Why does Trump want to replace Powell?

US Federal Reserve Chair Jerome Powell has kept interest rates on hold at 4.25-4.5% at every meeting this year, stating at the European Central Bank conference in June that if not for Trump’s ‘Liberation Day’ tariffs in April, and their potential impact on inflation, the Fed “would probably have cut rates again by now.” Powell’s position has drawn fierce pressure from Trump, who has called the Fed chair a “numbskull” and “stubborn mule” and discussed appointing a ‘shadow chair’ by nominating Powell’s replacement before his term ends in May 20261.

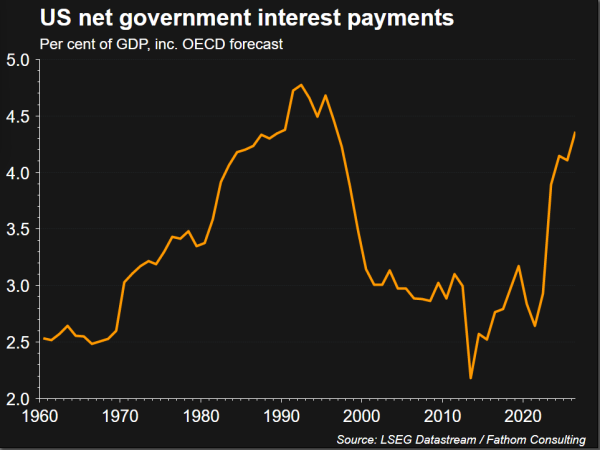

Trump’s motivation to replace Powell is driven by higher interest rates increasing US government borrowing costs and interest payments, as he conveyed in late-June with a handwritten note showing US rates as higher than other developed countries, and stating that Powell was “costing the USA a fortune.”

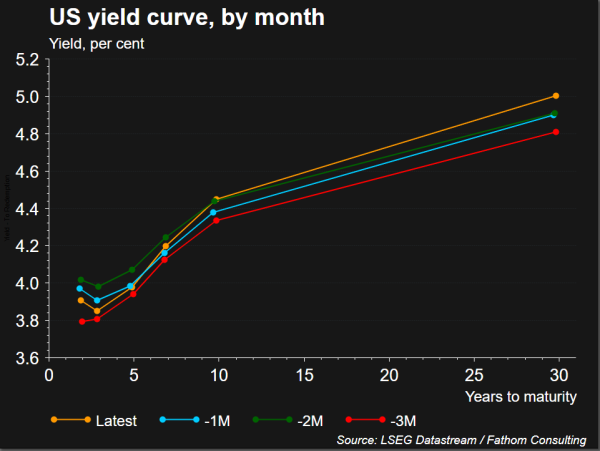

Trump followed this up by saying that the next Fed chair “will lower rates” and “if I think someone is going to keep rates where they are, I’m not going to put them in.” Markets reacted by pricing in more rates cuts post Powell’s term ending, lowering their expectations for short-dated government borrowing costs and bond yields.

Will Trump get his way on interest rates?

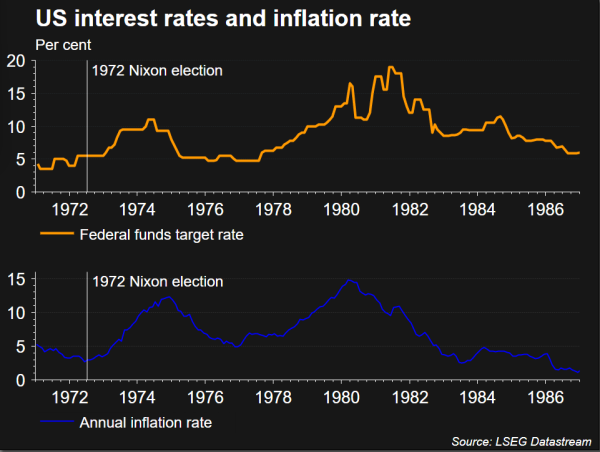

In the lead up to the 1972 presidential election, President Richard Nixon pressured Fed Chair Arthur Burns into cutting rates to prop up economic growth. The delayed effects proved detrimental to the US economy, as monetary expansion—combined with oil price shocks—caused inflation to soar. This ultimately forced Burn’s successor, Paul Volcker, to raise interest rates to double digits in the early 1980s. In the decades following, Burns faced significant criticism for his decision, affirming the importance of the Fed’s monetary policy being independent from political influences. Some have suggested this may serve as a cautionary tale for a Trump ‘shadow chair’ to institute politically motivated rate cuts, as they try to avoid longer-term criticism of their decisions. The president’s pick for chair will also need to be confirmed by congress, which may push back against any appointment that clearly undermines Fed independence.

Although the opinion of the Fed chair is key in determining monetary policy, the majority of the Fed committee—comprised of 7 governors and 5 rotating votes from the 12 regional Federal Reserve banks—still need to agree on decisions. The 12 regional Feds are appointed by local business leaders from their regions, with the 7 governors being appointed by the president and confirmed by congress. Of these 7, only 2 governors’ seats, including Powell’s, will fall vacant during Trump’s term. This potentially limits the president’s ability to gain control of the committee and force his preferred interest rate movements through.

Committee consensus about the direction of interest rates has, however, started to break down. Governors Christoper Waller, a candidate for chair, and Michelle Bowman, Trump’s pick to head-up banking supervision, have both signalled they would vote for rate cuts at the Fed’s next meeting in July. It remains unclear whether Powell will support cuts in July, with the decision still dependent on how Trump’s tariffs flow through in future economic data. If Powell votes against a cut, though, it will be the first time that two governors have voted against the chair since 1993, and suggests that pressure from Trump may be having some influence over existing governors.

How would the appointment of a ‘shadow chair’ impact markets?

While the decision a central bank makes about interest rates at its latest meeting is important, what also drive markets is the guidance the bank gives on the direction of future rates. Therefore, if Trump’s ‘shadow chair’ nominee signals aggressive future rate cuts, this may cause investors to adjust their expectations for rates and US government borrowing costs from the expiry of Powell’s term in May 2026.

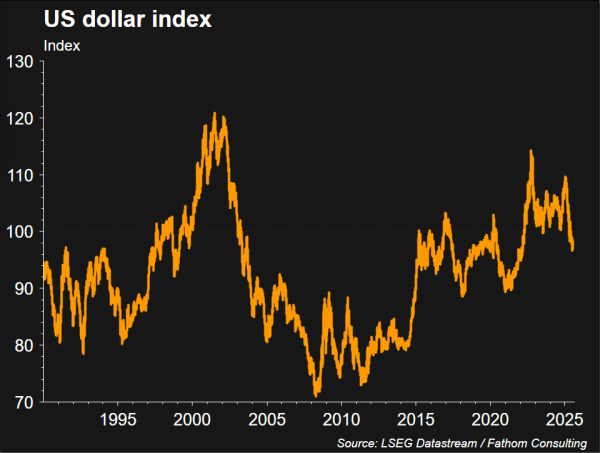

‘Shadow chair’ rumours and Trump’s criticism of Powell have already caused the USD to reach multi-year lows. As investors question America’s regulatory stability and safe haven status amidst potential violations of Fed independence. While also expressing concerns around the integrity of future monetary policy, and how political pressure may curtail the central bank’s ability to keep inflation down and protect the purchasing power of the USD.

Regardless of whether Trump names a Fed ‘shadow chair,’ he has undoubtedly caused investor confidence in the Fed’s independence to wane, and will continue to exert pressure on Fed governors and the new chair to achieve his political goals in the years ahead.

References

- Financial Times, “Can the Fed stay independent under Trump?” 10 July 2025