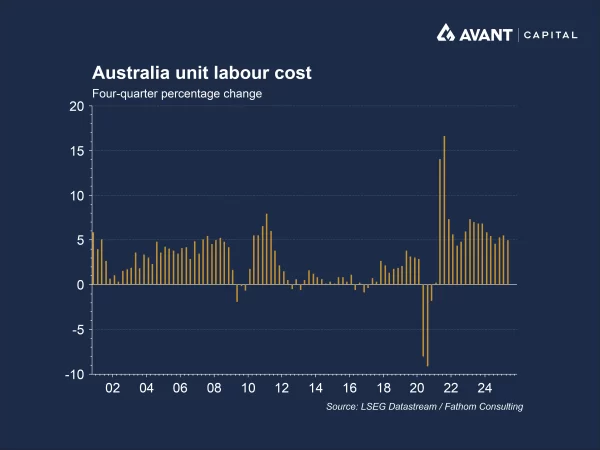

Beyond energy, services inflation proved particularly sticky. Prices for travel, dining out, and hospital care rose sharply, reflecting both strong demand and rising labour costs. The RBA has highlighted unit labour cost growth, running at around 5% annually, as a key driver of inflation in labour-intensive sectors5.

This is compounded by Australia’s weak productivity performance, which limits the economy’s ability to absorb wage increases without passing them on to consumers.

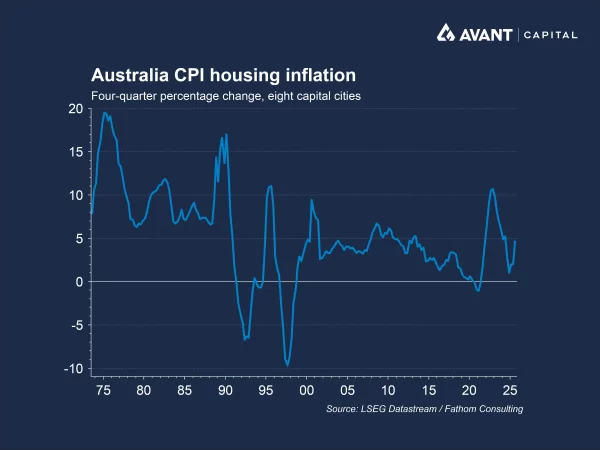

Housing costs also played a role. The cost of building new dwellings rose 1.1% in the quarter, and rents continued to climb, adding further pressure to inflation6. Importantly, the inflation spike was broad-based: all 11 of the major CPI components rose in the quarter, the first time this has happened since 2022 and signalling widespread pricing pressure across the economy7.

While some of these factors, such as fuel and travel costs, are expected to ease in coming quarters, others like services and housing inflation may prove more structural, complicating the RBA’s path back to its 2–3% target band and its ability to further cut interest rates.

What did the RBA say about the path for interest rates?

The RBA’s November Statement on Monetary Policy revealed a cautious stance. While the central bank had previously assumed further rate cuts were likely, it now concedes that the easing cycle may be over. Bullock noted that “it’s possible that there are no more rate cuts. It’s possible there’s some more,” but stressed that the board is going meeting by meeting in making its monetary policy decisions. Markets have responded swiftly, with bond traders having largely abandoned bets on near-term rate cuts, pricing in only a 70% chance of another rate cut by mid-2026.

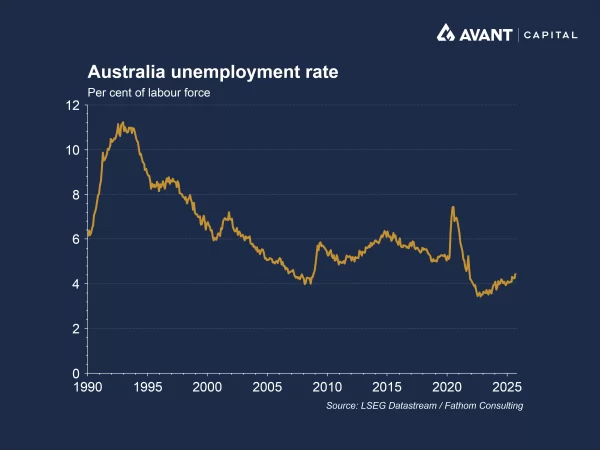

How is employment data influencing the RBA’s decisions?

The unemployment rate rose to 4.5% in September, slightly above the RBA’s forecast of 4.3% year-end unemployment8. However, the central bank remains cautious about interpreting this as a sign of labour market weakness. Despite the uptick, unemployment remains historically low, and other indicators, such as voluntary job changes and reduced underemployment, suggest the labour market is still tight.

The RBA has forecast the jobless rate to hold around 4.4% for the next two years, indicating a belief that the labour market will remain resilient. The central bank is therefore increasingly focused on inflation risks, with Bullock stating that while employment remains part of the bank’s mandate, “we’re a little more concerned about making sure that we do get inflation sustainably back in the band.”

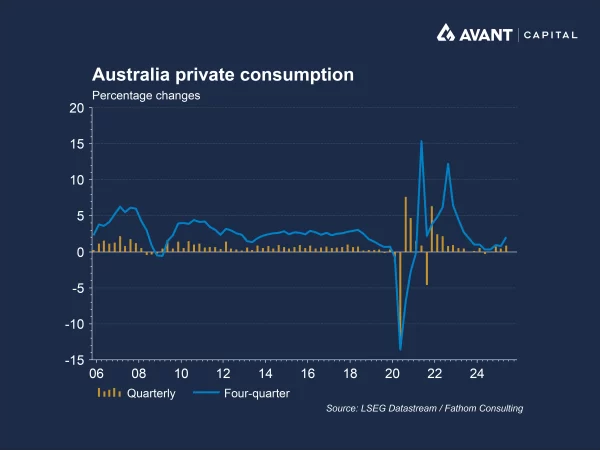

How could this impact the broader economy?

The RBA’s three rate cuts earlier this year helped fuel a rebound in consumer spending. However, with rates now on hold and inflation eroding real wages, households may begin to feel the pinch. The RBA expects real wages to go backwards in 2026 before recovering in 2027. Higher mortgage repayments and cost-of-living pressures could also dampen discretionary spending, particularly if inflation remains sticky and interest rates stay elevated.

Price growth in the housing market could also be impacted by the RBA’s more cautious stance. The prospect of further rate cuts earlier in the year helped fuel a strong rebound in home prices throughout 2025, with October recording the fastest monthly increase in two years9. However, the RBA’s recent shift in tone, signalling that the rate-cutting cycle may be over, could temper expectations among buyers, causing transaction volumes and demand to soften as prospective buyers reassess borrowing capacity. This cooling effect could be more pronounced in segments of the market that had been driven by policy incentives, such as first-home buyer schemes.

The RBA has made clear that future decisions will be data dependent, making upcoming inflation and employment reports critical in determining the path for interest rates going forward.

References

- Reserve Bank of Australia, “Statement on Monetary Policy – November 2025,” 4 November 2025

- Australian Financial Review, “RBA in firing line as inflation miss blows out target,” 4 November 2025

- Australian Financial Review, “No more interest rate cuts, say economists after inflation bump,” 29 October 2025

- ABC News, “Labor promises to shave $150 off energy bills in fresh election pledge,” 23 March 2025

- Australian Financial Review, “Bullock flags end to rate cut cycle amid high inflation, jobless spike,” 4 November 2025

- Australian Financial Review, “Markets forced to face the risk of higher rates,” 31 October 2025

- Australian Financial Review, “RBA must make it clear that inflation means higher interest rates,” 3 November 2025

- Australian Financial Review, “Blame Canberra circus for RBA’s high-wire act on rates and jobs,” 2 November 2025

- Australian Financial Review, “Housing market tipped to cool as rate cut hopes diminish,” 4 November 2025